Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain clearly. Thank you so much!! QUESTION 1 A Private Equity (PE) is holding a well-diversified portfolio that invests 70% in common share portfolio

Please explain clearly. Thank you so much!!

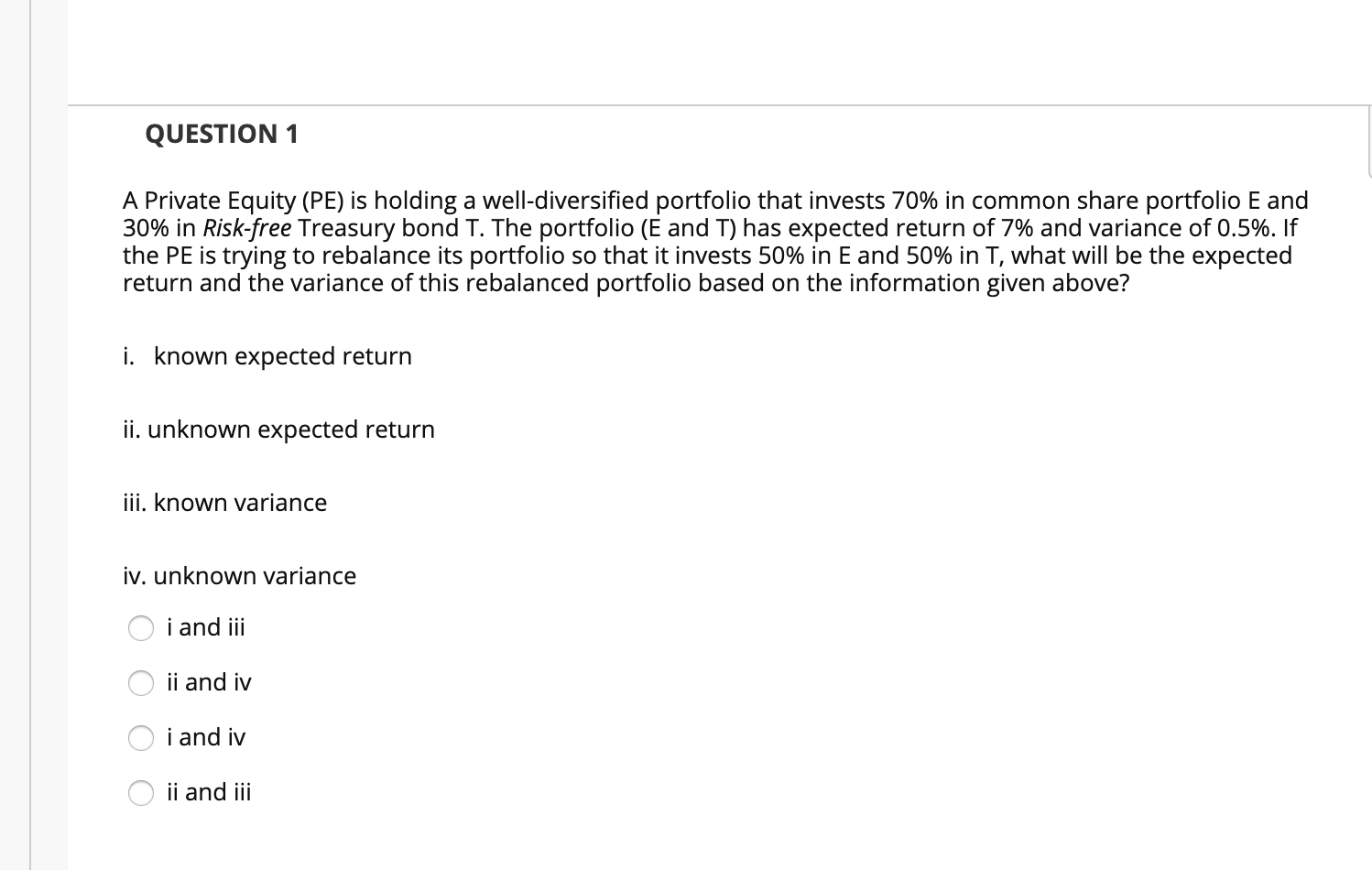

QUESTION 1 A Private Equity (PE) is holding a well-diversified portfolio that invests 70% in common share portfolio E and 30% in Risk-free Treasury bond T. The portfolio (E and T) has expected return of 7% and variance of 0.5%. If the PE is trying to rebalance its portfolio so that it invests 50% in E and 50% in T, what will be the expected return and the variance of this rebalanced portfolio based on the information given above? i. known expected return ii. unknown expected return iii. known variance iv. unknown variance O i and iii O ii and iv O i and iv O ii andStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started