Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please fast I have only 5 hours Q.2 Quebec plc. is a large conglomerate company and is considering three potential investment projects for which it

please fast I have only 5 hours

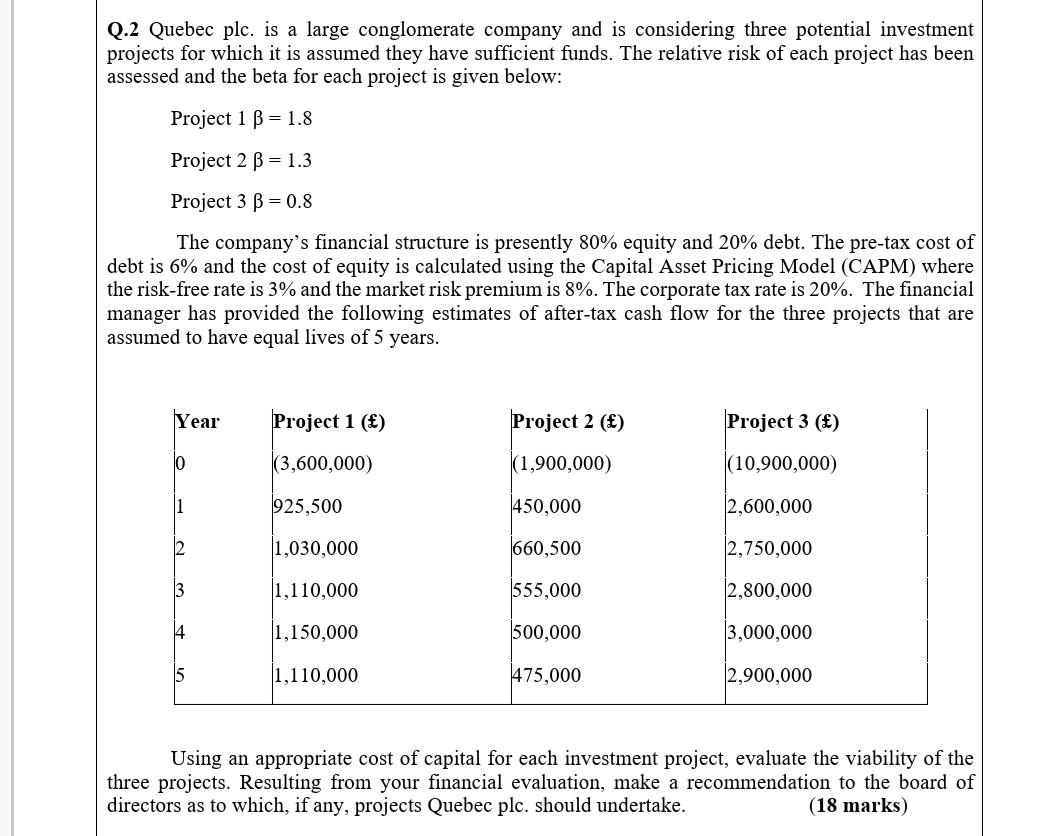

Q.2 Quebec plc. is a large conglomerate company and is considering three potential investment projects for which it is assumed they have sufficient funds. The relative risk of each project has been assessed and the beta for each project is given below: Project 1 B = 1.8 Project 2 B = 1.3 Project 3 B = 0.8 The company's financial structure is presently 80% equity and 20% debt. The pre-tax cost of debt is 6% and the cost of equity is calculated using the Capital Asset Pricing Model (CAPM) where the risk-free rate is 3% and the market risk premium is 8%. The corporate tax rate is 20%. The financial manager has provided the following estimates of after-tax cash flow for the three projects that are assumed to have equal lives of 5 years. Year Project 1 () Project 2 () Project 3 () (3,600,000) (1,900,000) (10,900,000) 1 925,500 450,000 2,600,000 2 1,030,000 660,500 2,750,000 3 1,110,000 555,000 2,800,000 14 1,150,000 500,000 3,000,000 15 1,110,000 475,000 2,900,000 Using an appropriate cost of capital for each investment project, evaluate the viability of the three projects. Resulting from your financial evaluation, make a recommendation to the board of directors as to which, if any, projects Quebec plc. should undertake. (18 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started