Answered step by step

Verified Expert Solution

Question

1 Approved Answer

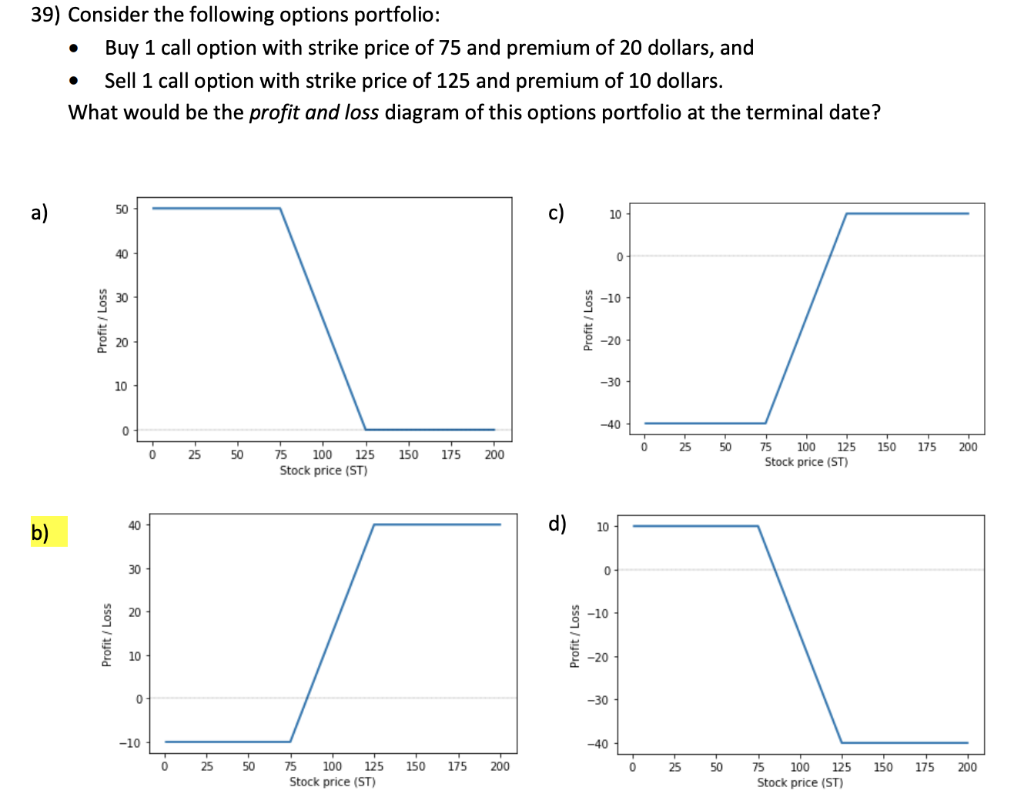

Please explain the solution. 39) Consider the following options portfolio: Buy 1 call option with strike price of 75 and premium of 20 dollars, and

Please explain the solution.

39) Consider the following options portfolio: Buy 1 call option with strike price of 75 and premium of 20 dollars, and Sell 1 call option with strike price of 125 and premium of 10 dollars. What would be the profit and loss diagram of this options portfolio at the terminal date? c) 101 Profit / Loss Profit / Loss -401 0 25 50 150 175 200 25 50 75 100 125 Stock price (ST) 75 100 125 Stock price (ST) 150 175 200 d) 107 Profit / Loss Profit / Loss -10 L 0 25 50 75 100 125 Stock price (ST) 150 175 200 25 50 75 100 125 Stock price (ST) 150 175 200Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started