Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please explain to me ,in required 5 why we deduct the non redeemable preferred stock, knowing in the equation we deduct preferred stock equity we

please explain to me ,in required 5 why we deduct the non redeemable preferred stock, knowing in the equation we deduct preferred stock equity

we must don't deduct the non redeemable preferred stock because it's liability

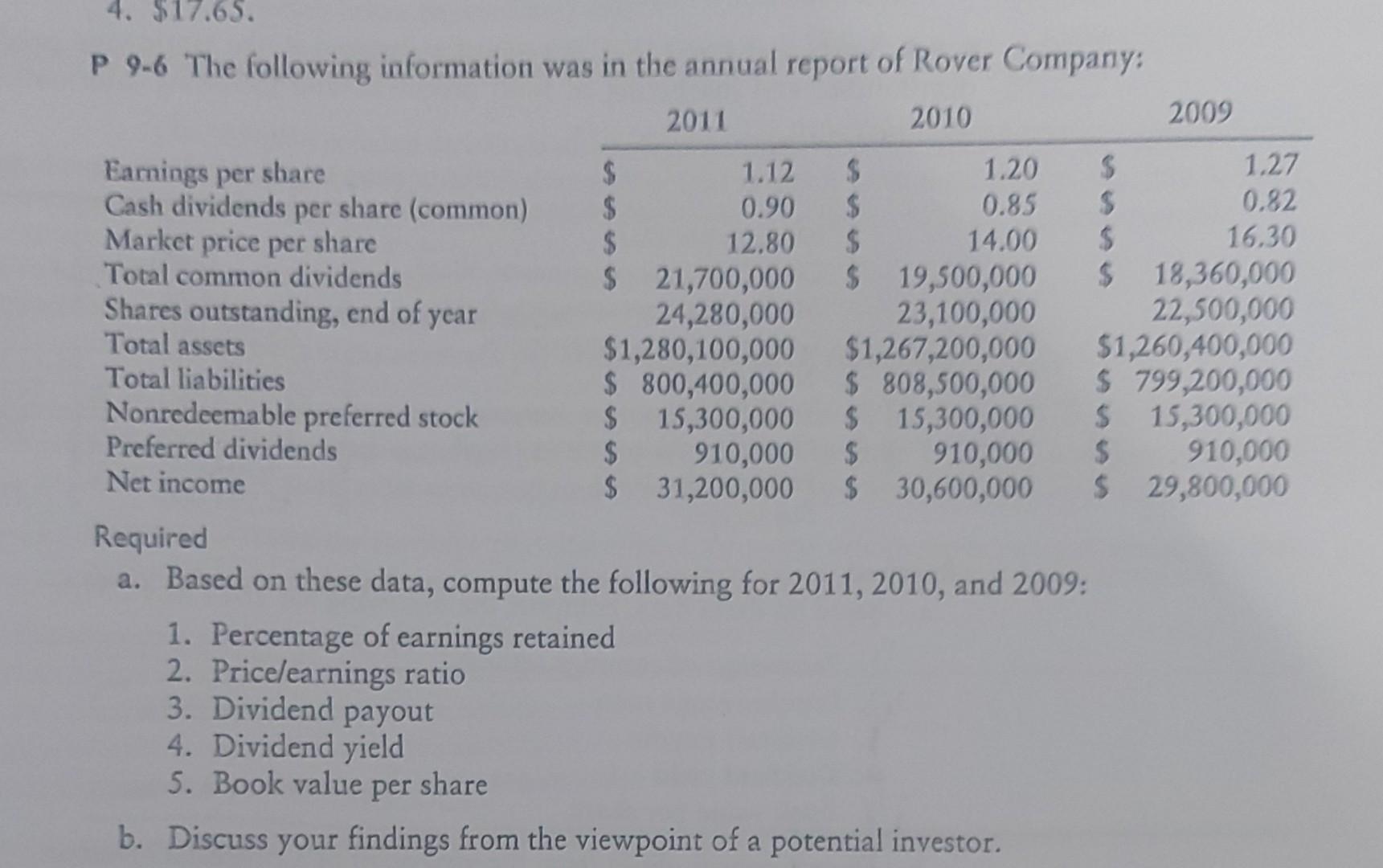

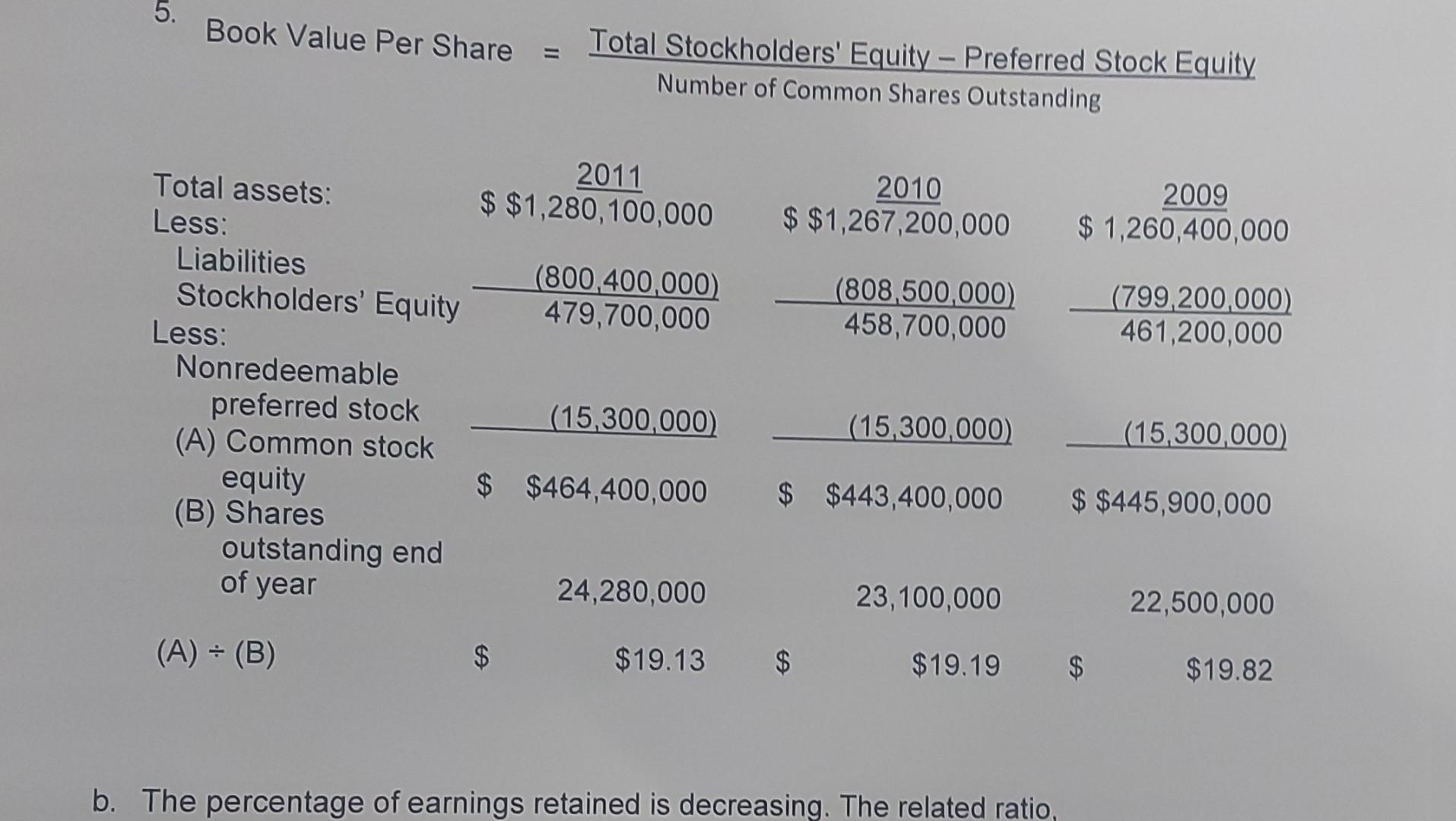

17.65. P 9-6 The following information was in the annual report of Rover Company: 2011 2010 2009 Earnings per share $ 1.12 $ 1.20 $ 1.27 Cash dividends per share (common) $ 0.90 $ 0.85 $ 0.82 Market price per share $ 12.80 $ 14.00 $ 16.30 Total common dividends $ 21,700,000 $ 19,500,000 $ 18,360,000 Shares outstanding, end of year 24,280,000 23,100,000 22,500,000 Total assets $1,280,100,000 $1,267,200,000 $1,260,400,000 Total liabilities $ 800,400,000 $ 808,500,000 $ 799,200,000 Nonredeemable preferred stock $ 15,300,000 $ 15,300,000 $ 15,300,000 Preferred dividends $ 910,000 $ 910,000 $ 910,000 Net income $ 31,200,000 $ 30,600,000 $ 29,800,000 Required a. Based on these data, compute the following for 2011, 2010, and 2009: 1. Percentage of earnings retained 2. Pricelearnings ratio 3. Dividend payout 4. Dividend yield 5. Book value per share b. Discuss your findings from the viewpoint of a potential investor. 5. Book Value Per Share Total Stockholders' Equity - Preferred Stock Equity Number of Common Shares Outstanding 2011 $ $1,280,100,000 2010 $ $1,267,200,000 2009 $ 1,260,400,000 (800,400,000) 479,700,000 (808,500,000) 458,700,000 (799,200,000) 461,200,000 Total assets: Less: Liabilities Stockholders' Equity Less: Nonredeemable preferred stock (A) Common stock equity (B) Shares outstanding end of year (15,300,000) (15,300,000) (15,300,000) $ $464,400,000 $ $443,400,000 $ $445,900,000 24,280,000 23,100,000 22,500,000 (A) - (B) $ $19.13 $ $19.19 $ $19.82 b. The percentage of earnings retained is decreasing. The related ratio Book Value per Share Total Shareholders' Equity -- Preferred Stock Equity Number of Common Shares Outstanding Iroms Not Including IncludeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started