Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please explain the steps I have the answer from class notes just need to learn how we get the numbers for the NPV. I also

please explain the steps I have the answer from class notes just need to learn how we get the numbers for the NPV. I also have a Casio Grapghing Calculator that can do NPV fast.

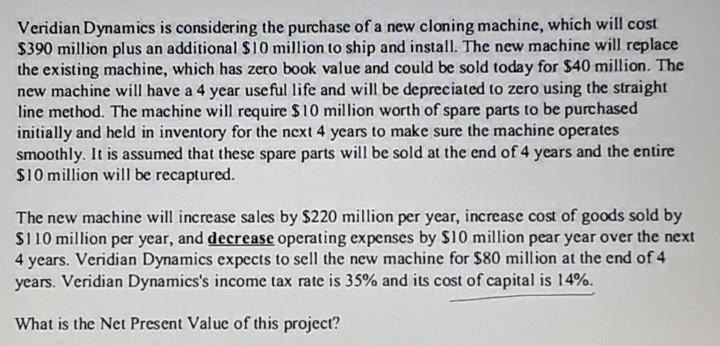

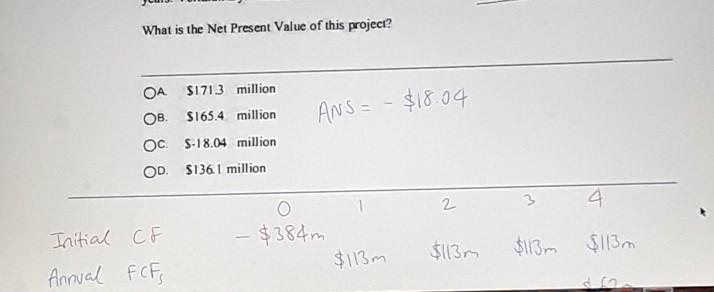

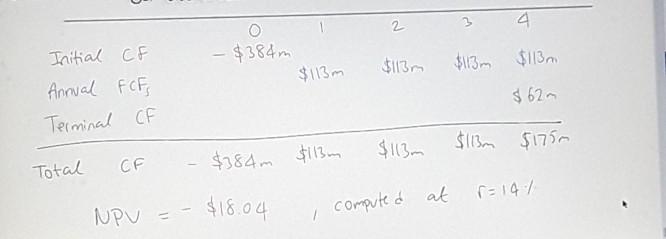

Veridian Dynamics is considering the purchase of a new cloning machine, which will cost $390 million plus an additional $10 million to ship and install. The new machine will replace the existing machine, which has zero book value and could be sold today for $40 million. The new machine will have a 4 year useful life and will be depreciated to zero using the straight line method. The machine will require $10 million worth of spare parts to be purchased initially and held in inventory for the next 4 years to make sure the machine operates smoothly. It is assumed that these spare parts will be sold at the end of 4 years and the entire $10 million will be recaptured. The new machine will increase sales by $220 million per year, increase cost of goods sold by $110 million per year, and decrease operating expenses by $10 million pear year over the next 4 years. Veridian Dynamics expects to sell the new machine for $80 million at the end of 4 years. Veridian Dynamics's income tax rate is 35% and its cost of capital is 14%. What is the Net Present Value of this project? What is the Net Present Value of this project? $ ANS = - $18.04 OA $1713 million OB. $165.4 million OCS-18.04 million OD $136.1 million 2 4 $384m $113m Initial CF Annual FCF $113 $113m $113 2 4 O $384m $113 $113m $113 $113m Initial CF Annual FCF Terminal CF $ 62 $113m $113m $175m Total CF $384m $113m r = 147 $18.04 NPV = computed at

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started