Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please explain step by step I've got the set up eqt but don't know how to solve it please explain how to solve I get

please explain step by step I've got the set up eqt but don't know how to solve it please explain how to solve I get stuck here (p/f,14%,2) don't know how to solve that if you could please explain that on the losses to get the answer that would be great.

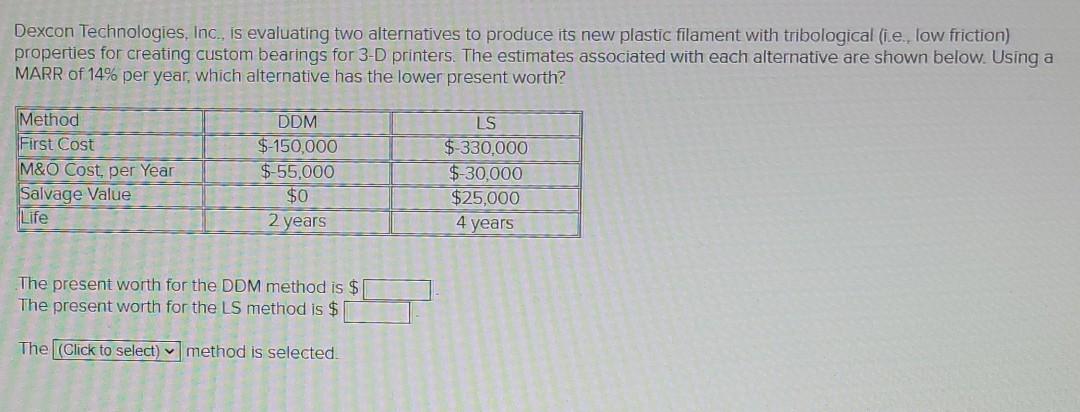

Dexcon Technologies, Inc., is evaluating two alternatives to produce its new plastic filament with tribological (ie., low friction) properties for creating custom bearings for 3-D printers. The estimates associated with each alternative are shown below. Using a MARR of 14% per year, which alternative has the lower present worth? Method First Cost M&O Cost, per Year Salvage Value Life DDM $-150,000 $-55.000 $0 2 years LS $-330,000 $-30,000 $25,000 4 years The present worth for the DDM method is $ The present worth for the LS method is $ The (Click to select) method is selectedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started