Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain these questions, thanks? Problem Four Jane purchased a residential property on 13 August 1989 (settlement took place on 29 October 1990) for $330,000.

Please explain these questions, thanks?

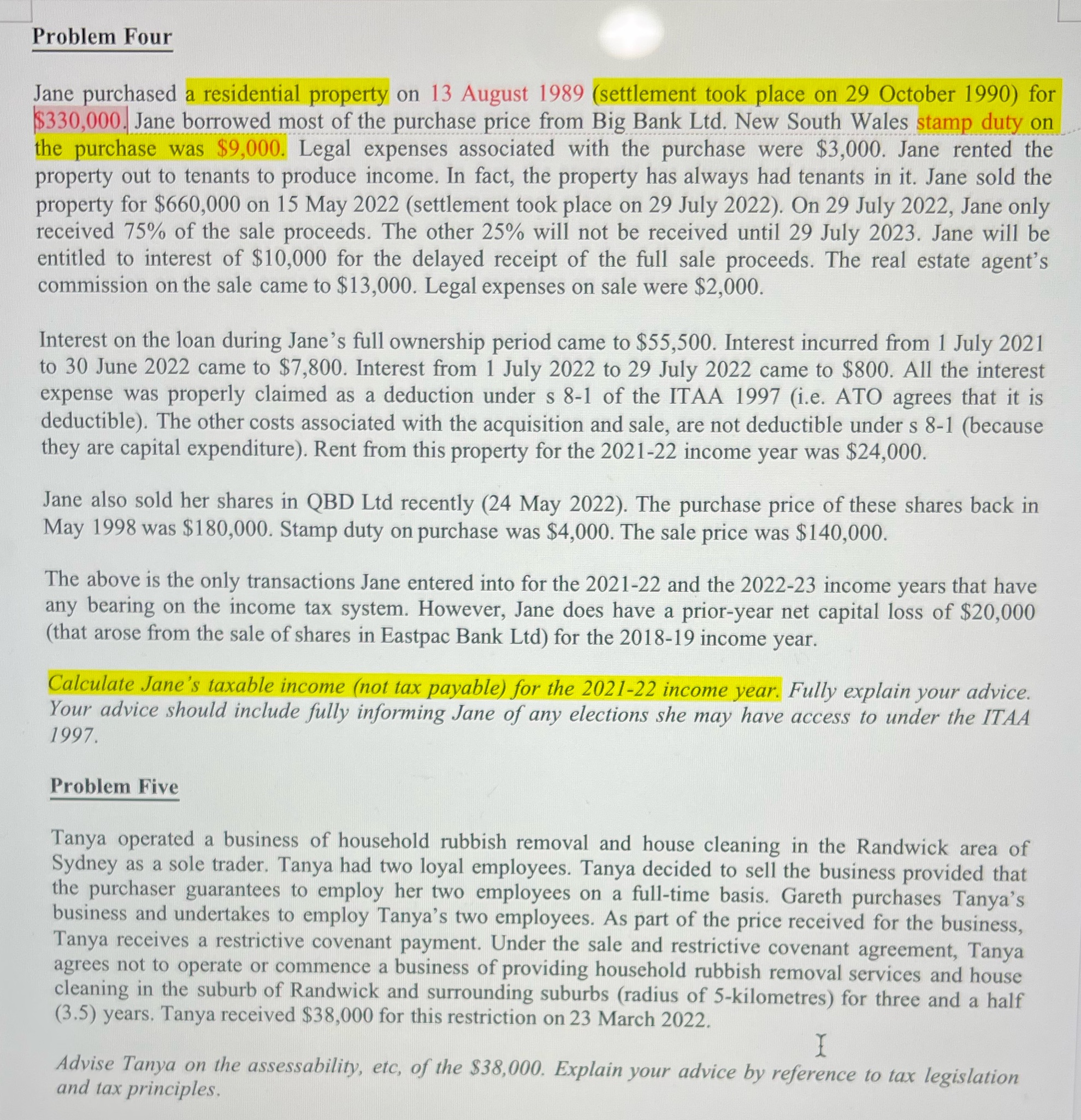

Problem Four Jane purchased a residential property on 13 August 1989 (settlement took place on 29 October 1990) for $330,000. Jane borrowed most of the purchase price from Big Bank Ltd. New South Wales stamp duty on the purchase was $9,000. Legal expenses associated with the purchase were $3,000. Jane rented the property out to tenants to produce income. In fact, the property has always had tenants in it. Jane sold the property for $660,000 on 15 May 2022 (settlement took place on 29 July 2022). On 29 July 2022, Jane only received 75% of the sale proceeds. The other 25% will not be received until 29 July 2023. Jane will be entitled to interest of $10,000 for the delayed receipt of the full sale proceeds. The real estate agent's commission on the sale came to $13,000. Legal expenses on sale were $2,000. Interest on the loan during Jane's full ownership period came to $55,500. Interest incurred from 1 July 2021 to 30 June 2022 came to $7,800. Interest from 1 July 2022 to 29 July 2022 came to $800. All the interest expense was properly claimed as a deduction under s 8-1 of the ITAA 1997 (i.e. ATO agrees that it is deductible). The other costs associated with the acquisition and sale, are not deductible under s 8-1 (because they are capital expenditure). Rent from this property for the 2021-22 income year was $24,000. Jane also sold her shares in QBD Ltd recently (24 May 2022). The purchase price of these shares back in May 1998 was $180,000. Stamp duty on purchase was $4,000. The sale price was $140,000. The above is the only transactions Jane entered into for the 2021-22 and the 2022-23 income years that have any bearing on the income tax system. However, Jane does have a prior-year net capital loss of $20,000 (that arose from the sale of shares in Eastpac Bank Ltd) for the 2018-19 income year. Calculate Jane's taxable income (not tax payable) for the 2021-22 income year. Fully explain your advice. Your advice should include fully informing Jane of any elections she may have access to under the ITAA 1997. Problem Five Tanya operated a business of household rubbish removal and house cleaning in the Randwick area of Sydney as a sole trader. Tanya had two loyal employees. Tanya decided to sell the business provided that the purchaser guarantees to employ her two employees on a full-time basis. Gareth purchases Tanya's business and undertakes to employ Tanya's two employees. As part of the price received for the business, Tanya receives a restrictive covenant payment. Under the sale and restrictive covenant agreement, Tanya agrees not to operate or commence a business of providing household rubbish removal services and house cleaning in the suburb of Randwick and surrounding suburbs (radius of 5-kilometres) for three and a half (3.5) years. Tanya received $38,000 for this restriction on 23 March 2022. I Advise Tanya on the assessability, etc, of the $38,000. Explain your advice by reference to tax legislation and tax principles.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Problem Four Janes Capital Gains Tax This problem considers Janes capital gains tax for the 202122 i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started