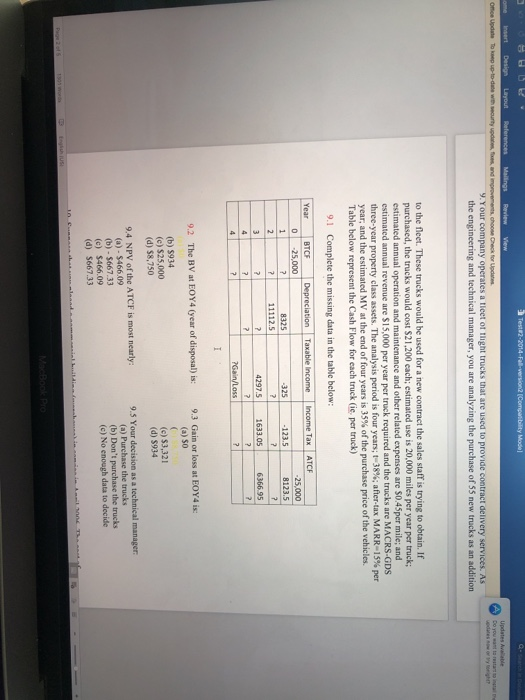

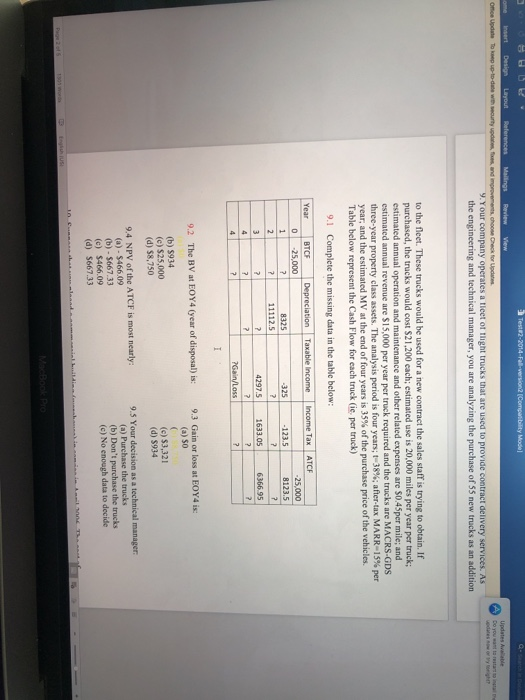

9.Your company operates a tieet ot tlight trucks that are used to provide contract delivery services. As the engineering and technical manager, you are analyzing the purchase of SS new trucks as an addition to the fleet. These trucks would be used for a new contract the sales staff is trying to obtain. If purchased, the trucks would cost $21,200 each; estimated use is 20,000 miles per year per truck; estimated annual operation and maintenance and other related expenses are $0.45per mile; and estimated annual revenue are $15,000 per year per truck required and the trucks are MACRS-GDS three-year property class assets. The analysis period is four years,1-38%; after-tax MARR-15% per year, and the estimated MV at the end of four years is 35% of the purchase price of the vehicles. Table below represent the Cash Flow for each truck (ie, per truck) 9.1 Complete the missing data in the table below: Year BTCF 0 25,000 325 123.5 11112.5 42975 1633.05 9.2 The BV at EOY4 (year of disposal) is: 9.3 Gain or loss at EOY4 is: (a) So (b) $934 (c) $25,000 (d) $8,750 (c) $3,321 (d) $934 9.4 NPV of the ATCF is most nearly: 9.5 Your decision as a technical manager (a) $466.09 (b) $667.33 (c) $466.09 (d) 5667.33 (a) Purchase the trucks (b) Don't parchase the trucks (c) No enough data to decide 9.Your company operates a tieet ot tlight trucks that are used to provide contract delivery services. As the engineering and technical manager, you are analyzing the purchase of SS new trucks as an addition to the fleet. These trucks would be used for a new contract the sales staff is trying to obtain. If purchased, the trucks would cost $21,200 each; estimated use is 20,000 miles per year per truck; estimated annual operation and maintenance and other related expenses are $0.45per mile; and estimated annual revenue are $15,000 per year per truck required and the trucks are MACRS-GDS three-year property class assets. The analysis period is four years,1-38%; after-tax MARR-15% per year, and the estimated MV at the end of four years is 35% of the purchase price of the vehicles. Table below represent the Cash Flow for each truck (ie, per truck) 9.1 Complete the missing data in the table below: Year BTCF 0 25,000 325 123.5 11112.5 42975 1633.05 9.2 The BV at EOY4 (year of disposal) is: 9.3 Gain or loss at EOY4 is: (a) So (b) $934 (c) $25,000 (d) $8,750 (c) $3,321 (d) $934 9.4 NPV of the ATCF is most nearly: 9.5 Your decision as a technical manager (a) $466.09 (b) $667.33 (c) $466.09 (d) 5667.33 (a) Purchase the trucks (b) Don't parchase the trucks (c) No enough data to decide