Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please explain with calculation. thank you QUESTION 5 (20 MARKS) While preparing the financial statements of the company for the financial year (A) ended 30

please explain with calculation. thank you

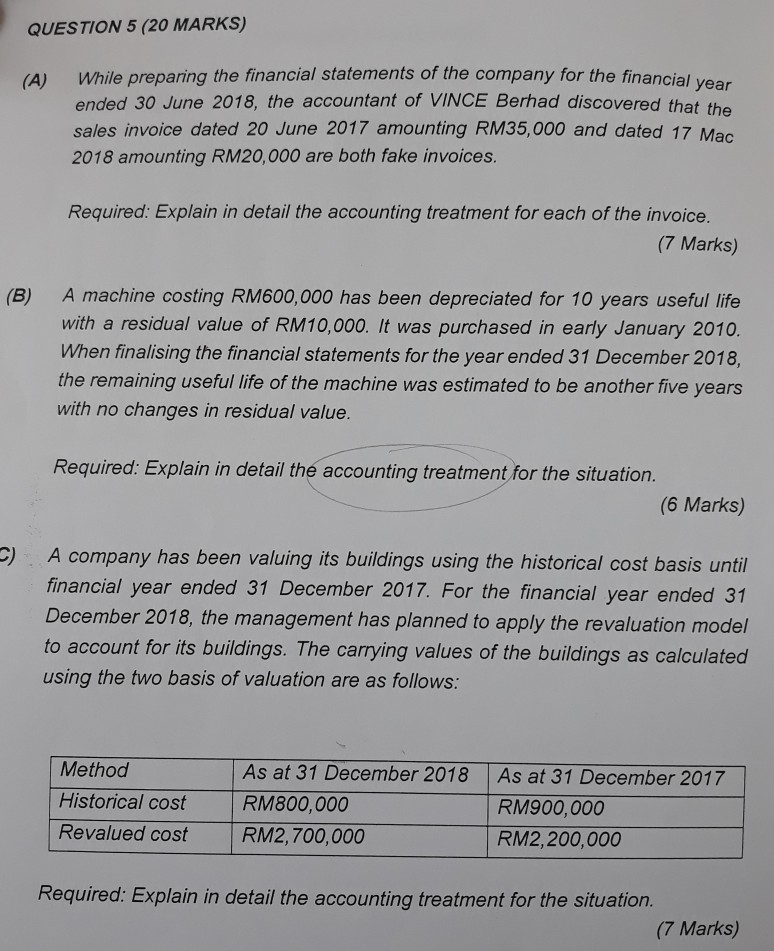

QUESTION 5 (20 MARKS) While preparing the financial statements of the company for the financial year (A) ended 30 June 2018, the accountant of VINCE Berhad discovered that the sales invoice dated 20 June 2017 amounting RM35,000 and dated 17 Mac 2018 amounting RM20,000 are both fake invoices. Required: Explain in detail the accounting treatment for each of the invoice. (7 Marks) A machine costing RM600,000 has been depreciated for 10 years useful life (B) with a residual value of RM10,000. It was purchased in early January 2010. When finalising the financial statements for the year ended 31 December 2018, the remaining useful life of the machine was estimated to be another five years with no changes in residual value Required: Explain in detail the accounting treatment for the situation. (6 Marks) A company has been valuing its buildings using the historical cost basis until financial year ended 31 December 2017. For the financial year ended 31 December 2018, the management has planned to apply the revaluation model to account for its buildings. The carrying values of the buildings as calculated using the two basis of valuation are as follows: Method As at 31 December 2018 As at 31 December 2017 Historical cost RM800,000 RM900,000 Revalued cost RM2, 700,000 RM2,200,000 Required: Explain in detail the accounting treatment for the situation. (7 Marks) QUESTION 5 (20 MARKS) While preparing the financial statements of the company for the financial year (A) ended 30 June 2018, the accountant of VINCE Berhad discovered that the sales invoice dated 20 June 2017 amounting RM35,000 and dated 17 Mac 2018 amounting RM20,000 are both fake invoices. Required: Explain in detail the accounting treatment for each of the invoice. (7 Marks) A machine costing RM600,000 has been depreciated for 10 years useful life (B) with a residual value of RM10,000. It was purchased in early January 2010. When finalising the financial statements for the year ended 31 December 2018, the remaining useful life of the machine was estimated to be another five years with no changes in residual value Required: Explain in detail the accounting treatment for the situation. (6 Marks) A company has been valuing its buildings using the historical cost basis until financial year ended 31 December 2017. For the financial year ended 31 December 2018, the management has planned to apply the revaluation model to account for its buildings. The carrying values of the buildings as calculated using the two basis of valuation are as follows: Method As at 31 December 2018 As at 31 December 2017 Historical cost RM800,000 RM900,000 Revalued cost RM2, 700,000 RM2,200,000 Required: Explain in detail the accounting treatment for the situation. (7 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started