Answered step by step

Verified Expert Solution

Question

1 Approved Answer

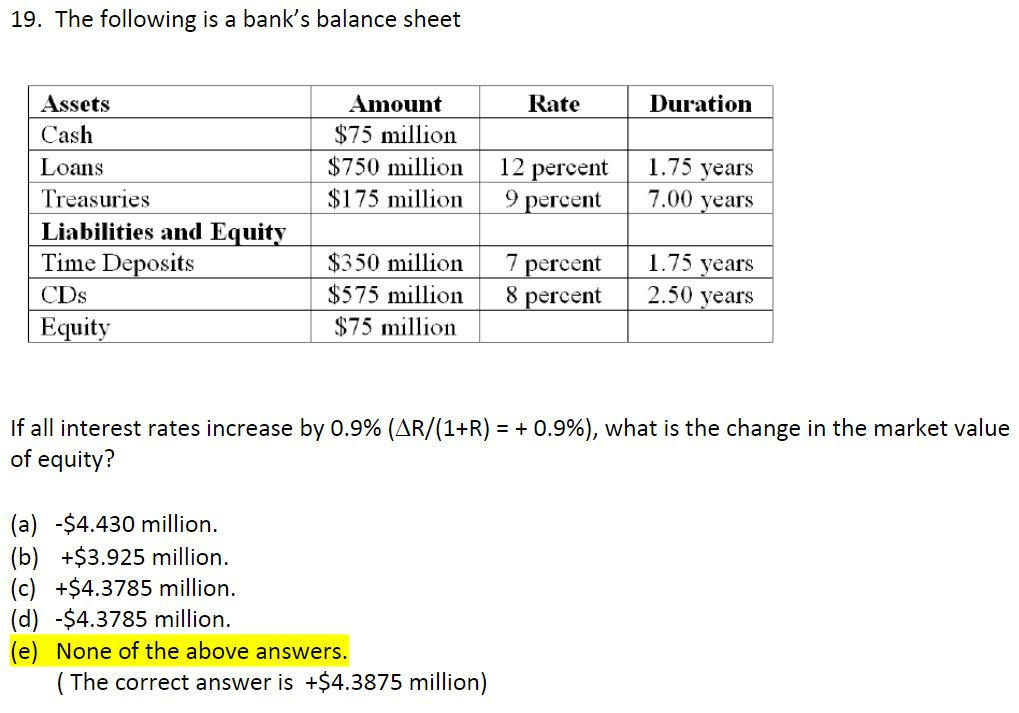

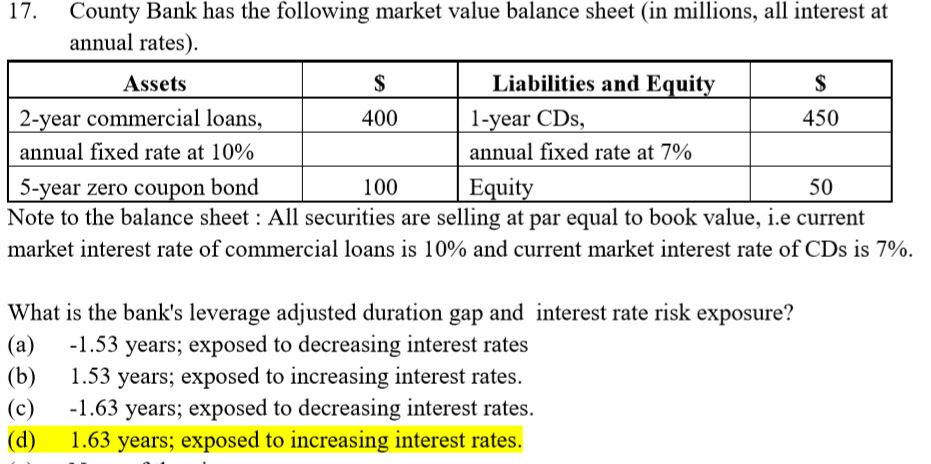

Please explain how the answers are calculated. 19. The following is a bank's balance sheet Amount Assets Rate Duration Cash $75 million 1.75 years 7.00

Please explain how the answers are calculated.

19. The following is a bank's balance sheet Amount Assets Rate Duration Cash $75 million 1.75 years 7.00 years $750 million 12 percent 9 percent Loans Treasuries $175 million Liabilities and Equity Time Deposits 1.75 years $350 million 7 percent 8 percent $575 million 2.50 years CDs $75 million Equity If all interest rates increase by 0.9% (AR/(1+R) = 0.9%), what is the change in the market value of equity? (a) -$4.430 million. (b) +$3.925 million (c) +$4.3785 million (d) -$4.3785 million. (e) None of the above answers. (The correct answer is +$4.3875 million) 17 County Bank has the following market value balance sheet (in millions, all interest at annual rates) Liabilities and Equity 1-year CDs, annual fixed rate at 7% Equity S Assets 450 2-year commercial loans, 400 annual fixed rate at 10% 5-year zero coupon bond Note to the balance sheet All securities are selling at par equal to book value, i.e current 50 100 market interest rate of commercial loans is 10% and current market interest rate of CDs is 7%. What is the bank's leverage adjusted duration gap and interest rate risk exposure? -1.53 years; exposed to decreasing interest rates (b) (a) 1.53 years; exposed to increasing interest rates. -1.63 years; exposed to decreasing interest rates (d) (c) 1.63 years; exposed to increasing interest rates. 19. The following is a bank's balance sheet Amount Assets Rate Duration Cash $75 million 1.75 years 7.00 years $750 million 12 percent 9 percent Loans Treasuries $175 million Liabilities and Equity Time Deposits 1.75 years $350 million 7 percent 8 percent $575 million 2.50 years CDs $75 million Equity If all interest rates increase by 0.9% (AR/(1+R) = 0.9%), what is the change in the market value of equity? (a) -$4.430 million. (b) +$3.925 million (c) +$4.3785 million (d) -$4.3785 million. (e) None of the above answers. (The correct answer is +$4.3875 million) 17 County Bank has the following market value balance sheet (in millions, all interest at annual rates) Liabilities and Equity 1-year CDs, annual fixed rate at 7% Equity S Assets 450 2-year commercial loans, 400 annual fixed rate at 10% 5-year zero coupon bond Note to the balance sheet All securities are selling at par equal to book value, i.e current 50 100 market interest rate of commercial loans is 10% and current market interest rate of CDs is 7%. What is the bank's leverage adjusted duration gap and interest rate risk exposure? -1.53 years; exposed to decreasing interest rates (b) (a) 1.53 years; exposed to increasing interest rates. -1.63 years; exposed to decreasing interest rates (d) (c) 1.63 years; exposed to increasing interest ratesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started