Answered step by step

Verified Expert Solution

Question

1 Approved Answer

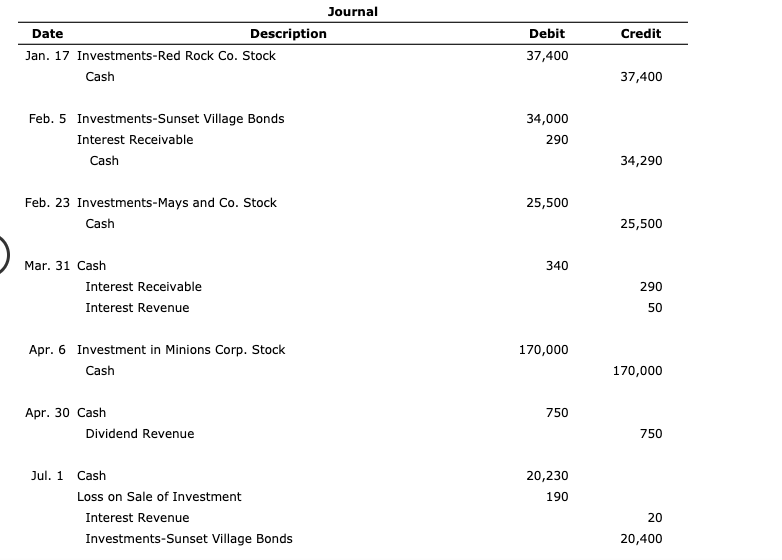

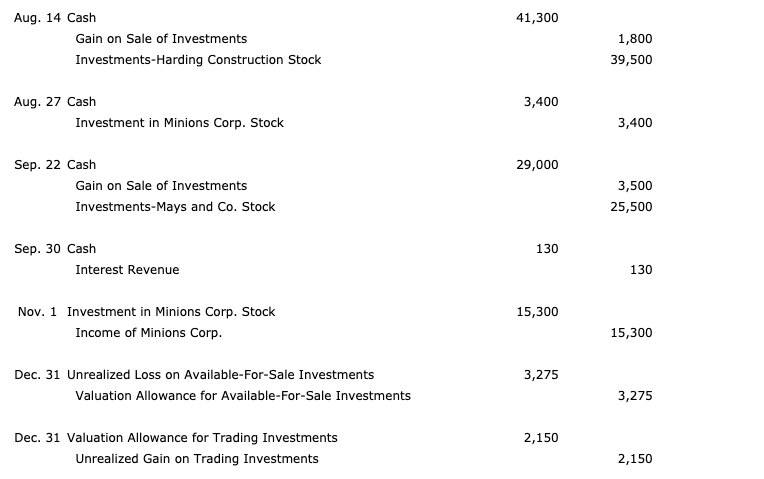

Please explain how to get answers. 41,300 Aug. 14 Cash Gain on Sale of Investments Investments-Harding Construction Stock 1,800 39,500 3,400 Aug. 27 Cash Investment

Please explain how to get answers.

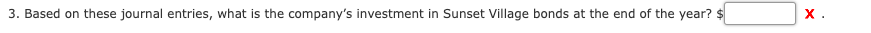

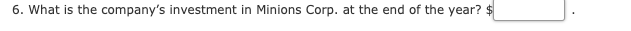

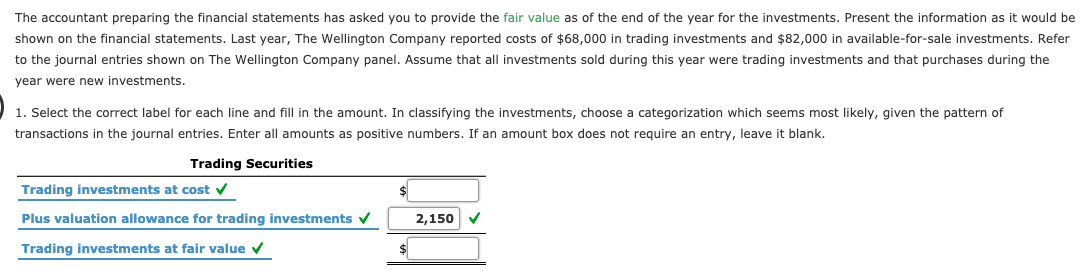

41,300 Aug. 14 Cash Gain on Sale of Investments Investments-Harding Construction Stock 1,800 39,500 3,400 Aug. 27 Cash Investment in Minions Corp. Stock 3,400 29,000 Sep. 22 Cash Gain on Sale of Investments Investments-Mays and Co. Stock 3,500 25,500 130 Sep. 30 Cash Interest Revenue 130 15,300 Nov. 1 Investment in Minions Corp. Stock Income of Minions Corp. 15,300 3,275 Dec. 31 Unrealized Loss on Available-For-Sale Investments Valuation Allowance for Available-For-Sale Investments 3,275 2,150 Dec. 31 Valuation Allowance for Trading Investments Unrealized Gain on Trading Investments 2,150 3. Based on these journal entries, what is the company's investment in Sunset Village bonds at the end of the year? $ 6. What is the company's investment in Minions Corp. at the end of the year? $ The accountant preparing the financial statements has asked you to provide the fair value as of the end of the year for the investments. Present the information as it would be shown on the financial statements. Last year, The Wellington Company reported costs of $68,000 in trading investments and $82,000 in available-for-sale investments. Refer to the journal entries shown on the Wellington Company panel. Assume that all investments sold during this year were trading investments and that purchases during the year were new investments. 1. Select the correct label for each line and fill in the amount. In classifying the investments, choose a categorization which seems most likely, given the pattern of transactions in the journal entries. Enter all amounts as positive numbers. If an amount box does not require an entry, leave it blank. Trading Securities Trading investments at cost Plus valuation allowance for trading investments 2,150 Trading investments at fair value 41,300 Aug. 14 Cash Gain on Sale of Investments Investments-Harding Construction Stock 1,800 39,500 3,400 Aug. 27 Cash Investment in Minions Corp. Stock 3,400 29,000 Sep. 22 Cash Gain on Sale of Investments Investments-Mays and Co. Stock 3,500 25,500 130 Sep. 30 Cash Interest Revenue 130 15,300 Nov. 1 Investment in Minions Corp. Stock Income of Minions Corp. 15,300 3,275 Dec. 31 Unrealized Loss on Available-For-Sale Investments Valuation Allowance for Available-For-Sale Investments 3,275 2,150 Dec. 31 Valuation Allowance for Trading Investments Unrealized Gain on Trading Investments 2,150 3. Based on these journal entries, what is the company's investment in Sunset Village bonds at the end of the year? $ 6. What is the company's investment in Minions Corp. at the end of the year? $ The accountant preparing the financial statements has asked you to provide the fair value as of the end of the year for the investments. Present the information as it would be shown on the financial statements. Last year, The Wellington Company reported costs of $68,000 in trading investments and $82,000 in available-for-sale investments. Refer to the journal entries shown on the Wellington Company panel. Assume that all investments sold during this year were trading investments and that purchases during the year were new investments. 1. Select the correct label for each line and fill in the amount. In classifying the investments, choose a categorization which seems most likely, given the pattern of transactions in the journal entries. Enter all amounts as positive numbers. If an amount box does not require an entry, leave it blank. Trading Securities Trading investments at cost Plus valuation allowance for trading investments 2,150 Trading investments at fair valueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started