Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain the purchase and sale of equipment with ledger accounts! View Policies Current Attempt in Progress The balance sheet data of Bridgeport Company at

Please explain the purchase and sale of equipment with ledger accounts!

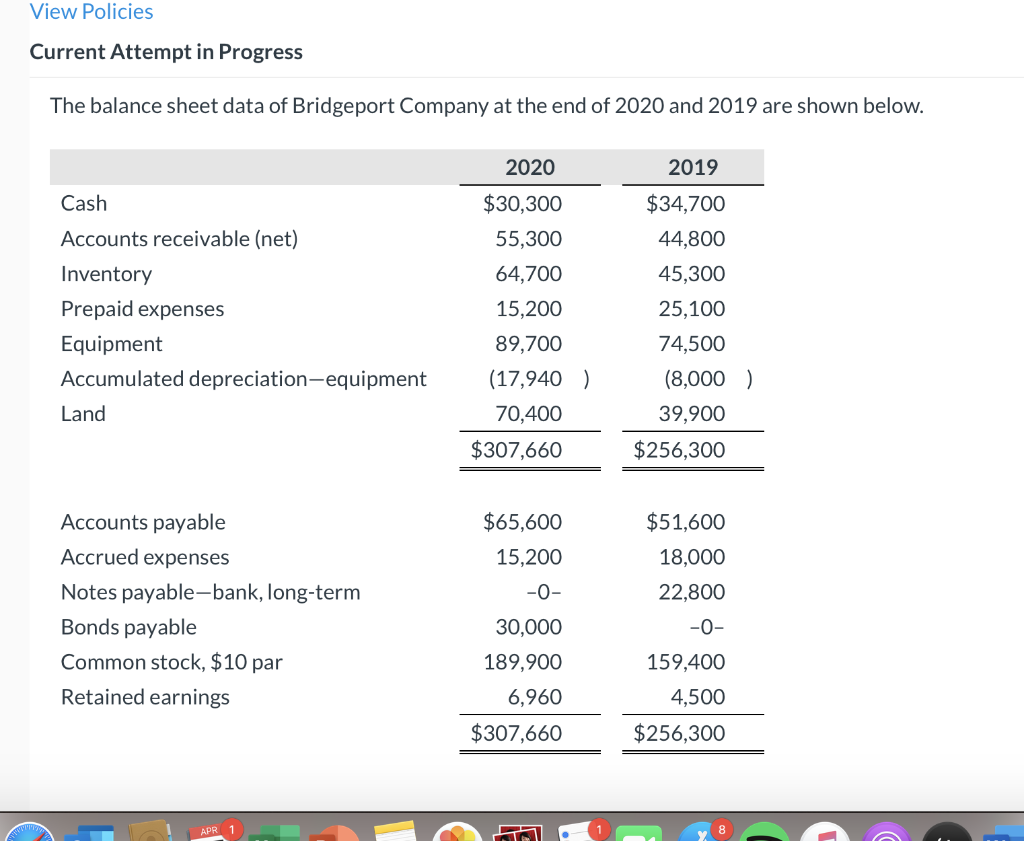

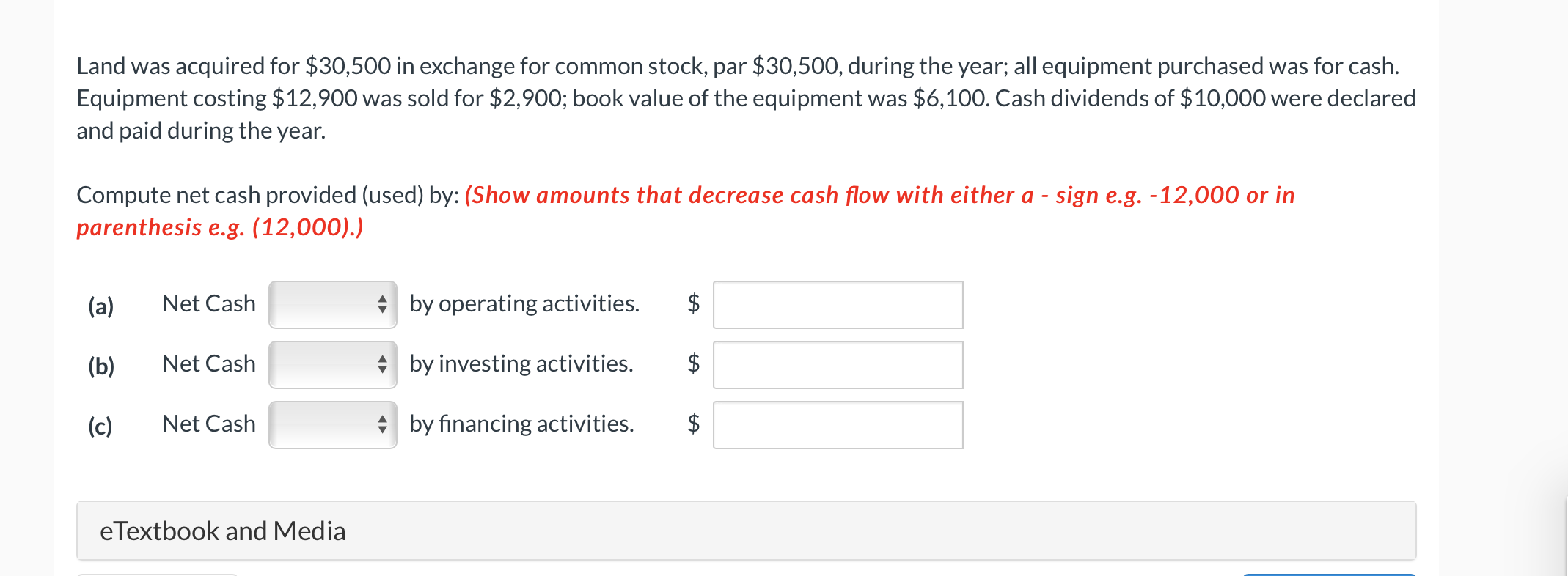

View Policies Current Attempt in Progress The balance sheet data of Bridgeport Company at the end of 2020 and 2019 are shown below. 2020 2019 Cash $30,300 55,300 64,700 15,200 $34,700 44,800 45,300 25,100 Accounts receivable (net) Inventory Prepaid expenses Equipment Accumulated depreciation-equipment Land 74,500 (8,000) 89,700 (17,940) 70,400 $307,660 39,900 $256,300 $65,600 $51,600 15,200 18,000 22,800 -0- Accounts payable Accrued expenses Notes payable-bank, long-term Bonds payable Common stock, $10 par Retained earnings 30,000 -0- 159,400 189,900 6,960 $307,660 4,500 $256,300 Land was acquired for $30,500 in exchange for common stock, par $30,500, during the year; all equipment purchased was for cash. Equipment costing $12,900 was sold for $2,900; book value of the equipment was $6,100. Cash dividends of $10,000 were declared and paid during the year. Compute net cash provided (used) by: (Show amounts that decrease cash flow with either a - sign e.g.-12,000 or in parenthesis e.g. (12,000).) (a) Net Cash A by operating activities. $ (b) Net Cash A by investing activities. TA (c) Net Cash A by financing activities. $ eTextbook and MediaStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started