Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please enter the correct answer in Excel with proper labels and formulas for a positive rating. Thank you! P 9-14 Answer the following multiple-choice questions:

Please enter the correct answer in Excel with proper labels and formulas for a positive rating. Thank you!

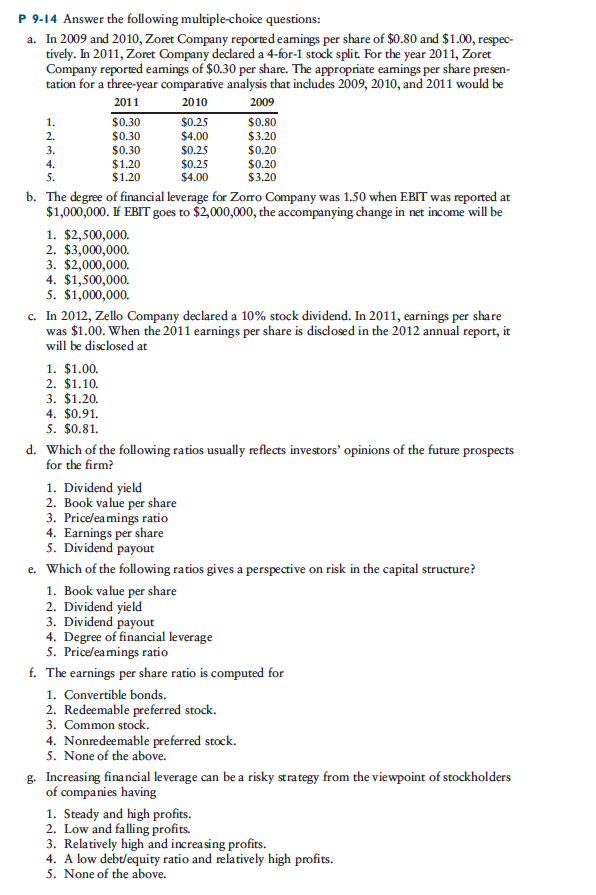

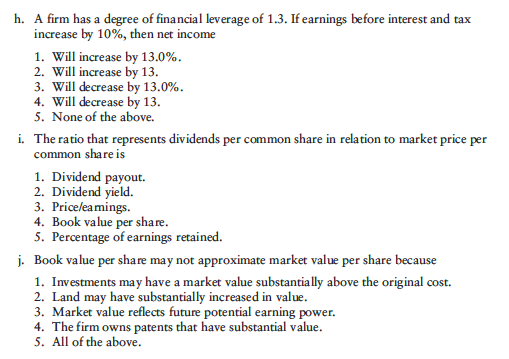

P 9-14 Answer the following multiple-choice questions: a. In 2009 and 2010, Zoret Company reported eamings per share of $0.80 and $1.00, respec- tively. In 2011, Zoret Company declared a 4-for-1 stock split. For the year 2011, Zoret Company reported eamings of $0.30 per share. The appropriate eamings per share presen- tation for a three-year comparative analysis that includes 2009, 2010, and 2011 would be 2010 $0.25 $4.00 $0.25 $0.25 $4.00 2011 2009 1. 2. 3. $0.30 $0.30 $0.30 $1.20 $1.20 $0.80 $3.20 $0.20 $0.20 $3.20 5. b. The degree of financial leverage for Zorro Company was 1.50 when EBIT was reported at $1,000,000. If EBIT goes to $2,000,000, the accompanying change in net income will be 1. $2,500,000. 2. $3,000,000. 3. $2,000,000. 4. $1,500,000. 5. $1,000,000. In 2012, Zello Company declared a 10% stock dividend. In 2011, earnings per share was $1.00. When the 2011 earnings per share is disclosed in the 2012 annual report, it will be disclosed at c. 1. $1.00 2. $1.10. 3. $1.20. 4. $0.91. 5. $0.81. d. Which of the following ratios usually reflects investors' opinions of the future prospects for the firm? 1. Dividend yield 2. Book value per share 3. Price/eamings ratio 4. Earnings per share 5. Dividend payout e. Which of the following ratios gives a perspective on risk in the capital structure? 1. Book value per share 2. Dividend yield 3. Dividend payout 4. Degree of financial leverage 5. Price/eamings ratio f. The earnings per share ratio is computed for 1. Convertible bonds. 2. Redeemable preferred stock. 3. Common stock 4. Nonredeemable preferred stock. 5. None of the above. Increasing financial leverage can be a risky strategy from the viewpoint of stockholders of companies having g. 1. Steady and high profits. 2. Low and falling profits. 3. Relatively high and increasing profits. 4. A low debt/equity ratio and relatively high profits. 5. None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started