Please explain it step by step

Please explain it step by step

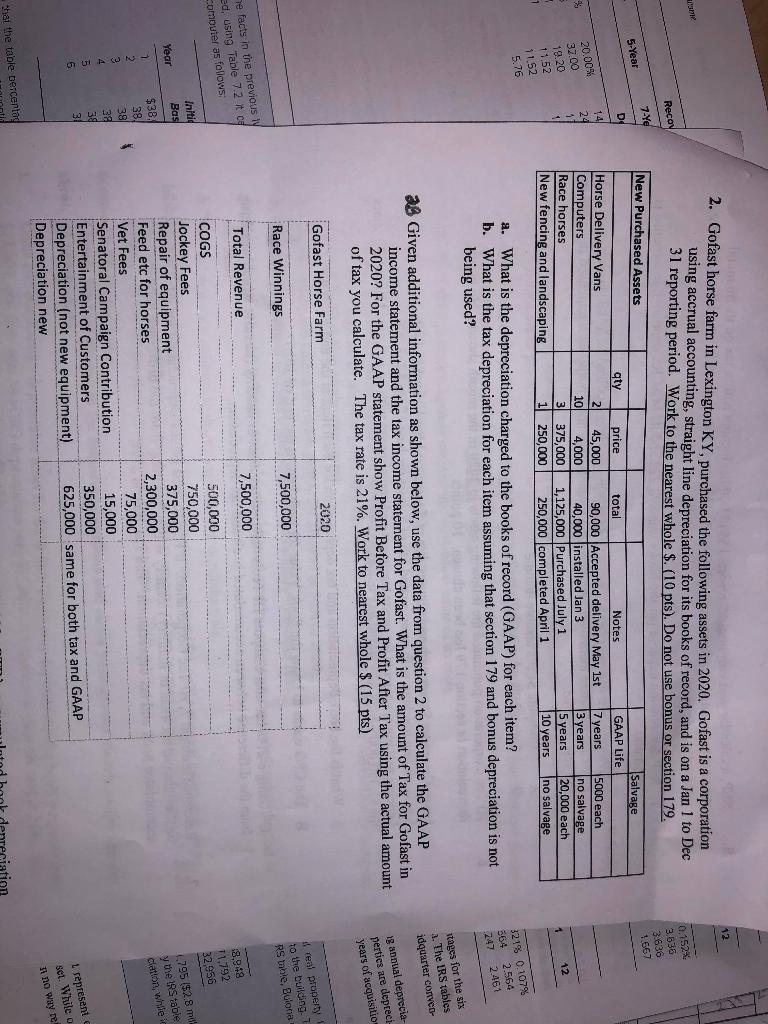

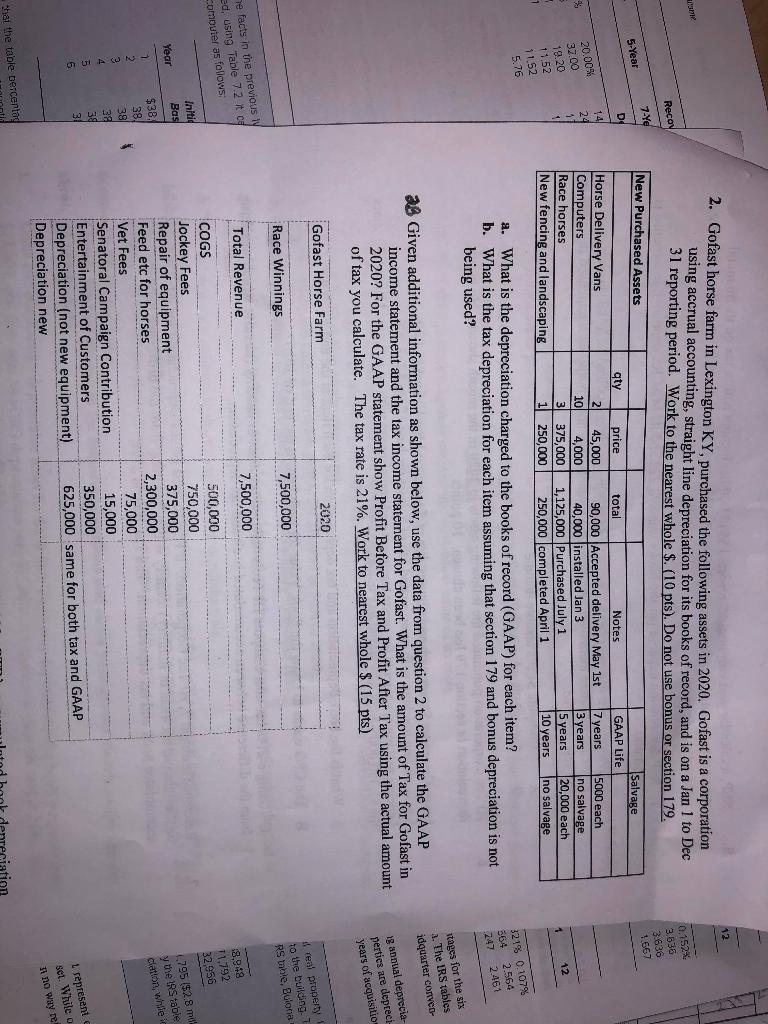

2. Gofast horse farm in Lexington KY, purchased the following assets in 2020. Gofast is a corporation using accrual accounting, straight line depreciation for its books of record, and is on a Jan 1 to Dec 31 reporting period. Work to the nearest whole $. (10 pts). Do not use bonus or section 179. Recov 6.1528 3.535 3.636 1667 720 New Purchased Assets 5-Year De qty 14 24 20.00% 37.00 19.20 1352 Horse Delivery Vans Computers Race horses New fencing and landscaping 2 10 3 price 45,000 4,000 375,000 250,000 total Notes 90,000 Accepted delivery May 1st 40,000 installed Jan 3 1,125,000 Purchased July 1 250,000 completed April 1 Salvage GAAP Life 7 years 5000 each 3 years no salvage 5 years 20,000 each 10 years no salvage 12 1 1 7152 5.76 a. What is the depreciation charged to the books of record (GAAP) for each item? b. What is the tax depreciation for each item assuming that section 179 and bonus depreciation is not being used? $21% 0.107% 564 2.564 2.461 tages for the six 1. The IRS tables idquarter conveo as Given additional information as shown below, use the data from question 2 to calculate the GAAP income statement and the tax income statement for Gofast. What is the amount of Tax for Gofast in 2020? For the GAAP statement show Profit Before Tax and Profit After Tax using the actual amount of tax you calculate. The tax rate is 21%. Work to nearest whole $ (15 pts) 13 annual deprecia perties are depreci years of acquisitio 2020 Gofast Horse Farm real property to the building RS tabte, Buona Race Winnings 7,500,000 Total Revenue 7,500,000 ne facts in the previous 1 ed, using Table 72 it co comouier as folows 18.948 11,792 32,956 Initi Bas Year 1.795 $2.8 mis y the RS table clation, while $38. 38. 35 39 3d 31 2 2 4 5 6 500,000 750,000 375,000 2,300,000 75,000 15,000 350,000 625,000 same for both tax and GAAP COGS Jockey Fees Repair of equipment Feed etc for horses Vet Fees Senatoral Campaign Contribution Entertainment of Customers Depreciation (not new equipment) Depreciation new 1 represent set. While o n no way re that the table berceria 2. Gofast horse farm in Lexington KY, purchased the following assets in 2020. Gofast is a corporation using accrual accounting, straight line depreciation for its books of record, and is on a Jan 1 to Dec 31 reporting period. Work to the nearest whole $. (10 pts). Do not use bonus or section 179. Recov 6.1528 3.535 3.636 1667 720 New Purchased Assets 5-Year De qty 14 24 20.00% 37.00 19.20 1352 Horse Delivery Vans Computers Race horses New fencing and landscaping 2 10 3 price 45,000 4,000 375,000 250,000 total Notes 90,000 Accepted delivery May 1st 40,000 installed Jan 3 1,125,000 Purchased July 1 250,000 completed April 1 Salvage GAAP Life 7 years 5000 each 3 years no salvage 5 years 20,000 each 10 years no salvage 12 1 1 7152 5.76 a. What is the depreciation charged to the books of record (GAAP) for each item? b. What is the tax depreciation for each item assuming that section 179 and bonus depreciation is not being used? $21% 0.107% 564 2.564 2.461 tages for the six 1. The IRS tables idquarter conveo as Given additional information as shown below, use the data from question 2 to calculate the GAAP income statement and the tax income statement for Gofast. What is the amount of Tax for Gofast in 2020? For the GAAP statement show Profit Before Tax and Profit After Tax using the actual amount of tax you calculate. The tax rate is 21%. Work to nearest whole $ (15 pts) 13 annual deprecia perties are depreci years of acquisitio 2020 Gofast Horse Farm real property to the building RS tabte, Buona Race Winnings 7,500,000 Total Revenue 7,500,000 ne facts in the previous 1 ed, using Table 72 it co comouier as folows 18.948 11,792 32,956 Initi Bas Year 1.795 $2.8 mis y the RS table clation, while $38. 38. 35 39 3d 31 2 2 4 5 6 500,000 750,000 375,000 2,300,000 75,000 15,000 350,000 625,000 same for both tax and GAAP COGS Jockey Fees Repair of equipment Feed etc for horses Vet Fees Senatoral Campaign Contribution Entertainment of Customers Depreciation (not new equipment) Depreciation new 1 represent set. While o n no way re that the table berceria

Please explain it step by step

Please explain it step by step