Answered step by step

Verified Expert Solution

Question

1 Approved Answer

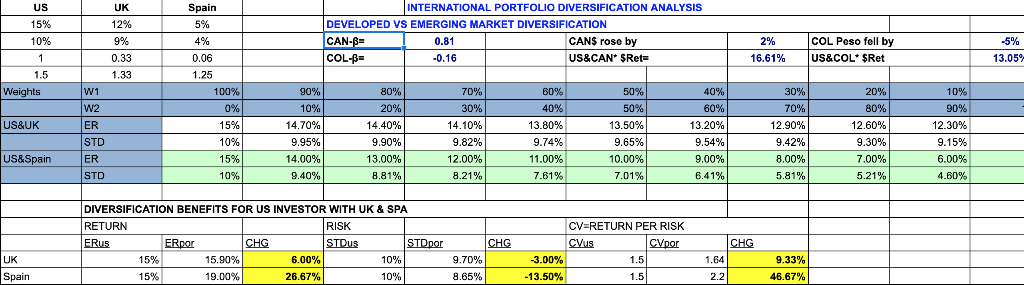

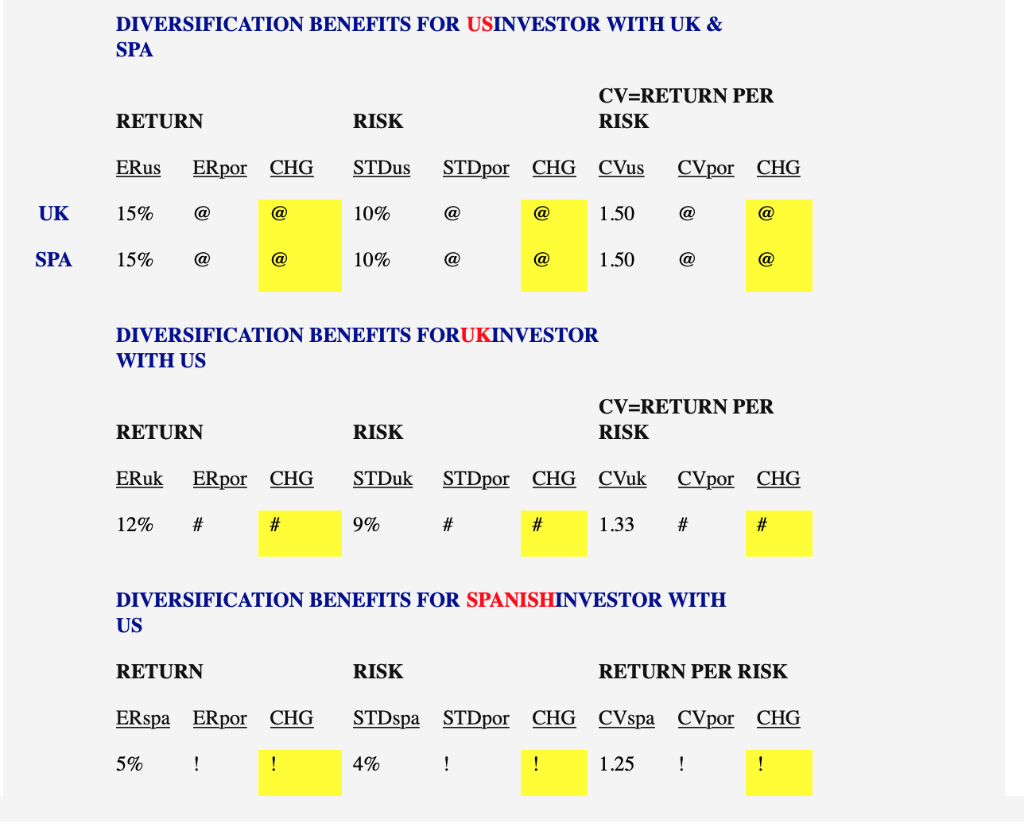

Please explain how to slove for these answers. The answers are in the information above just not sure how to slove for them. INTERNATIONAL PORTFOLIO

Please explain how to slove for these answers. The answers are in the information above just not sure how to slove for them.

INTERNATIONAL PORTFOLIO DIVERSIFICATION ANALYSIS UK 12% 996 0.33 Spain 5% 4% 0.06 1.25 DEVELOPED VS EMERGING MARKET DIVERSIFICATION CAN-B- COL 15% 10% 2% 16.61% COL Peso fell by | US&COL+$Ret -5% 13.05 CAN$ rose by 0.81 US&CAN $Ret- 0.16 20% 80% 12.60% 9.30% 30% 70% 40% 70% 30% 14.10% 9.82% 12.00% 8.21% 50% 50% 13.50% 9.65% 10.00% 60% 80% 20% 14.40% 9.90% 13.00%) 8.81% 100% 90% 10% 14.70% 9.95% 14.00%) 9.40% 90% 12.30% 9.15% 60% 13.20% 12 .90% 15% 10% 15% 10% 13.80%, 9.74% 11.00% US&UK 9.54% 9.42% STD ER STD 9.00%) 6.41% 8.00% 5.81% 7.00% 5.21% 6.00% 4.60% US&Spain 7.61% 7.01% DIVERSIFICATION BENEFITS FOR US INVESTOR WITH UK & SPA RETURN ERus CV-RETURN PER RISK CVus RISK CHC cVnor CHG CHG 1.64 9.33% -3.00% -13.50% 6.00% 10% 970% 15% 15% 15.90% UK 46.67% 19.00% 26.67% 10% 8.65% Spain DIVERSIFICATION BENEFITS FOR USINVESTOR WITH UK & SPA CV-RETURN PER RISK RETURN RISK ERus ERpor CHG STDus STDpor CHG CVus CVpor CHG UK 15% @ 10% 1.50@ SPA 15% 10% 1.50@ DIVERSIFICATION BENEFITS FORUKINVESTOR WITH US RETURN ERuk ERpor CHG STDuk STDpor CHG CVuk CVpor CHG 12% RISK RISK 9% 1.33 DIVERSIFICATION BENEFITS FOR SPANISHINVESTOR WITH US RETURN ERspa ERpor CHG STDspa STDpor CHG CVspa CVpor CHG 5% RISK RETURN PER RISK 4% 1.25! INTERNATIONAL PORTFOLIO DIVERSIFICATION ANALYSIS UK 12% 996 0.33 Spain 5% 4% 0.06 1.25 DEVELOPED VS EMERGING MARKET DIVERSIFICATION CAN-B- COL 15% 10% 2% 16.61% COL Peso fell by | US&COL+$Ret -5% 13.05 CAN$ rose by 0.81 US&CAN $Ret- 0.16 20% 80% 12.60% 9.30% 30% 70% 40% 70% 30% 14.10% 9.82% 12.00% 8.21% 50% 50% 13.50% 9.65% 10.00% 60% 80% 20% 14.40% 9.90% 13.00%) 8.81% 100% 90% 10% 14.70% 9.95% 14.00%) 9.40% 90% 12.30% 9.15% 60% 13.20% 12 .90% 15% 10% 15% 10% 13.80%, 9.74% 11.00% US&UK 9.54% 9.42% STD ER STD 9.00%) 6.41% 8.00% 5.81% 7.00% 5.21% 6.00% 4.60% US&Spain 7.61% 7.01% DIVERSIFICATION BENEFITS FOR US INVESTOR WITH UK & SPA RETURN ERus CV-RETURN PER RISK CVus RISK CHC cVnor CHG CHG 1.64 9.33% -3.00% -13.50% 6.00% 10% 970% 15% 15% 15.90% UK 46.67% 19.00% 26.67% 10% 8.65% Spain DIVERSIFICATION BENEFITS FOR USINVESTOR WITH UK & SPA CV-RETURN PER RISK RETURN RISK ERus ERpor CHG STDus STDpor CHG CVus CVpor CHG UK 15% @ 10% 1.50@ SPA 15% 10% 1.50@ DIVERSIFICATION BENEFITS FORUKINVESTOR WITH US RETURN ERuk ERpor CHG STDuk STDpor CHG CVuk CVpor CHG 12% RISK RISK 9% 1.33 DIVERSIFICATION BENEFITS FOR SPANISHINVESTOR WITH US RETURN ERspa ERpor CHG STDspa STDpor CHG CVspa CVpor CHG 5% RISK RETURN PER RISK 4% 1.25Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started