Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please explain all steps, Im trying to learn, thank you. Huntington Medical Center purchased a used low-field MRI scanner 2 years ago for $445,000. Its

please explain all steps, Im trying to learn, thank you.

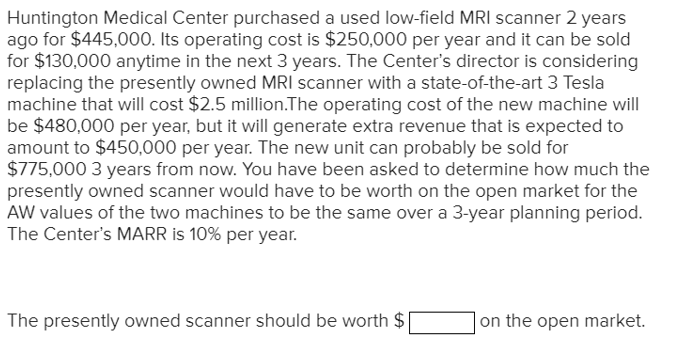

Huntington Medical Center purchased a used low-field MRI scanner 2 years ago for $445,000. Its operating cost is $250,000 per year and it can be sold for $130,000 anytime in the next 3 years. The Center's director is considering replacing the presently owned MRI scanner with a state-of-the-art 3 Tesla machine that will cost $2.5 million.The operating cost of the new machine will be $480,000 per year, but it will generate extra revenue that is expected to amount to $450,000 per year. The new unit can probably be sold for $775,000 3 years from now. You have been asked to determine how much the presently owned scanner would have to be worth on the open market for the AW values of the two machines to be the same over a 3-year planning period. The Center's MARR is 10% per year. The presently owned scanner should be worth$ on the open marketStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started