Answered step by step

Verified Expert Solution

Question

1 Approved Answer

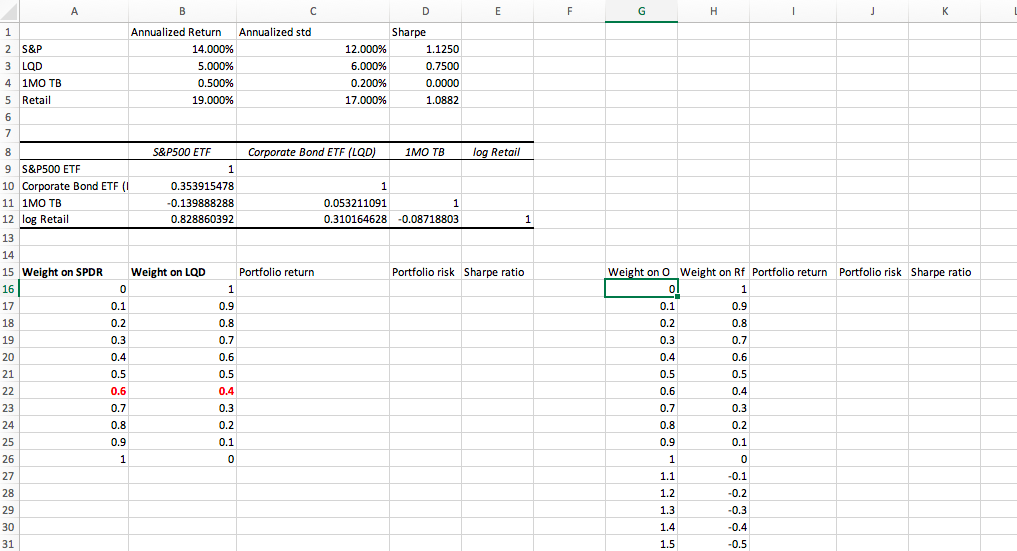

Please explain and include excel formulas Complete the template to obtain the optimal risky portfolio using SPDR and LQD. Compute the portfolio average return, portfolio

Please explain and include excel formulas

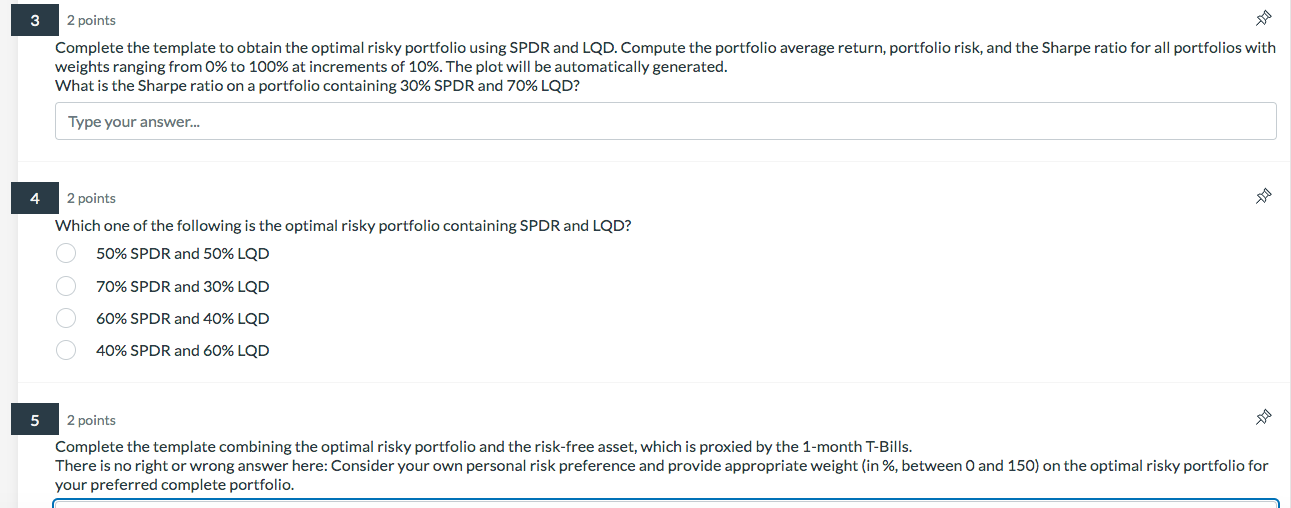

Complete the template to obtain the optimal risky portfolio using SPDR and LQD. Compute the portfolio average return, portfolio risk, and the Sharpe ratio for all portfolios with weights ranging from 0% to 100% at increments of 10%. The plot will be automatically generated. What is the Sharpe ratio on a portfolio containing 30\% SPDR and 70\% LQD? Type your answer... 2 points Which one of the following is the optimal risky portfolio containing SPDR and LQD? 50% SPDR and 50\% LQD 70% SPDR and 30% LQD 60% SPDR and 40% LQD 40% SPDR and 60% LQD 2 points Complete the template combining the optimal risky portfolio and the risk-free asset, which is proxied by the 1-month T-Bills. There is no right or wrong answer here: Consider your own personal risk preference and provide appropriate weight (in \%, between 0 and 150 ) on the optimal risky portfolio for your preferred complete portfolio. Complete the template to obtain the optimal risky portfolio using SPDR and LQD. Compute the portfolio average return, portfolio risk, and the Sharpe ratio for all portfolios with weights ranging from 0% to 100% at increments of 10%. The plot will be automatically generated. What is the Sharpe ratio on a portfolio containing 30\% SPDR and 70\% LQD? Type your answer... 2 points Which one of the following is the optimal risky portfolio containing SPDR and LQD? 50% SPDR and 50\% LQD 70% SPDR and 30% LQD 60% SPDR and 40% LQD 40% SPDR and 60% LQD 2 points Complete the template combining the optimal risky portfolio and the risk-free asset, which is proxied by the 1-month T-Bills. There is no right or wrong answer here: Consider your own personal risk preference and provide appropriate weight (in \%, between 0 and 150 ) on the optimal risky portfolio for your preferred complete portfolio

Complete the template to obtain the optimal risky portfolio using SPDR and LQD. Compute the portfolio average return, portfolio risk, and the Sharpe ratio for all portfolios with weights ranging from 0% to 100% at increments of 10%. The plot will be automatically generated. What is the Sharpe ratio on a portfolio containing 30\% SPDR and 70\% LQD? Type your answer... 2 points Which one of the following is the optimal risky portfolio containing SPDR and LQD? 50% SPDR and 50\% LQD 70% SPDR and 30% LQD 60% SPDR and 40% LQD 40% SPDR and 60% LQD 2 points Complete the template combining the optimal risky portfolio and the risk-free asset, which is proxied by the 1-month T-Bills. There is no right or wrong answer here: Consider your own personal risk preference and provide appropriate weight (in \%, between 0 and 150 ) on the optimal risky portfolio for your preferred complete portfolio. Complete the template to obtain the optimal risky portfolio using SPDR and LQD. Compute the portfolio average return, portfolio risk, and the Sharpe ratio for all portfolios with weights ranging from 0% to 100% at increments of 10%. The plot will be automatically generated. What is the Sharpe ratio on a portfolio containing 30\% SPDR and 70\% LQD? Type your answer... 2 points Which one of the following is the optimal risky portfolio containing SPDR and LQD? 50% SPDR and 50\% LQD 70% SPDR and 30% LQD 60% SPDR and 40% LQD 40% SPDR and 60% LQD 2 points Complete the template combining the optimal risky portfolio and the risk-free asset, which is proxied by the 1-month T-Bills. There is no right or wrong answer here: Consider your own personal risk preference and provide appropriate weight (in \%, between 0 and 150 ) on the optimal risky portfolio for your preferred complete portfolio Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started