Answered step by step

Verified Expert Solution

Question

1 Approved Answer

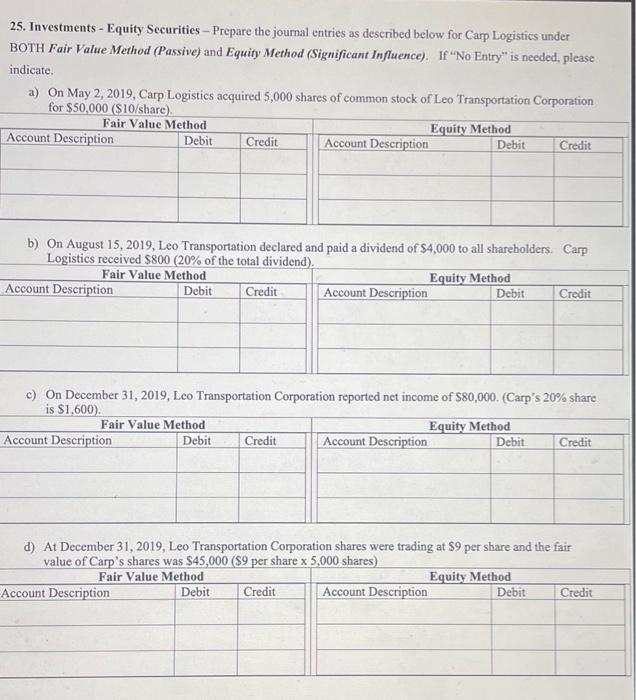

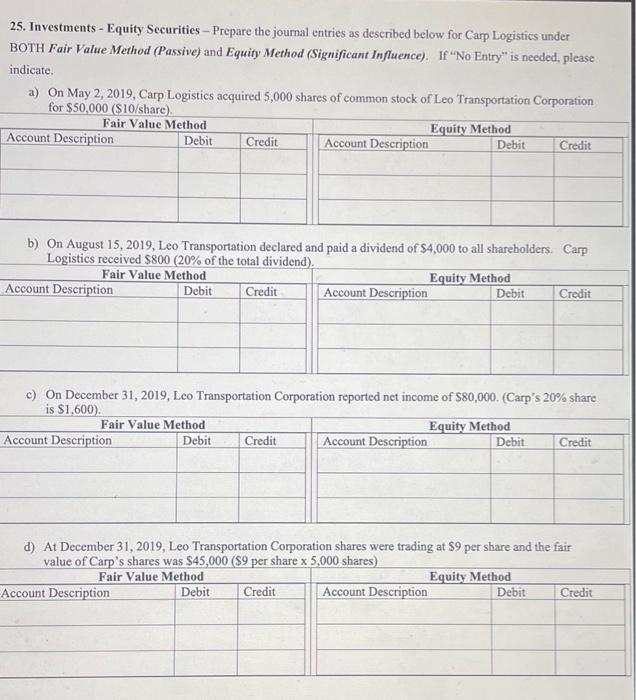

please fill all parts out, thank u! 25. Investments - Equity Securities - Prepare the journal entries as described below for Carp Logistics under BOTH

please fill all parts out, thank u!

25. Investments - Equity Securities - Prepare the journal entries as described below for Carp Logistics under BOTH Fair Value Method (Passive) and Equity Method (Significant Influence). If "No Entry" is needed, please indicate. a) On May 2, 2019, Carp Logistics acquired 5,000 shares of common stock of Leo Transportation Corporation for $50,000 (\$10/share). b) On August 15, 2019, Leo Transportation declared and paid a dividend of $4,000 to all shareholders. Carp Logistics received $800 ( 20% of the total dividend). c) On December 31, 2019, Leo Transportation Corporation reported net income of $80,000. (Carp's 20% share is $1.600). d) At December 31, 2019, Leo Transportation Corporation shares were trading at $9 per share and the fair value of Carp's shares was $45,000 ( $9 per share x5,000 shares)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started