Answered step by step

Verified Expert Solution

Question

1 Approved Answer

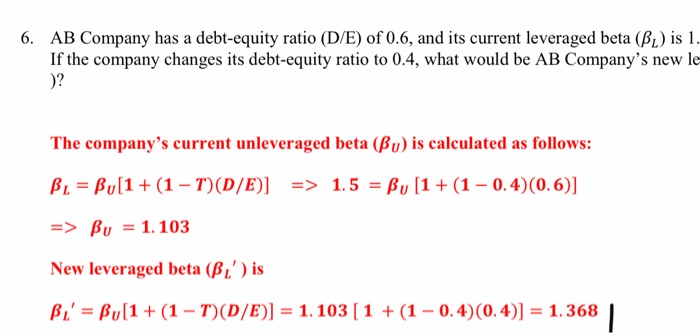

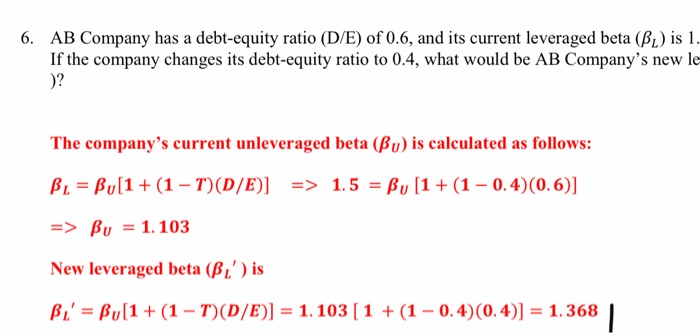

please explain how the current unleveraged beta was caculated below. The example when typed in caculator isnt giving me the same answer. 6. AB Company

please explain how the current unleveraged beta was caculated below. The example when typed in caculator isnt giving me the same answer.

6. AB Company has a debt-equity ratio (D/E) of 0.6, and its current leveraged beta (BL) is 1. If the company changes its debt-equity ratio to 0.4, what would be AB Company's new le )? The company's current unleveraged beta (Bu) is calculated as follows: Bu = Bu[1 + (1 - T)(D/E)] => 1.5 = By [1 + (1 - 0.4)(0.6)] => Bu = 1.103 New leveraged beta (Bi') is Bi' = Bu[1 + (1 - T)(D/E)] = 1.103 [1 + (1 -0.4)(0.4)] = 1.368

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started