Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please explain each step and reasonings Grunsburg Textiles (GT) is a textile company founded by the paternalistic leader Henrik Steiner. As the company grew, it

please explain each step and reasonings

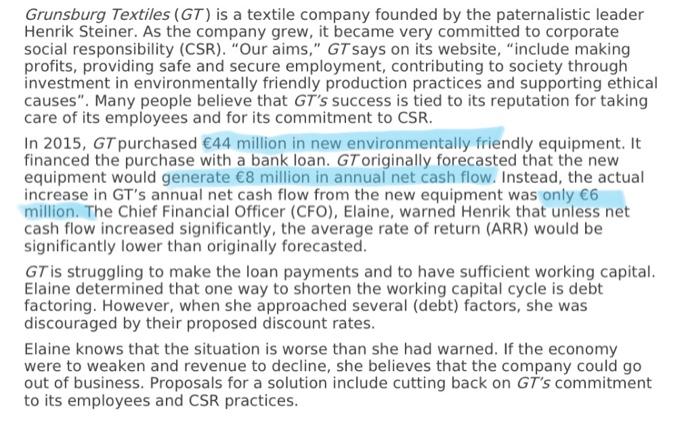

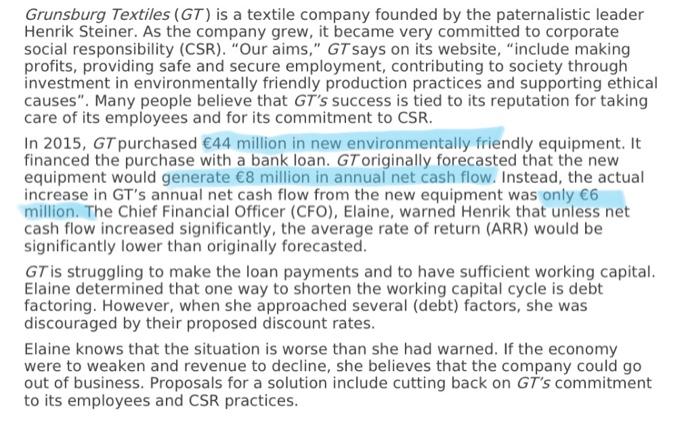

Grunsburg Textiles (GT) is a textile company founded by the paternalistic leader Henrik Steiner. As the company grew, it became very committed to corporate social responsibility (CSR). "Our aims," GT says on its website, "include making profits, providing safe and secure employment, contributing to society through investment in environmentally friendly production practices and supporting ethical causes". Many people believe that GT's success is tied to its reputation for taking care of its employees and for its commitment to CSR. In 2015, GT purchased 44 million in new environmentally friendly equipment. It financed the purchase with a bank loan. GToriginally forecasted that the new equipment would generate 8 million in annual net cash flow. Instead, the actual increase in GT's annual net cash flow from the new equipment was only 6 million. The Chief Financial Officer (CFO), Elaine, warned Henrik that unless net cash flow increased significantly, the average rate of return (ARR) would be significantly lower than originally forecasted. GT is struggling to make the loan payments and to have sufficient working capital. Elaine determined that one way to shorten the working capital cycle is debt factoring. However, when she approached several (debt) factors, she was discouraged by their proposed discount rates. Elaine knows that the situation is worse than she had warned. If the economy were to weaken and revenue to decline, she believes that the company could go out of business. Proposals for a solution include cutting back on GT's commitment to its employees and CSR practices. 5b. Calculate for GT: [2 marks] the payback period for the 44 million investment in new equipment based on the forecasted increase in net cash flow (show all your working). 19 5c. Calculate for GT : [2marks] the average rate of return (ARR) based on an annual increase in net cash flow of 6000 and assuming an asset life of the new equipment of eight years (show all your working)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started