please double-check for me

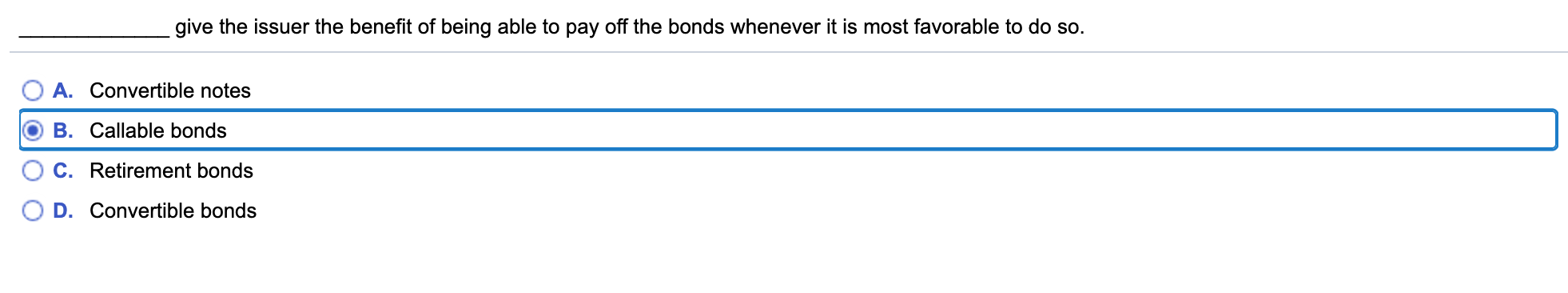

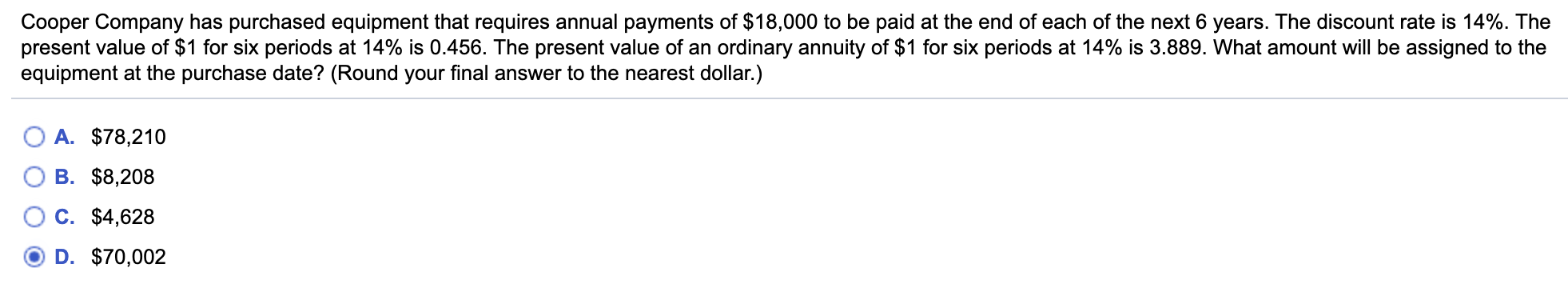

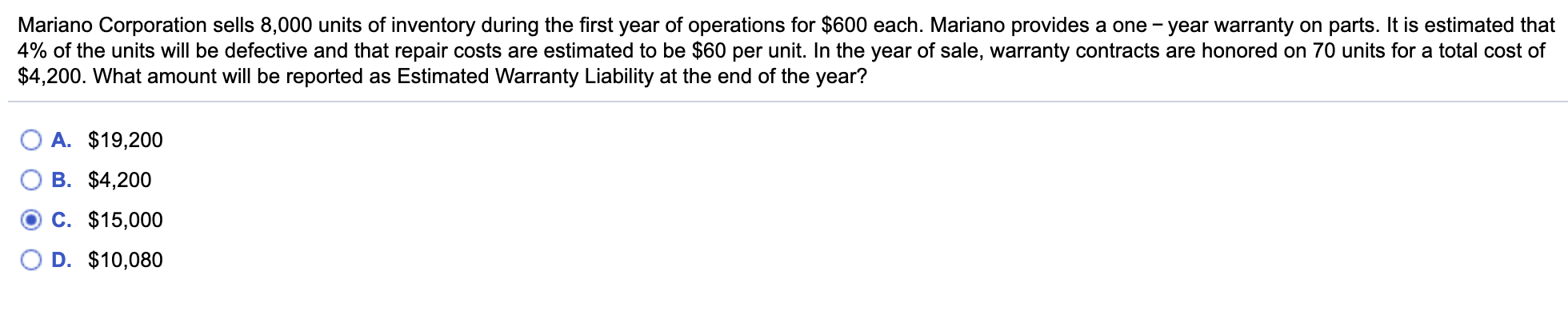

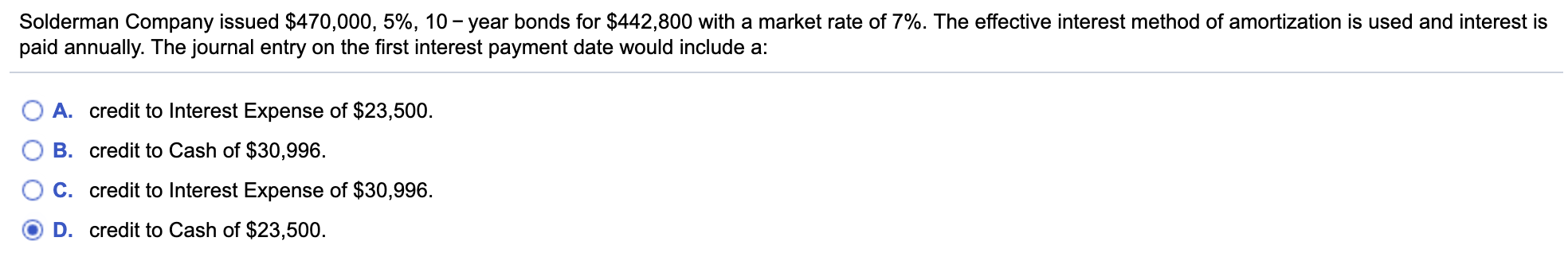

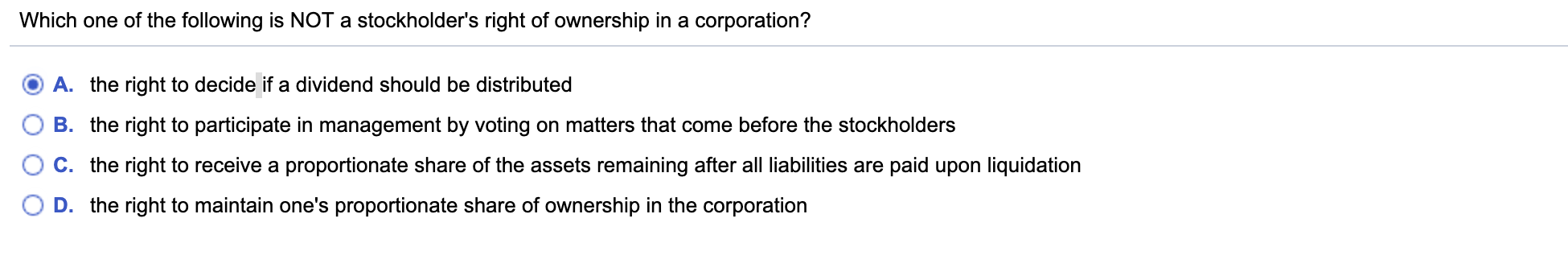

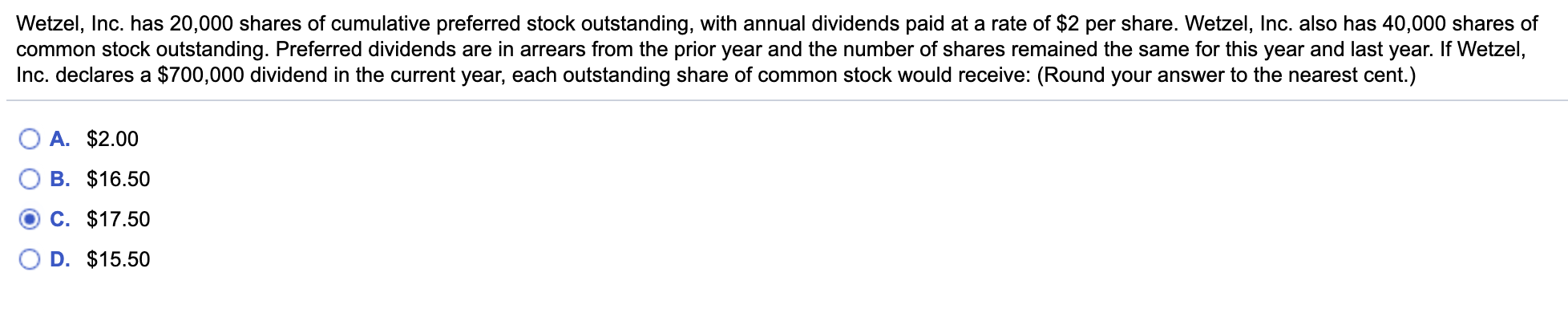

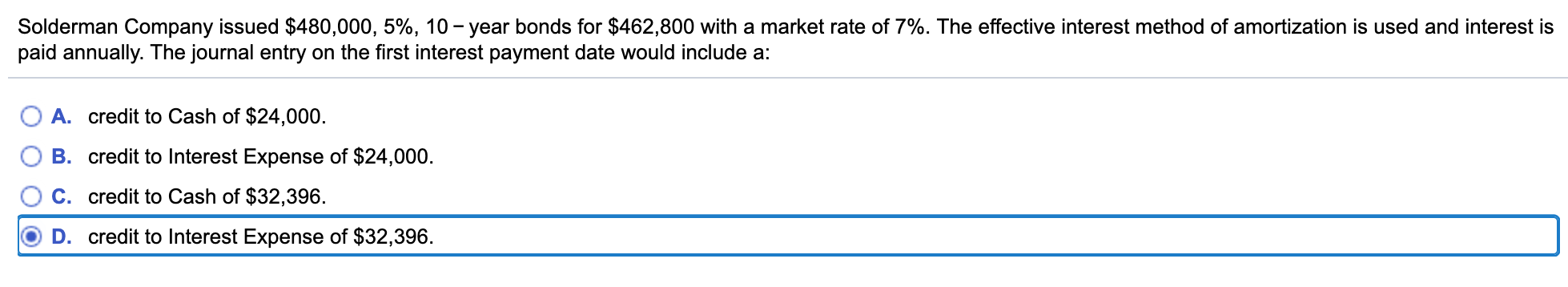

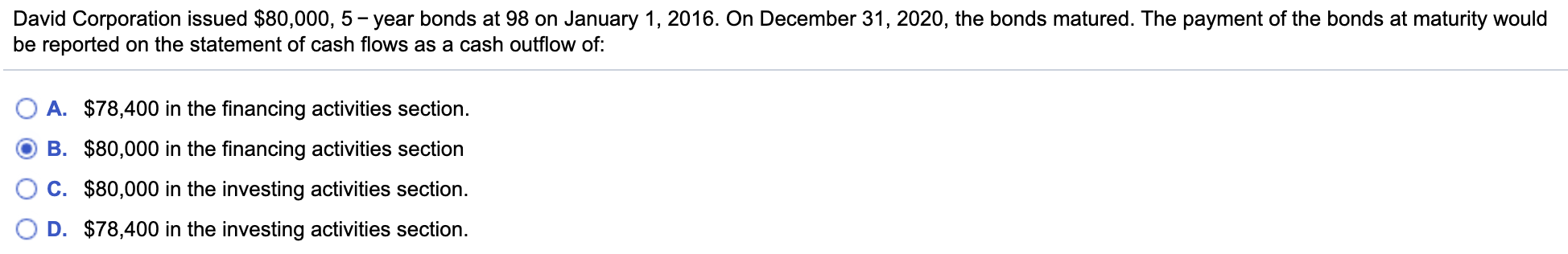

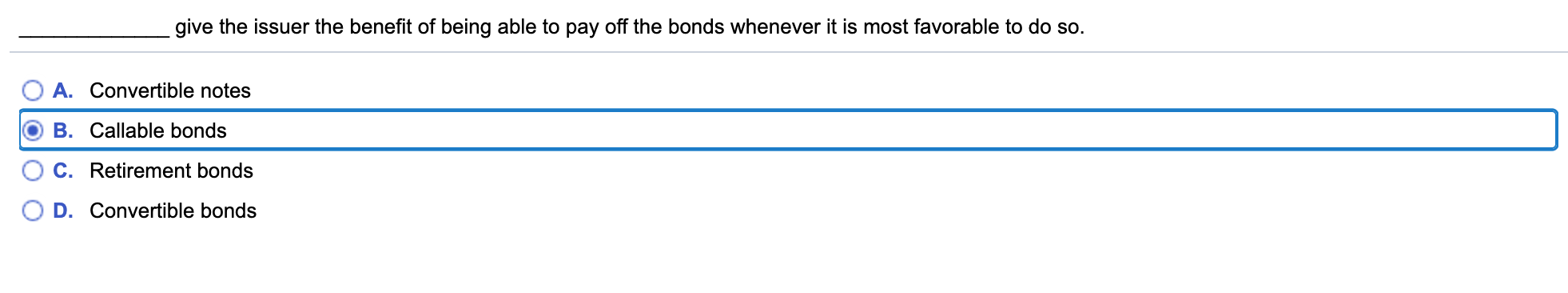

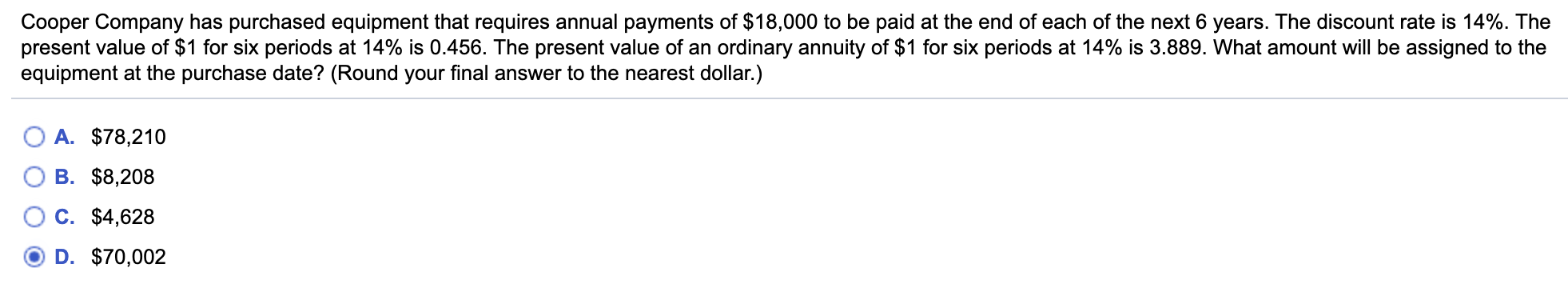

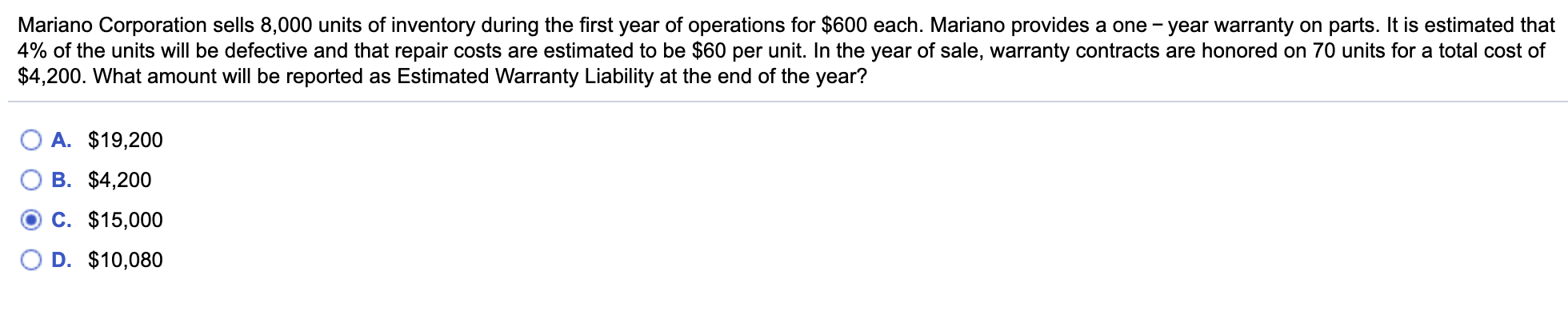

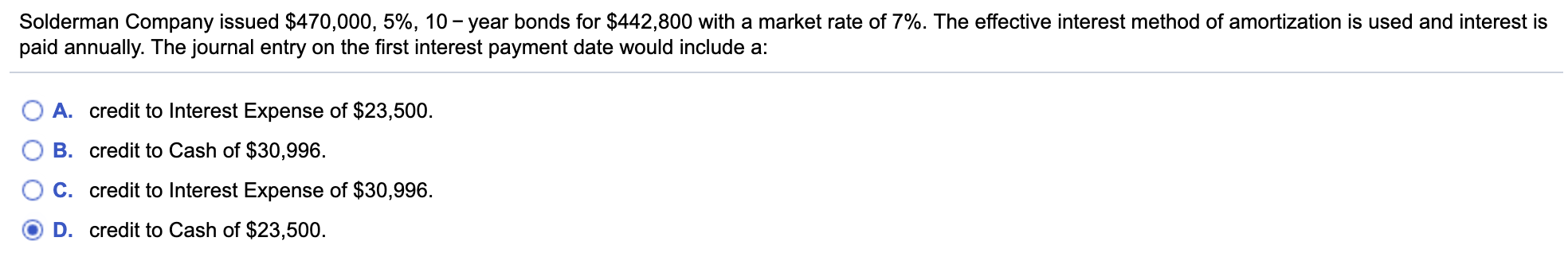

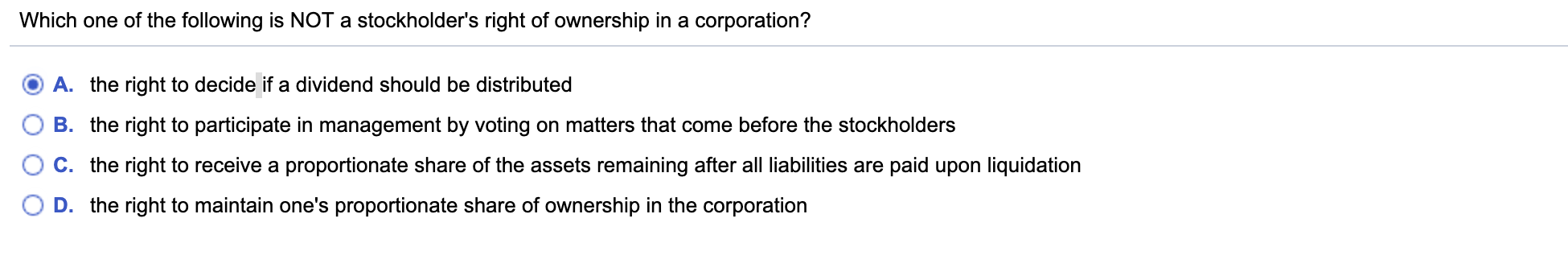

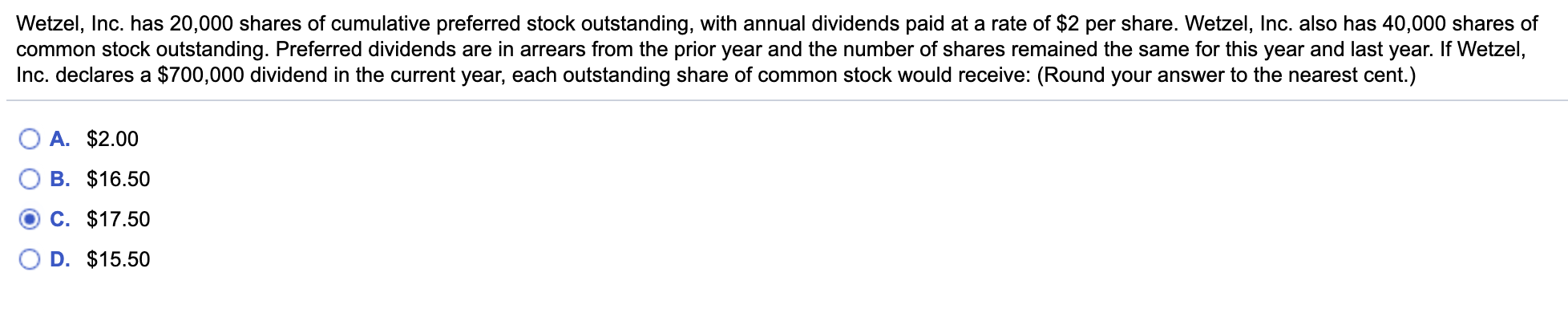

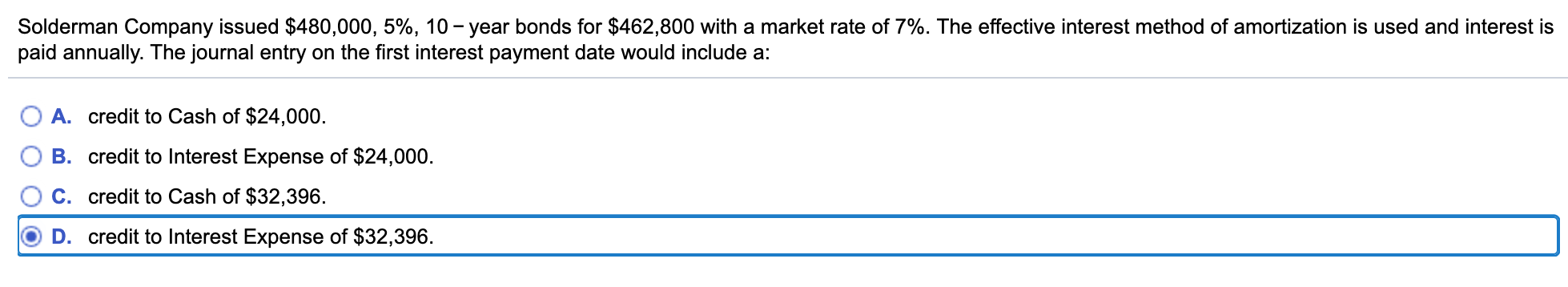

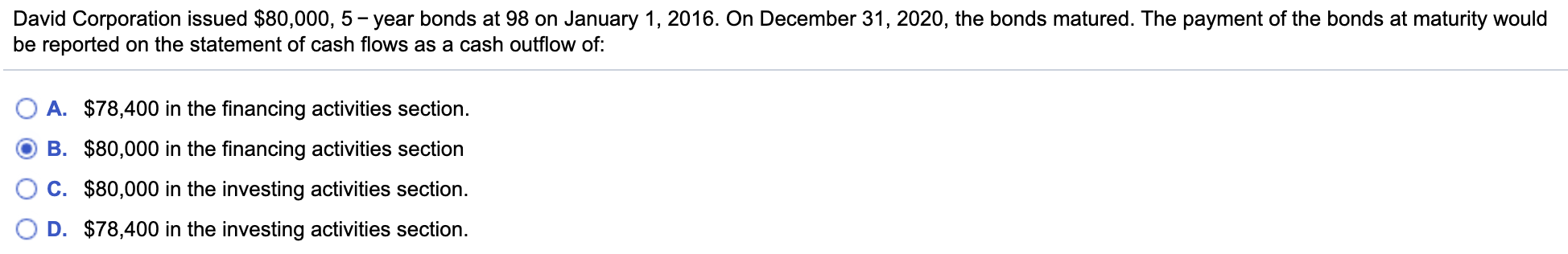

give the issuer the benefit of being able to pay off the bonds whenever it is most favorable to do so. O A. Convertible notes TO B. Callable bonds OC. Retirement bonds O D. Convertible bonds Cooper Company has purchased equipment that requires annual payments of $18,000 to be paid at the end of each of the next 6 years. The discount rate is 14%. The present value of $1 for six periods at 14% is 0.456. The present value of an ordinary annuity of $1 for six periods at 14% is 3.889. What amount will be assigned to the equipment at the purchase date? (Round your final answer to the nearest dollar.) O A. $78,210 OC. $4,628 OD. $70,002 Mariano Corporation sells 8,000 units of inventory during the first year of operations for $600 each. Mariano provides a one-year warranty on parts. It is estimated that 4% of the units will be defective and that repair costs are estimated to be $60 per unit. In the year of sale, warranty contracts are honored on 70 units for a total cost of $4,200. What amount will be reported as Estimated Warranty Liability at the end of the year? O A. $19,200 O B. $4,200 OC. $15,000 OD. $10,080 Solderman Company issued $470,000, 5%, 10-year bonds for $442,800 with a market rate of 7%. The effective interest method of amortization is used and interest is paid annually. The journal entry on the first interest payment date would include a: O A. credit to Interest Expense of $23,500. O B. credit to Cash of $30,996. O D. credit to Cash of $23,500. Which one of the following is NOT a stockholder's right of ownership in a corporation? O A. the right to decide if a dividend should be distributed O B. the right to participate in management by voting on matters that come before the stockholders O C. the right to receive a proportionate share of the assets remaining after all liabilities are paid upon liquidation O D. the right to maintain one's proportionate share of ownership in the corporation Wetzel, Inc. has 20,000 shares of cumulative preferred stock outstanding, with annual dividends paid at a rate of $2 per share. Wetzel, Inc. also has 40,000 shares of common stock outstanding. Preferred dividends are in arrears from the prior year and the number of shares remained the same for this year and last year. If Wetzel, Inc. declares a $700,000 dividend in the current year, each outstanding share of common stock would receive: (Round your answer to the nearest cent.) O A. $2.00 O B. $16.50 C. $17.50 O D. $15.50 Solderman Company issued $480,000, 5%, 10-year bonds for $462,800 with a market rate of 7%. The effective interest method of amortization is used and interest is paid annually. The journal entry on the first interest payment date would include a: O A. credit to Cash of $24,000. O B. credit to Interest Expense of $24,000. O C. credit to Cash of $32,396. JO D. credit to Interest Expense of $32,396. David Corporation issued $80,000, 5-year bonds at 98 on January 1, 2016. On December 31, 2020, the bonds matured. The payment of the bonds at maturity would be reported on the statement of cash flows as a cash outflow of: O A. $78,400 in the financing activities section. B. $80,000 in the financing activities section OC. $80,000 in the investing activities section. OD. $78,400 in the investing activities