Please feel free to only answer the questions I got wrong, but please show formulas, and scratch work.

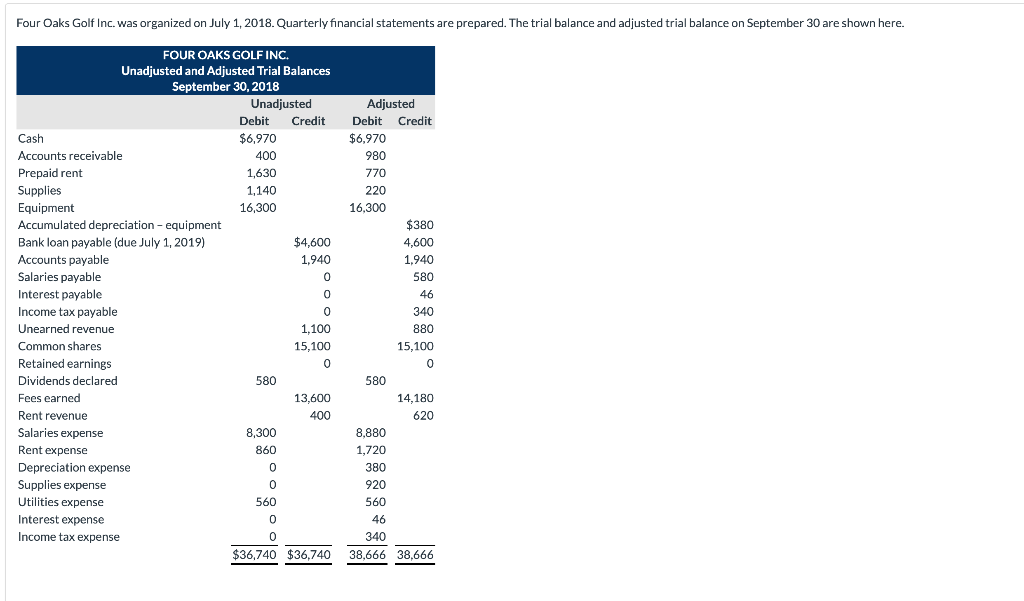

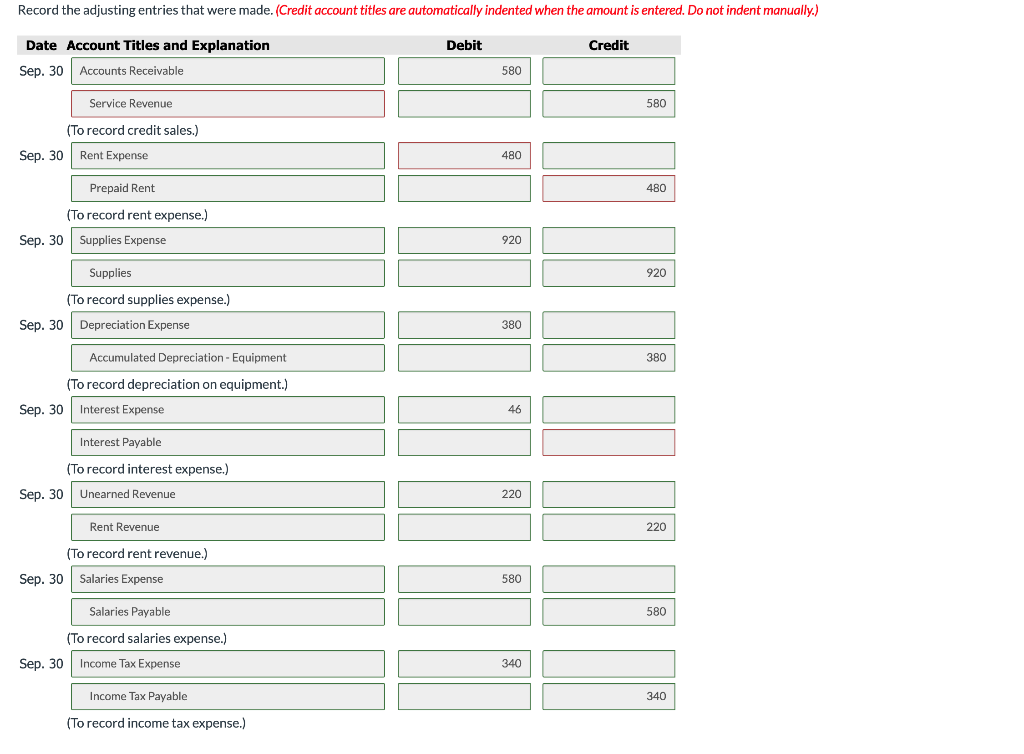

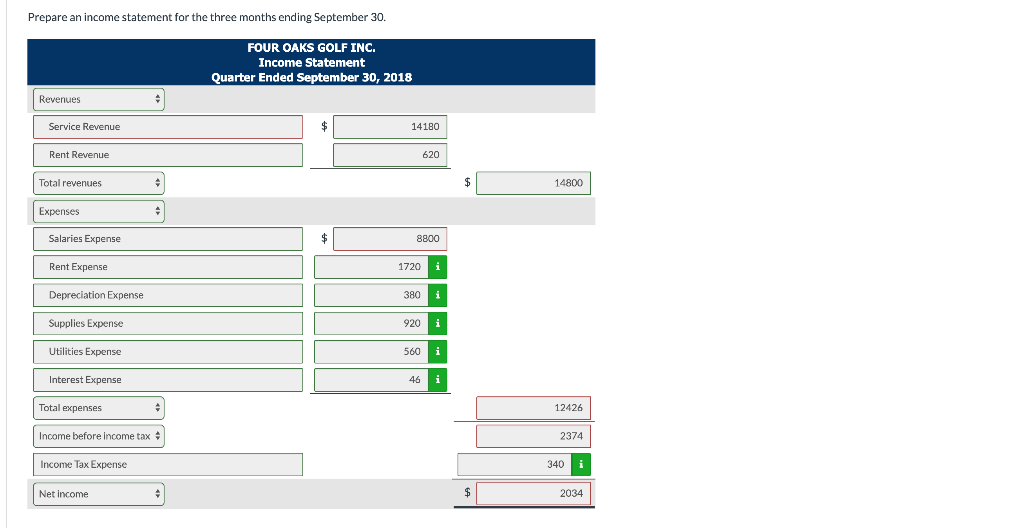

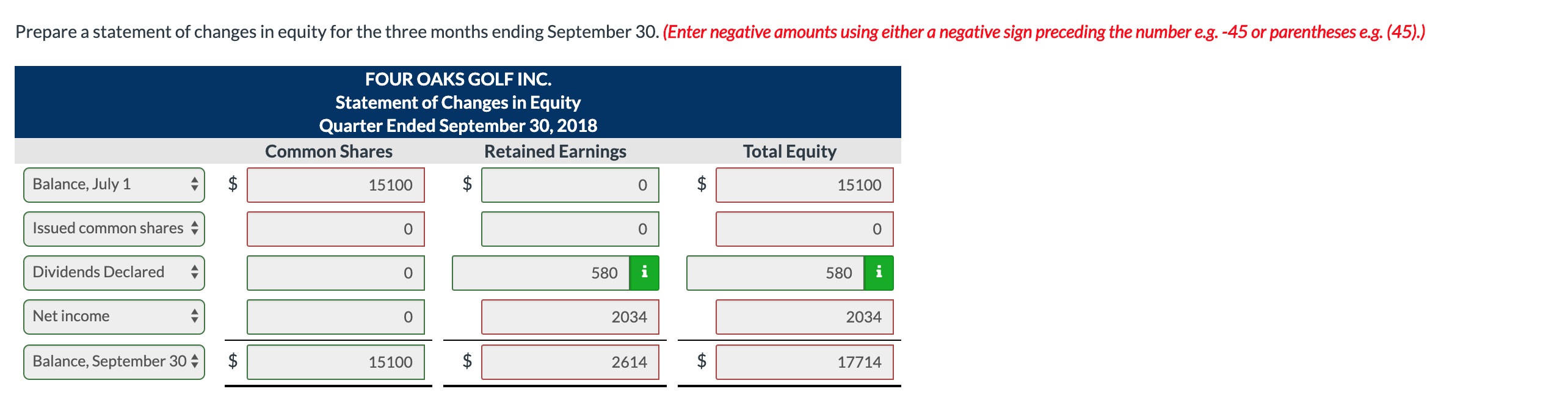

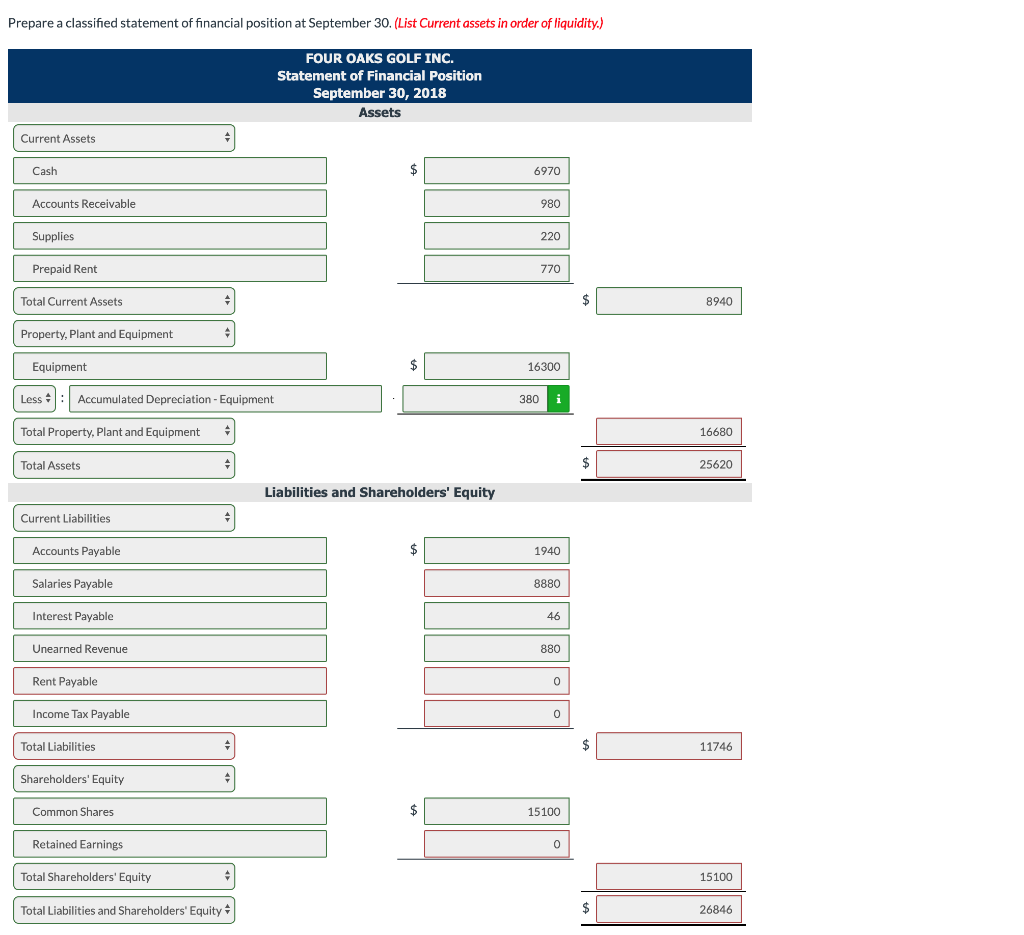

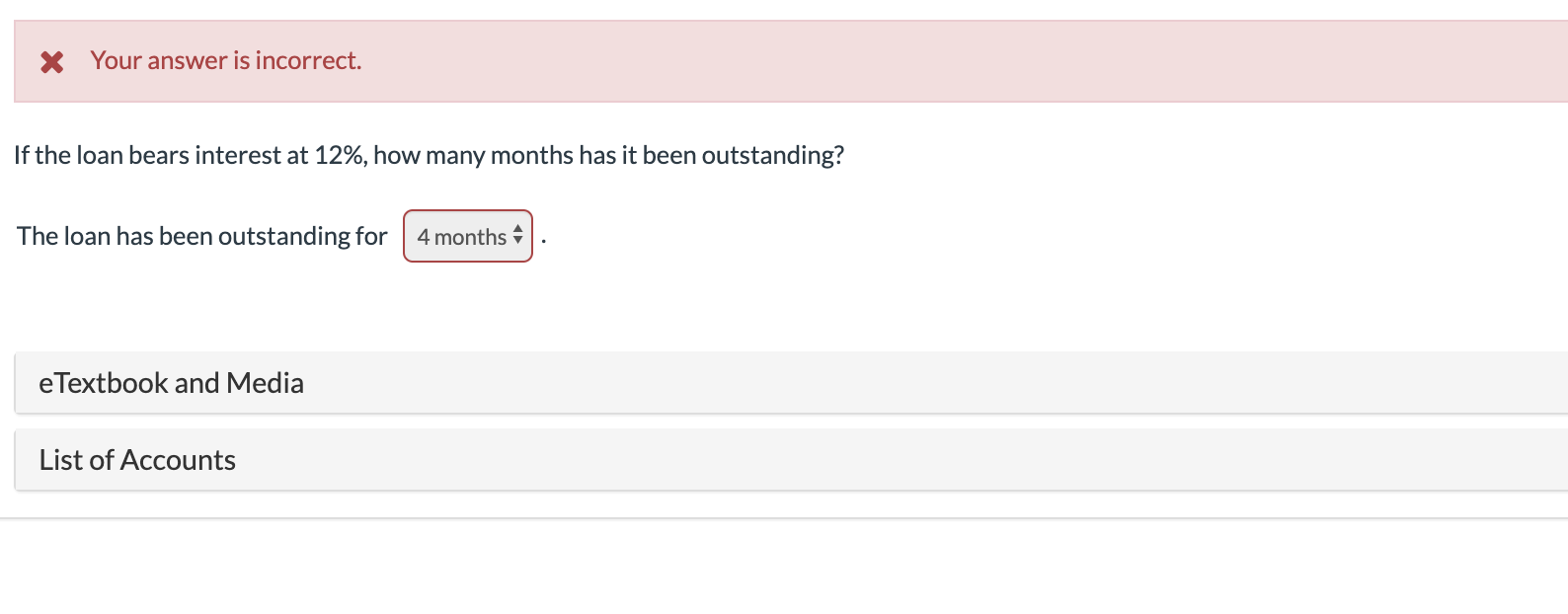

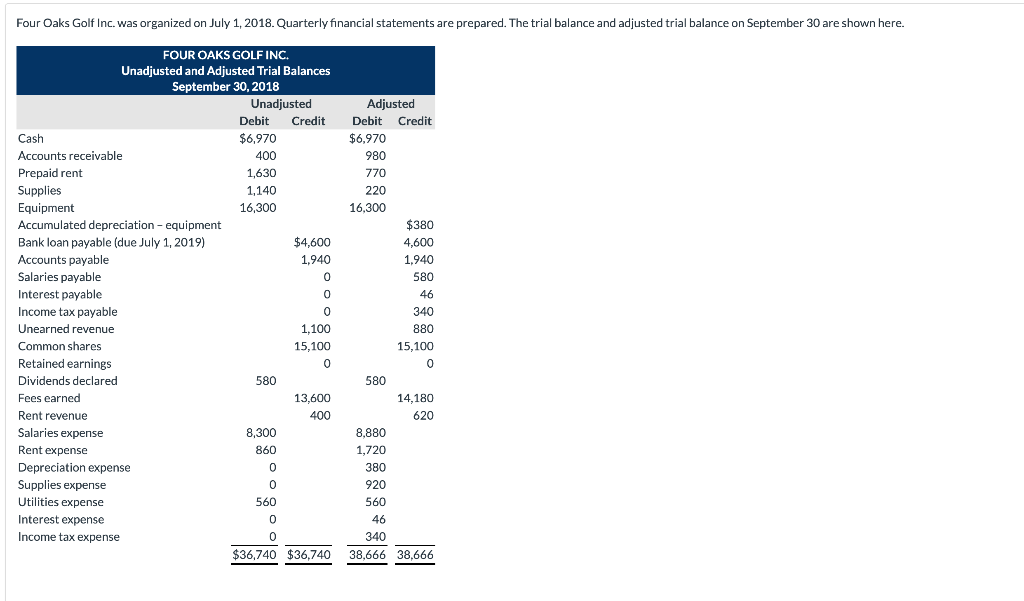

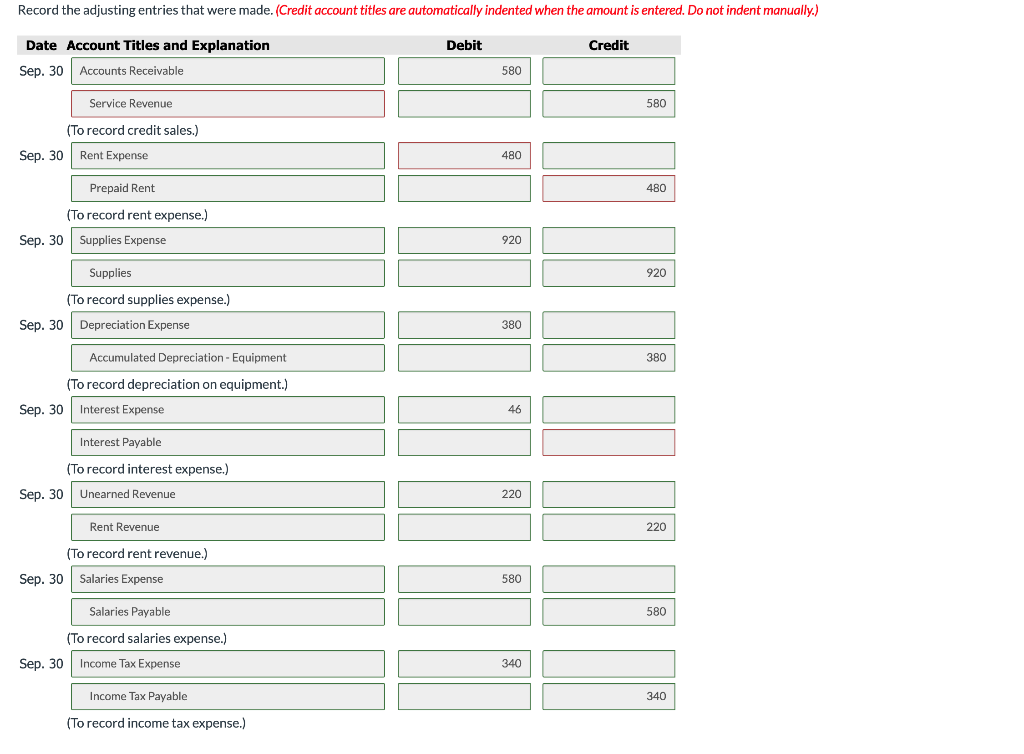

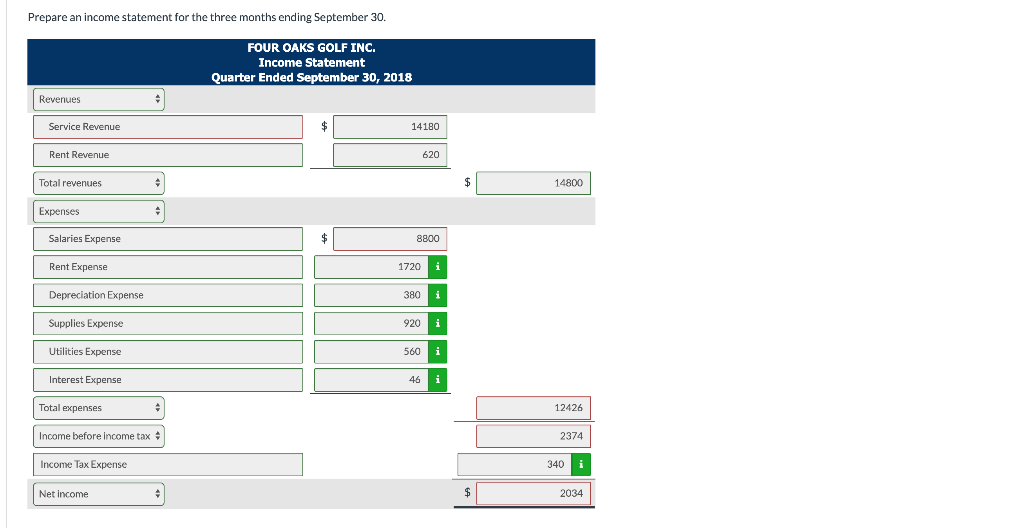

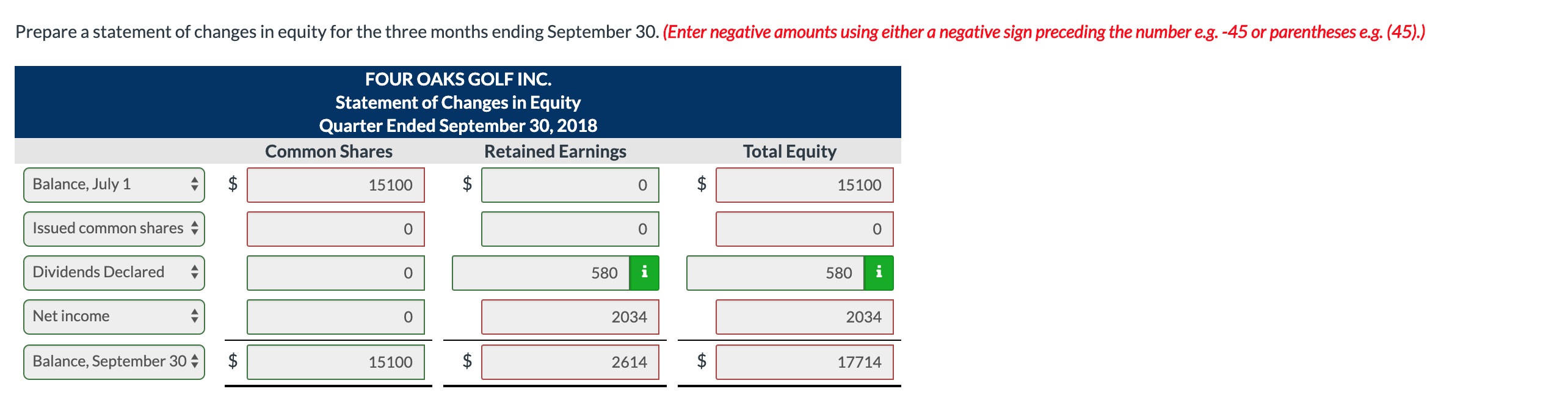

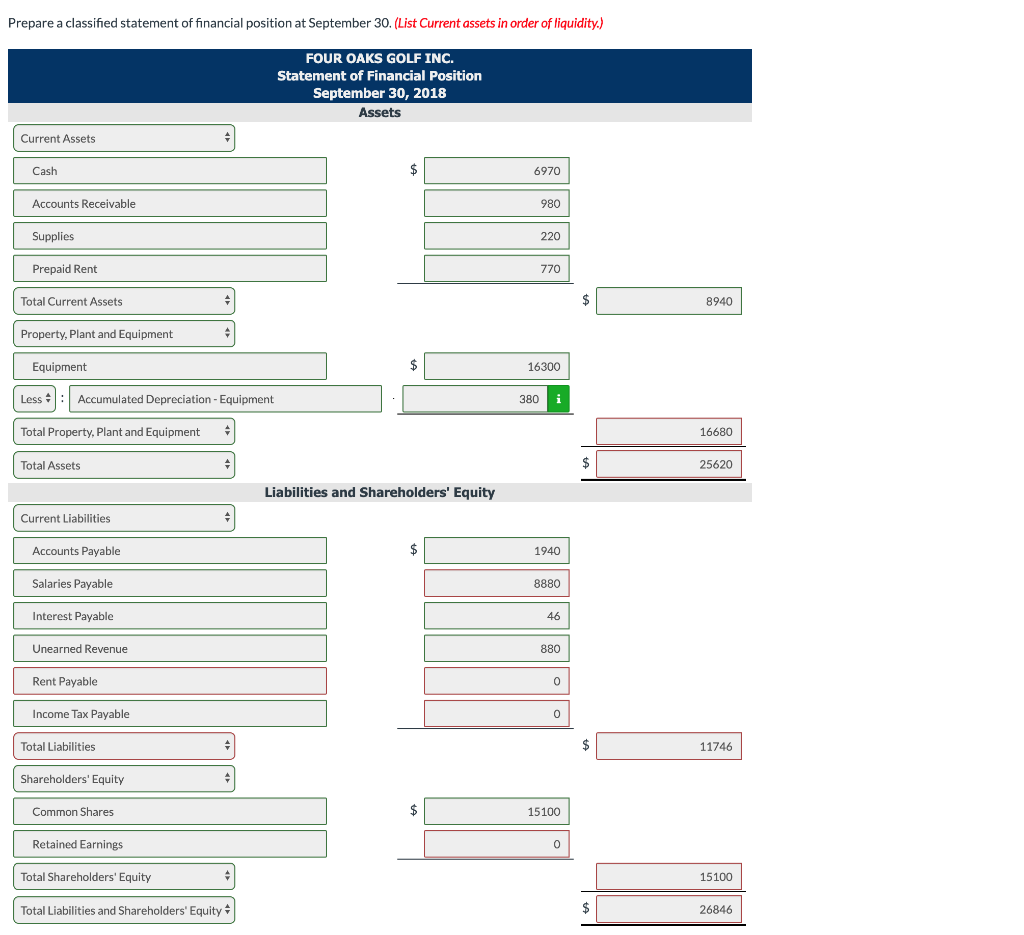

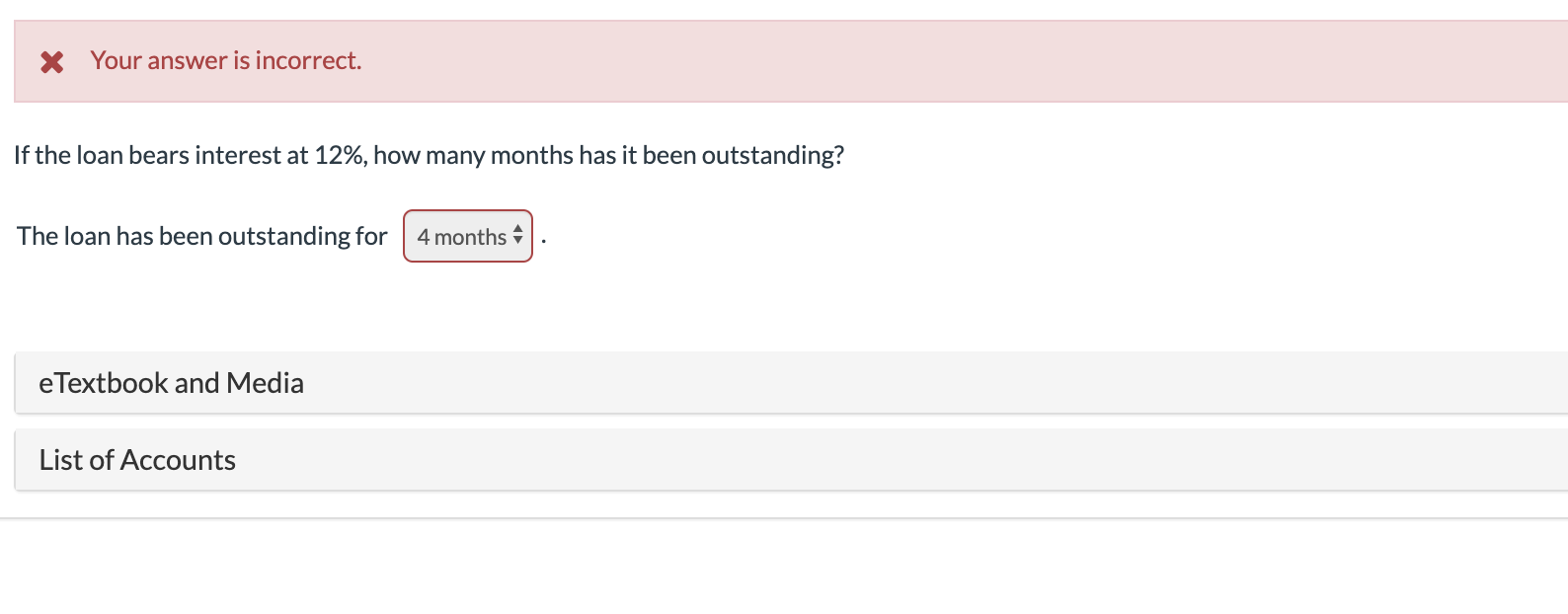

Four Oaks Golf Inc. was organized on July 1, 2018. Quarterly financial statements are prepared. The trial balance and adjusted trial balance on September 30 are shown here. 1,630 FOUR OAKS GOLF INC. Unadjusted and Adjusted Trial Balances September 30, 2018 Unadjusted Debit Credit Cash $6,970 Accounts receivable 400 Prepaid rent Supplies 1,140 Equipment 16,300 Accumulated depreciation - equipment Bank loan payable (due July 1, 2019) $4,600 Accounts payable 1,940 Salaries payable Interest payable Income tax payable Unearned revenue 1,100 Common shares 15,100 Retained earnings Dividends declared 580 Fees earned 13,600 Rent revenue 400 Salaries expense 8,300 Rent expense 860 Depreciation expense Supplies expense Utilities expense 560 Interest expense Income tax expense $36,740 $36,740 Adjusted Debit Credit $6,970 980 770 220 16,300 $380 4,600 1,940 580 46 340 880 15,100 0 580 14,180 620 8,880 1,720 380 920 560 46 340 38,666 38,666 Record the adjusting entries that were made. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation Sep. 30 Accounts Receivable 580 580 480 Service Revenue (To record credit sales.) Sep. 30 Rent Expense Prepaid Rent (To record rent expense.) Sep. 30 Supplies Expense 480 Supplies 920 (To record supplies expense.) Sep. 30 Depreciation Expense 380 380 Accumulated Depreciation - Equipment (To record depreciation on equipment.) Sep. 30 Interest Expense Interest Payable (To record interest expense.) Sep. 30 Unearned Revenue 220 Rent Revenue 220 (To record rent revenue.) Sep. 30 Salaries Expense 580 Salaries Payable 580 (To record salaries expense.) Sep. 30 Income Tax Expense 340 340 Income Tax Payable 340 (To record income tax expense.) Prepare an income statement for the three months ending September 30. FOUR OAKS GOLF INC. Income Statement Quarter Ended September 30, 2018 Revenues Service Revenue 14180 Rent Revenue 620 Total revenues $ 14800 Expenses Salaries Expense 8800 Rent Expense 1720 i Depreciation Expense 380 i Supplies Expense 920 Utilities Expense 560 i Interest Expense 46 i Total expenses 12426 Income before income tax 2374 Income Tax Expense 340 i Net income 2034 Prepare a statement of changes in equity for the three months ending September 30. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) FOUR OAKS GOLF INC. Statement of Changes in Equity Quarter Ended September 30, 2018 Common Shares Retained Earnings 15100 Total Equity 15100 Balance, July 1 Issued common shares Dividends Declared A 580 580 Net income 2034 2034 Balance, September 30 4 | 15100 2614 17714 Prepare a classified statement of financial position at September 30. (List Current assets in order of liquidity.) FOUR OAKS GOLF INC. Statement of Financial Position September 30, 2018 Assets Current Assets Cash 6970 Accounts Receivable 980 Supplies 220 Prepaid Rent 770 Total Current Assets $ 8940 Property, plant and Equipment Equipment 16300 Less : Accumulated Depreciation - Equipment 380 i Total Property, Plant and Equipment 16680 Total Assets 25620 Liabilities and Shareholders' Equity Current Liabilities Accounts Payable 1940 Salaries Payable 8880 Interest Payable 46 Unearned Revenue 880 Rent Payable Income Tax Payable Total Liabilities 11746 Shareholders' Equity Common Shares 15100 Retained Earnings Total Shareholders' Equity 15100 Total Liabilities and Shareholders' Equity 26846 Identify from the following items which accounts should be closed on September 30 by determining "Yes" or "No". FOUR OAKS GOLF INC. Trial Balance September 30, 2018 Cash Yes Accounts receivable Yes Prepaid rent Yes Supplies Yes Equipment Yes Accumulated depreciation - equipment Yes Bank loan payable Yes Accounts payable Yes Salaries payable Yes Interest payable Yes Income tax payable Yes Unearned revenue No 000000000000000000000000 Common shares Yes Retained earnings No Dividends declared Yes Fees earned Yes Rent revenue Yes Salaries expense Yes Rent expense Yes Depreciation expense Yes Supplies expense Yes Utilities expense Yes Interest expense Yes Income tax expense Yes x Your answer is incorrect. If the loan bears interest at 12%, how many months has it been outstanding? The loan has been outstanding for 4 months ^ . eTextbook and Media List of Accounts