Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain how to calculate total paid-in capital and retained earnings. During its second year of operatoons, Panzarella Corporation entered into several transactions relating to

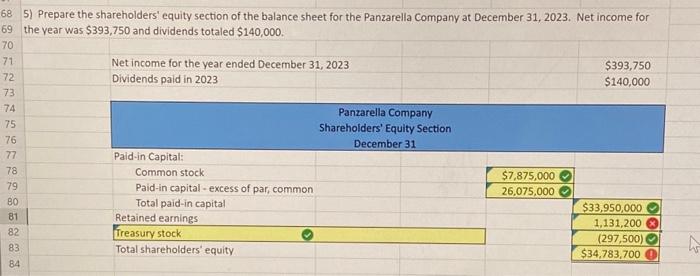

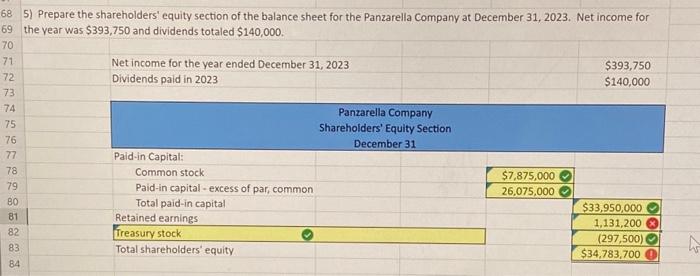

Please explain how to calculate total paid-in capital and retained earnings.

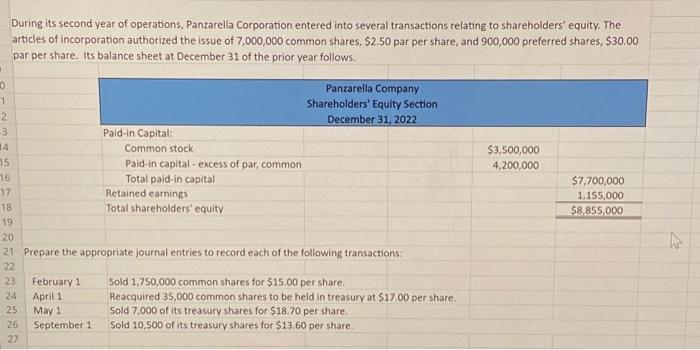

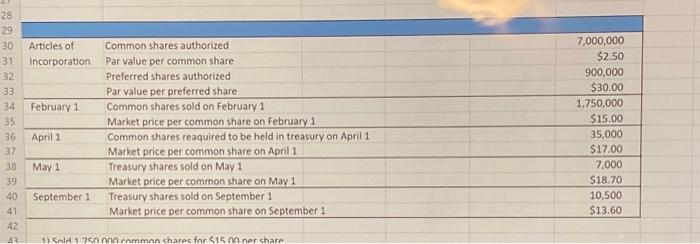

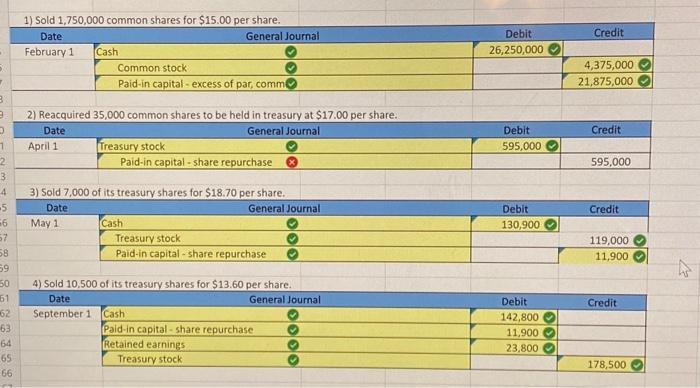

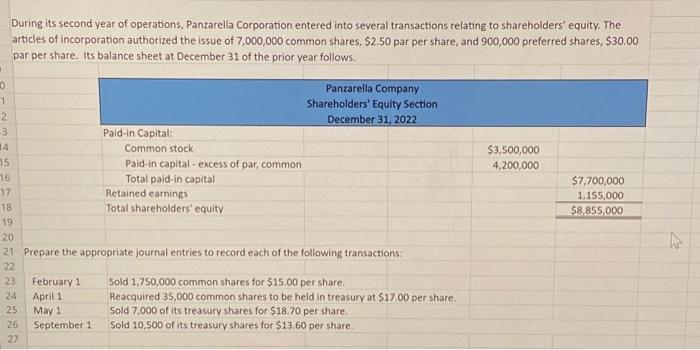

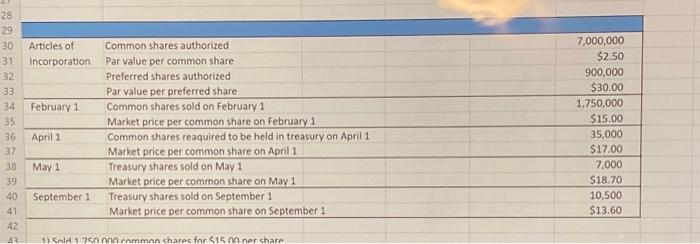

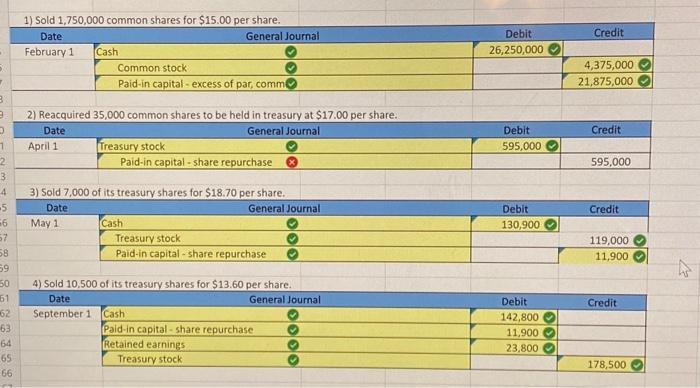

During its second year of operatoons, Panzarella Corporation entered into several transactions relating to shareholders' equity. The articles of incorporation authorized the issue of 7,000,000 common shares, $2.50 par per share, and 900,000 preferred shares, $30.00 par per share. Its balance sheet at December 31 of the prior year follows. Prepar 1) Sold 1,750,000 common shares for $15.00 per share. 2) Reacquired 35,000 common shares to be held in treasury at $17.00 per share. \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{1}{|c|}{ Date } & \multicolumn{1}{c|}{ General Journal } & Debit & \multicolumn{1}{c|}{ Credit } \\ \hline April1 & Treasury stock & P & 595,000 & \\ \hline & Paid-in capital - share repurchase & & 595,000 \\ \hline \end{tabular} 3) Sold 7,000 of its treasury shares for $18.70 per share. 4) Sold 10,500 of its treasury shares for $13.60 per share. 5) Prepare the shareholders' equity section of the balance sheet for the Panzarella Company at December 31, 2023. Net income for the year was $393,750 and dividends totaled $140,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started