Please explain the work to get these answers

Please explain the work to get these answers

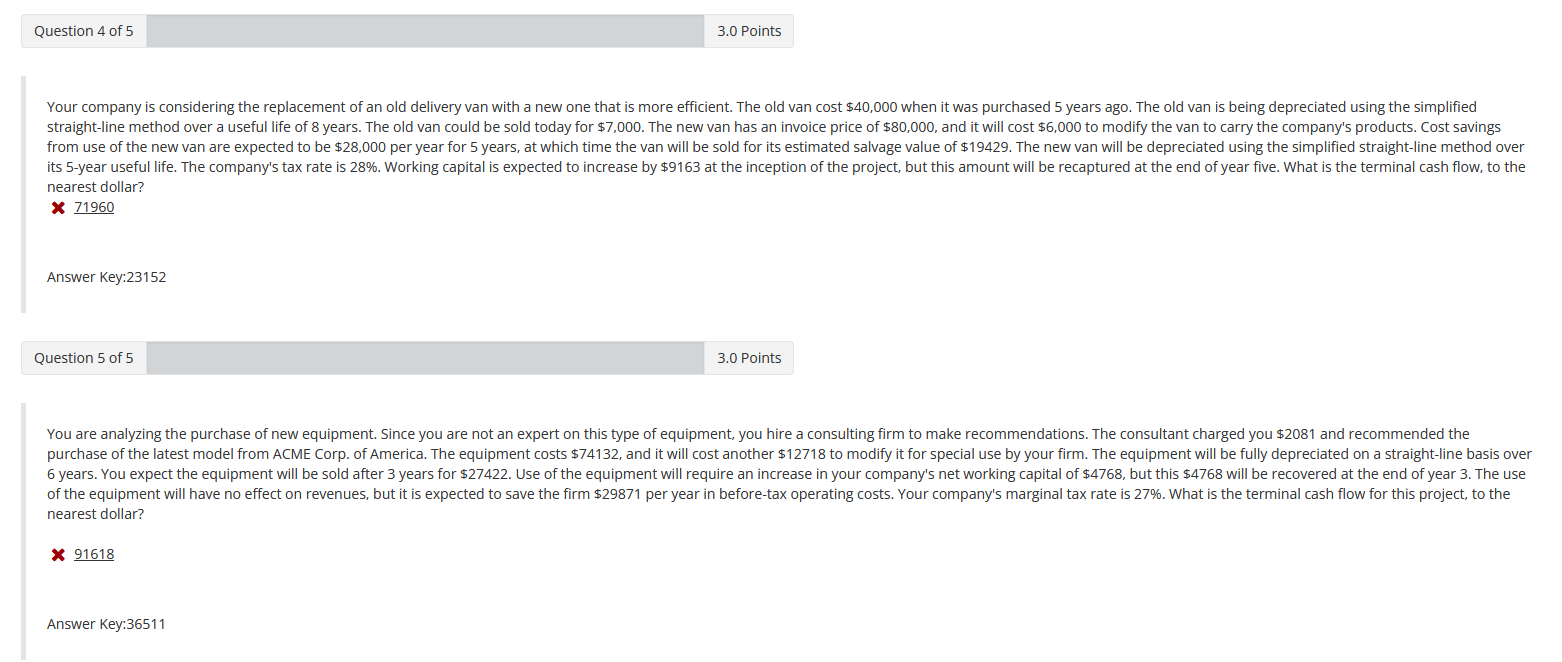

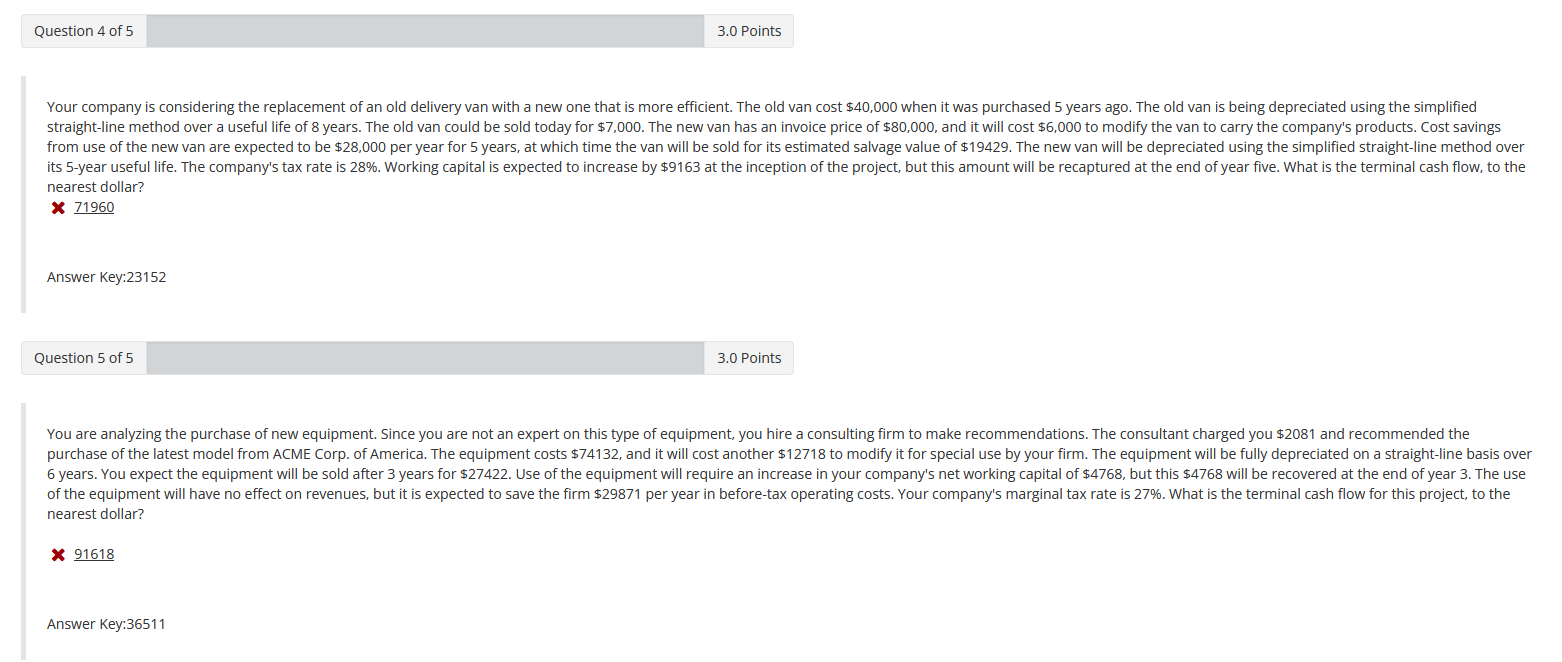

Question 4 of 5 3.0 Points Your company is considering the replacement of an old delivery van with a new one that is more efficient. The old van cost $40,000 when it was purchased 5 years ago. The old van is being depreciated using the simplified straight-line method over a useful life of 8 years. The old van could be sold today for $7,000. The new van has an invoice price of $80,000, and it will cost $6,000 to modify the van to carry the company's products. Cost savings from use of the new van are expected to be $28,000 per year for 5 years, at which time the van will be sold for its estimated salvage value of $19429. The new van will be depreciated using the simplified straight-line method over its 5-year useful life. The company's tax rate is 28%. Working capital is expected to increase by $9163 at the inception of the project, but this amount will be recaptured at the end of year five. What is the terminal cash flow, to the nearest dollar? X 71960 Answer Key:23152 Question 5 of 5 3.0 Points You are analyzing the purchase of new equipment. Since you are not an expert on this type of equipment, you hire a consulting firm to make recommendations. The consultant charged you $2081 and recommended the purchase of the latest model from ACME Corp. of America. The equipment costs $74132, and it will cost another $12718 to modify it for special use by your firm. The equipment will be fully depreciated on a straight-line basis over 6 years. You expect the equipment will be sold after 3 years for $27422. Use of the equipment will require an increase in your company's net working capital of $4768, but this $4768 will be recovered at the end of year 3. The use of the equipment will have no effect on revenues, but it is expected to save the firm $29871 per year in before-tax operating costs. Your company's marginal tax rate is 27%. What is the terminal cash flow for this project, to the nearest dollar? X 91618 Answer Key:36511 Question 4 of 5 3.0 Points Your company is considering the replacement of an old delivery van with a new one that is more efficient. The old van cost $40,000 when it was purchased 5 years ago. The old van is being depreciated using the simplified straight-line method over a useful life of 8 years. The old van could be sold today for $7,000. The new van has an invoice price of $80,000, and it will cost $6,000 to modify the van to carry the company's products. Cost savings from use of the new van are expected to be $28,000 per year for 5 years, at which time the van will be sold for its estimated salvage value of $19429. The new van will be depreciated using the simplified straight-line method over its 5-year useful life. The company's tax rate is 28%. Working capital is expected to increase by $9163 at the inception of the project, but this amount will be recaptured at the end of year five. What is the terminal cash flow, to the nearest dollar? X 71960 Answer Key:23152 Question 5 of 5 3.0 Points You are analyzing the purchase of new equipment. Since you are not an expert on this type of equipment, you hire a consulting firm to make recommendations. The consultant charged you $2081 and recommended the purchase of the latest model from ACME Corp. of America. The equipment costs $74132, and it will cost another $12718 to modify it for special use by your firm. The equipment will be fully depreciated on a straight-line basis over 6 years. You expect the equipment will be sold after 3 years for $27422. Use of the equipment will require an increase in your company's net working capital of $4768, but this $4768 will be recovered at the end of year 3. The use of the equipment will have no effect on revenues, but it is expected to save the firm $29871 per year in before-tax operating costs. Your company's marginal tax rate is 27%. What is the terminal cash flow for this project, to the nearest dollar? X 91618 Answer Key:36511

Please explain the work to get these answers

Please explain the work to get these answers