Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain your calculations [The following information applies to the questions displayed below.] Income is to be evaluated under four different situations as follows: a.

Please explain your calculations

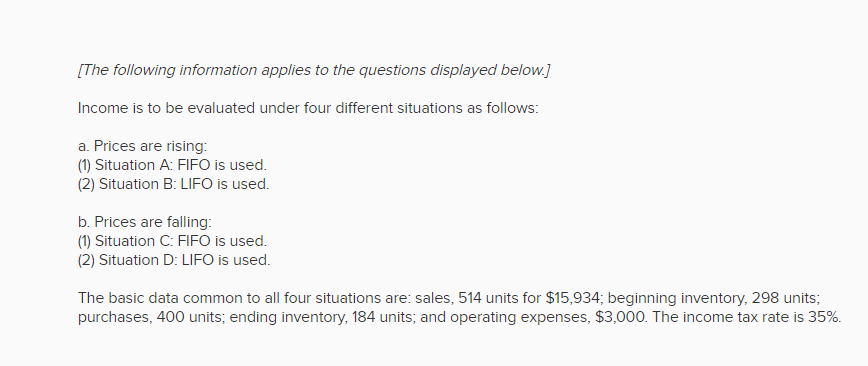

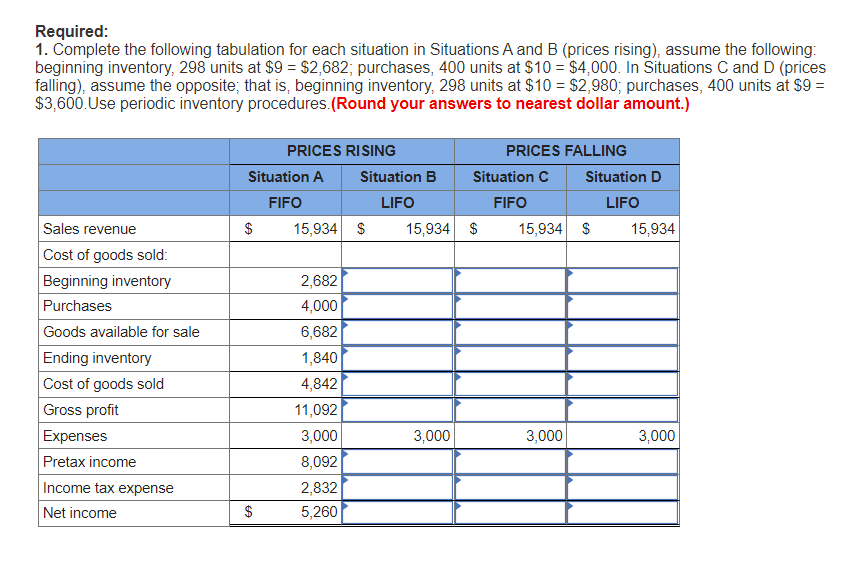

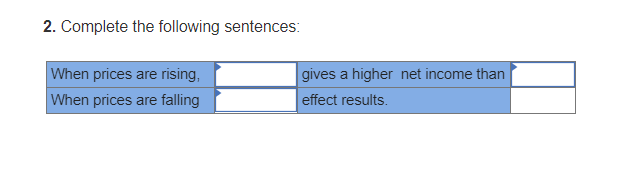

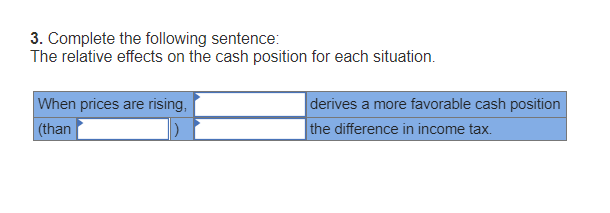

[The following information applies to the questions displayed below.] Income is to be evaluated under four different situations as follows: a. Prices are rising: (1) Situation A: FIFO is used. (2) Situation B: LIFO is used. b. Prices are falling: (1) Situation C: FIFO is used. (2) Situation D: LIFO is used. The basic data common to all four situations are: sales, 514 units for $15,934; beginning inventory, 298 units; purchases, 400 units; ending inventory, 184 units; and operating expenses, $3,000. The income tax rate is 35%. Required: 1. Complete the following tabulation for each situation in Situations A and B (prices rising), assume the following: beginning inventory, 298 units at $9=$2,682; purchases, 400 units at $10=$4,000. In Situations C and D (prices falling), assume the opposite; that is, beginning inventory, 298 units at $10=$2,980; purchases, 400 units at $9= $3,600. Use periodic inventory procedures. (Round your answers to nearest dollar amount.) 2. Complete the following sentences: 3. Complete the following sentence: The relative effects on the cash position for each situationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started