Question

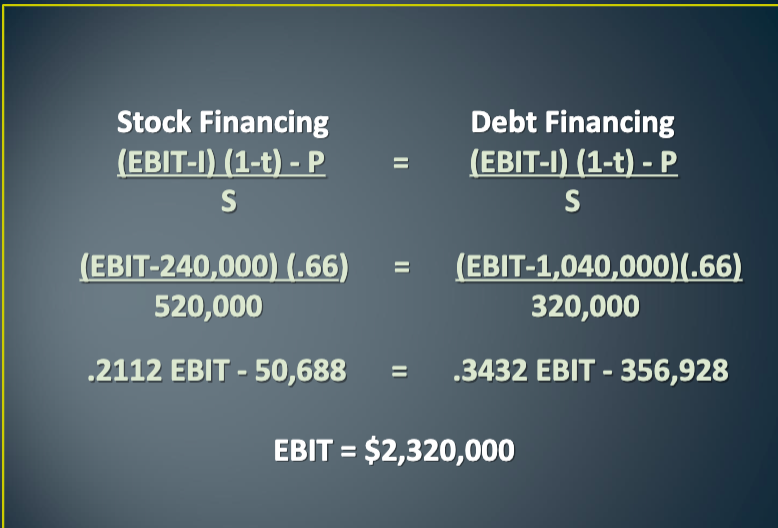

*****Please explain how to get each part of the equation! The formula needed is EPS = ((EBIT - I)(1 - t) - P)/ S ,

*****Please explain how to get each part of the equation! The formula needed is EPS = ((EBIT - I)(1 - t) - P)/ S , however I don't understand how to get I or S, so please explain! Thank you!!!

You are the CFO of Expo Corporation, a $20 million firm that is financed with $16 million in equity and $4 million in debt. The firms equity consists of 320,000 shares of common stock with a price of $50 per share. Expo has no preferred stock. The firms $4 million in debt has a coupon interest rate of 6%.You have decided to invest in a very promising $10 million capital investment project. Now you need to think about how to finance it. You can sell 200,000 shares of common stock at the current price of $50 per share, or you can just borrow the capital with a $10 million bond issue. The new bonds would have a coupon interest rate of 8%. Assume a 34% corporate tax rate.a)Find the break-even EBIT for your project.b)Calculate your firms EPS at the break-even EBIT.c)If your future EBIT is $4 million, which financing plan would give Expo the highest EPS?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started