Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show detailed steps. Thank you! You open a savings account that pays 3.000%, compounded annually. You invest $500 at the end of the year

Please show detailed steps. Thank you!

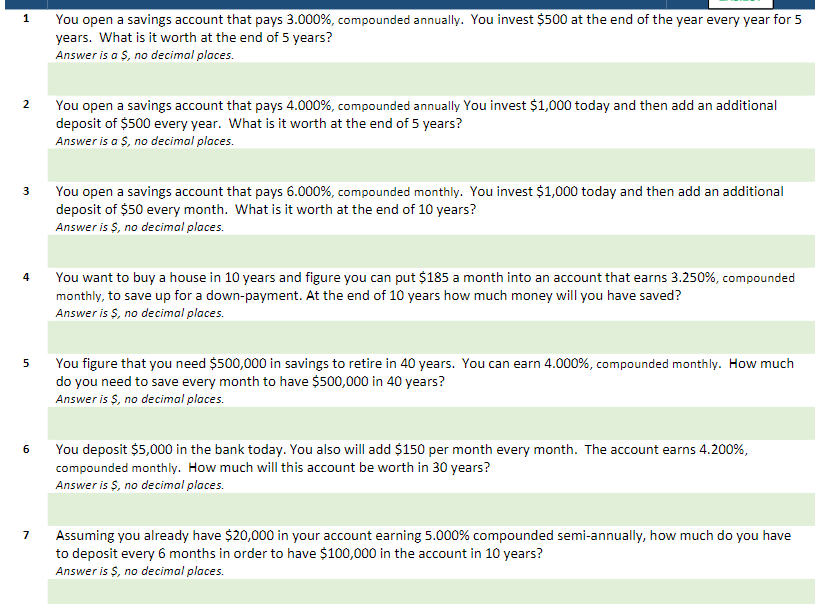

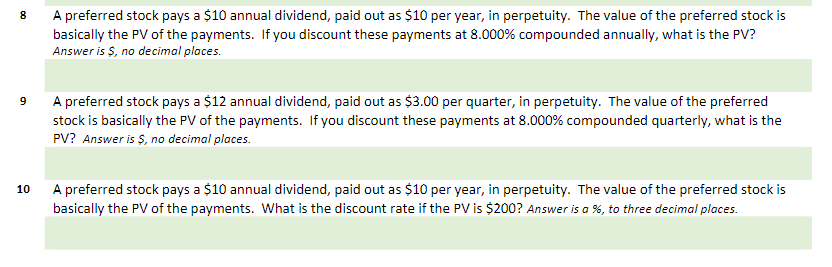

You open a savings account that pays 3.000%, compounded annually. You invest $500 at the end of the year every year for 5 years. What is it worth at the end of 5 years? 1 Answer is a $, no decimal places. You open a savings account that pays 4.000%, compounded annually You invest $1,000 today and then add an additional deposit of $500 every year. What is it worth at the end of 5 years? Answer is a S 2 no decimal places. You open a savings account that pays 6.000%, compounded monthly. You invest $1,000 today and then add an additional deposit of $50 every month. What is it worth at the end of 10 years? 3 Answer is $, no decimal places. You want to buy a house in 10 years and figure you can put $185 a month into an account that earns 3.250%, compounded monthly, to save up for a down-payment. At the end of 10 years how much money will you have saved? 4 Answer is $, no decimal places. You figure that you need $500,000 in savings to retire in 40 years. You can earn 4.000%, compounded monthly. How much do you need to save every month to have $500,000 in 40 years? Answer is $, no decimal places. 5 You deposit $5,000 in the bank today. You also will add $150 per month every month. The account earns 4.200% compounded monthly. How much will this account be worth in 30 years? Answer is $, no decimal places. 6 Assuming you already have $20,000 in your account earning 5.000% compounded semi-annually, how much do you have to deposit every 6 months in order to have $100,000 in the account in 10 years? Answer is $, no decimal places 7 A preferred stock pays a $10 annual dividend, paid out as $10 per year, in perpetuity. The value of the preferred stock is basically the PV of the payments. If you discount these payments at 8.000% compounded annually, what is the PV? Answer is $, no decimal places. 8 A preferred stock pays a $12 annual dividend, paid out as $3.00 per quarter, in perpetuity. The value of the preferred stock is basically the PV of the payments. If you discount these payments at 8.000% compounded quarterly, what is the PV? Answer is $, no decimal places 9 A preferred stock pays a $10 annual dividend, paid out as $10 per year, in perpetuity. The value of the preferred stock is basically the PV of the payments. What is the discount rate if the PV is $200? Answer is a %, to three decimal places. 10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started