Question

Please explain these questions clearly. I want to know how we get to the solution. The company has estimated the net present value of the

Please explain these questions clearly. I want to know how we get to the solution.

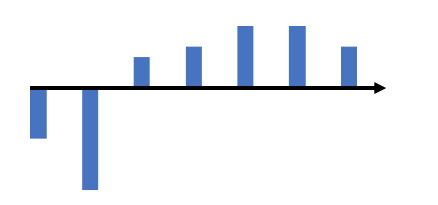

The company has estimated the net present value of the investment project at -0.294 M. In the calculation, the capital return requirement has been 6%. As illustrated in the picture, the initial investment includes a currently scheduled development phase of 1.2 M and the subsequent production system construction phase of 2.8 M. Two years from now, the first positive free cash flow from sales is scheduled.

Please explain how the answer is got in these next parts:

- How much is the investment estimated to increase the company's value at the point when the construction phase of the production system has been implemented a year from now? Enter the answer to three decimal places x.xxx [M]. -The correct answer is: 3.760

- How big would be the free cash flow after the initial investment [M/year], if, contrary to the picture, it were the same every year, but the net present value of the investment project was given above? Enter the answer to three decimal places x.xxx [M].- The correct answer is: 0.893

- The company has prepared two scenarios of the free cash flows generated after the initial investment, i.e. the development and construction phases. The probability of the realization of the better scenario is estimated to be 0.6, and the present value of the free cash flows after the initial investment is 4,717 M. The probability of the worse scenario being realized is estimated at 0.4, and the present value of the free cash flows after the initial investment is 1,792 M. It would be possible to divide the investment decision into two phases, because before starting the construction phase, we can find out which scenario will come true. What is the net present value of the investment with these assumptions? Enter the answer to three decimal places x.xxx [M].-The correct answer is: 0.045

You now have the net present value of the investment calculated in two ways: directly according to the expected value (given in the initial values) and taking into account the phasing (section 3). The calculation methods lead to different numerical values and, when following the NPV rule, to a different decision on starting the investment project.

Next, break-even questions related to either method of calculation are presented.

4. How large should the investment cost of the development phase (starting assumption 1.2 M) be at most, so that the net present values obtained by both calculation methods would lead to the start of the project in accordance with the NPV rule? Enter the answer to three decimal places x.xxx [M]. -The correct answer is: 0.906

5. How large should the investment cost of the construction phase be at most (starting assumption 2.8 M), so that the net present values obtained with both calculation methods would lead to the start of the project in accordance with the NPV rule? Enter the answer to three decimal places x.xxx [M]. - The correct answer is: 2.488

6. It is assumed that there is a small probability that after the development phase an environmental permit will not be obtained to continue the project, i.e. the project will have to be stopped. This applies to both scenarios. What is the minimum probability that the company should believe that it will receive an environmental permit so that the project would be worth starting (i.e. the NPV would not be negative). Enter the answer with two decimal places [0.xx]. - The correct answer is: 0.96

7. At least how big should the present value of the free cash flows after the initial investment be in the case of a worse scenario (probability=0.4) so that the net present values obtained by both calculation methods would lead to starting the project according to the NPV rule? Enter the answer to three decimal places x.xxx [M]. - The correct answer is: 2.528

8. What should be the minimum present value of the free cash flows after the initial investment in the case of a better scenario, so that the net present values obtained by both calculation methods would not lead to the rejection of the project according to the NPV rule? Enter the answer to three decimal places x.xxx [M]. - The correct answer is: 4.642

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started