Please fill in the blanks and answer all questions. Thank you!!!

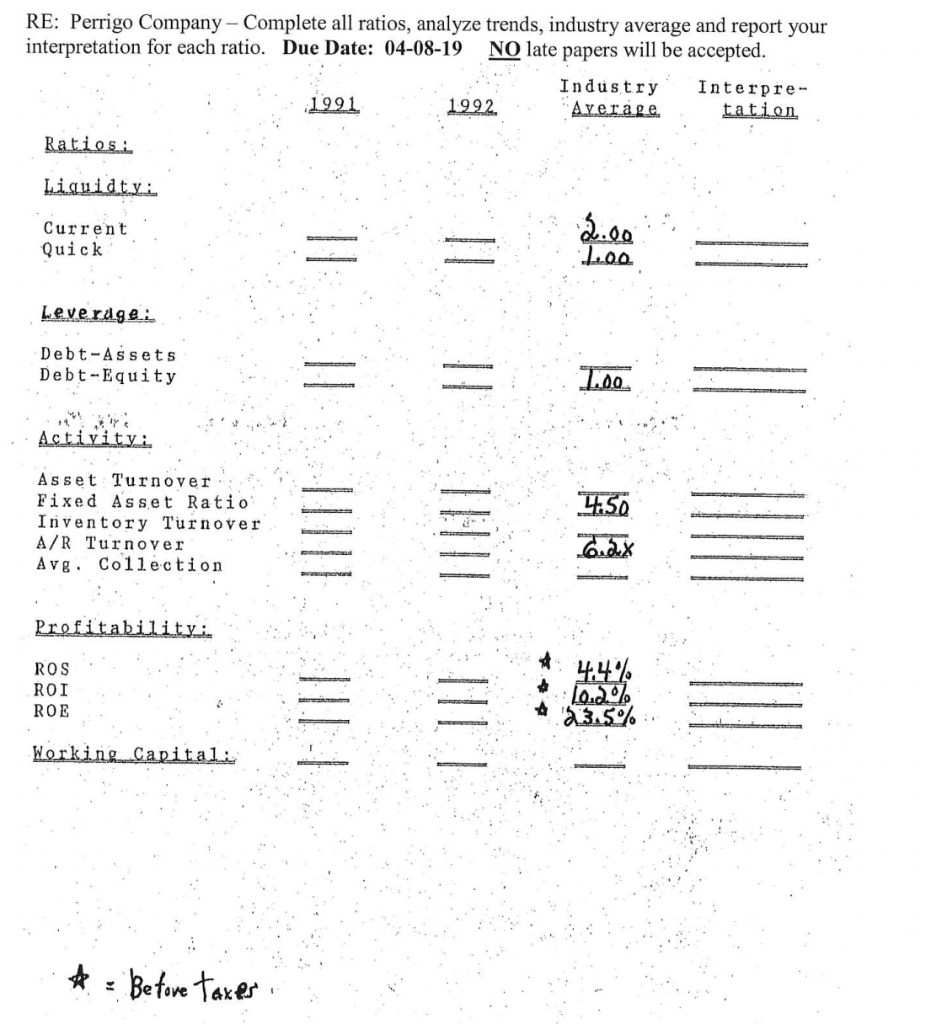

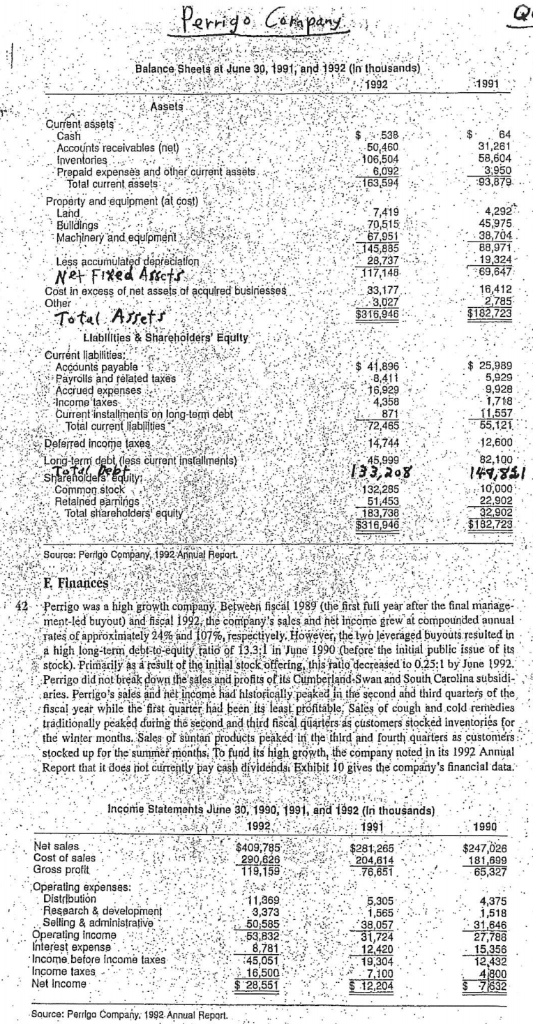

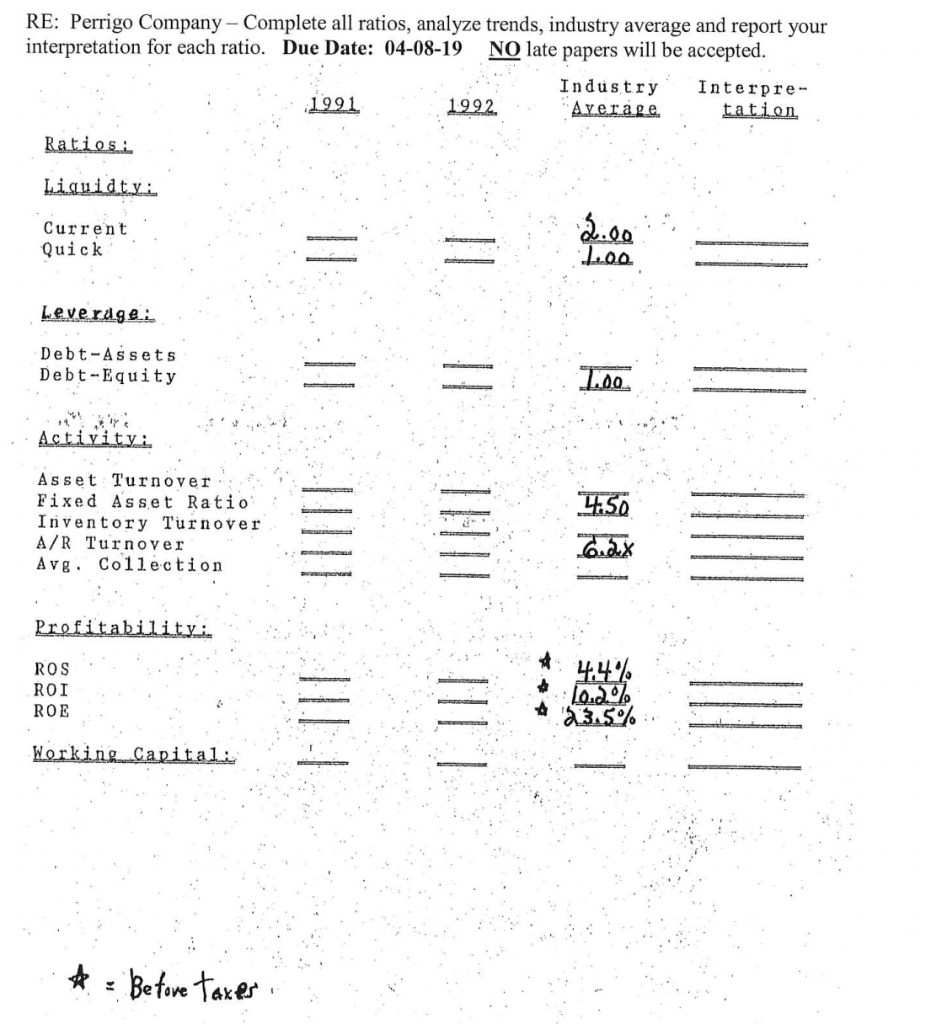

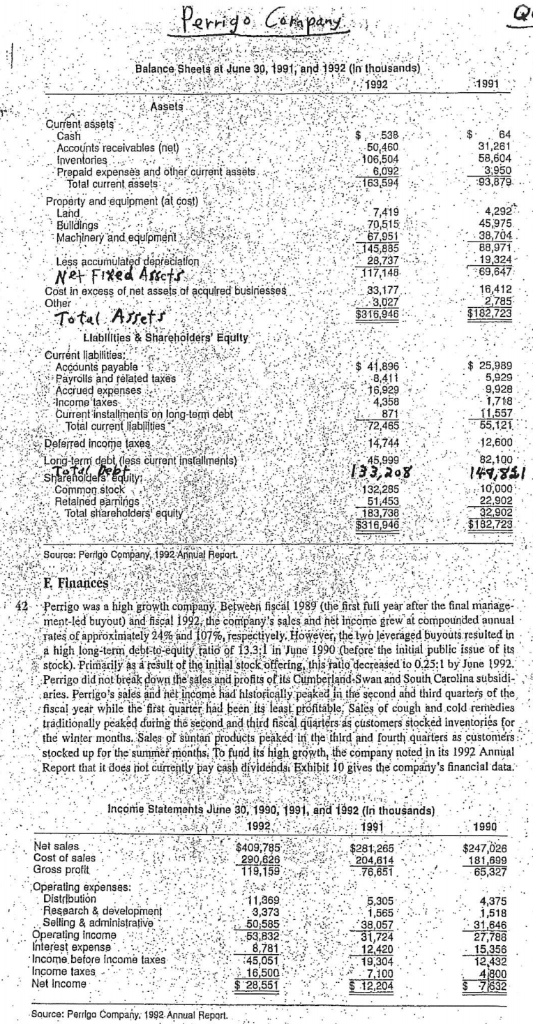

RE: Perrigo Company - Complete all ratios, analyze trends, industry average and report your interpretation for each ratio. Due Date: 04-08-19 NO late papers will be accepted Industry Interpre- 1991 1992 tation Current Quick Leverage Debt-Assets Debt-Equity 100 Asset Turnover Fixed Asset Ratio Inventory Turnover A/R Turnover Avg. Co11ection - : ROS ROI ROE Before Taker . Balance Sheels at June 30, t991, and 199z (In thousands) Current a . Accounts receivables ne 84 31,261 Cash . . i.., , ..;' 106,504 Inven Prepaid expenss and ther current assets,6092 . Total current asses Property and equlpmet (atcost)8.74 45,975 Machiner anden Less accumulat 19,324 d depreciatfon Coat i excess of net assels of ecured buslnlesses 3.027 ilabilities & Shareholders' Equity :: Curr t liabilities: ini 41 896. :: Accounts payable : f Payrolls and related taces .. Accrued expenses r C Current instets onlong-tom to mdebt 871, a ::. Total current liabi ties 14,744 12,600 (1 ss current installments) t..wh.ema a45.999.. 132,285 Retained earmings Total shareholders equity -source: PergO Company, 1992 AnalFeat.f. ::: Ode, v 42. Perrigo wa ahigh owth company Beween fiscal 1989 (he firat full year after the final marag ment-led buyout) and hsal 192 the company's sales and het income grew ai compounded aonual . Tates of approximately 24% and 07%, respectiyely. However helyoleveragedbuyouts resulted in ya _a high long-te debt-to equitytai of 3.3:1 nJune 1990 (before the initial public issue of its stock). Primacily as a tesult ot the initialstock ofering this alodecreased io 025:1 by June 1992. nd Swan and South Carolina subsidi aries. Perrigo's sales and het income had hlstorically peakad ii the second and third quarters of the, fiscal year while the frst quarter had been its least profitable, Sales of cough and cold remiedies iraditionally peakd during the second and third fiscal qarters as customers stocked inventories for the winter months. Sales of suntan products peaked in the third and fourth quarters as customiers stocked up for the summef months, To fund its high growth, the company noted in its 1992 Anmual Report that it does not currenily pay eash dividends Exhibit 10 gives the company's financial data. Perrigo did not break down the sales and profits ofits Cumberla -.' Inco ie Statements June 30, 1990 1991, and i992 (In thousands) RE 1992 Gross profit- . . Operating expenses: ;,.,,,, . .. e34%-' : .,..1 1,269.. HTT9,159 , 76,651 5.305 h Research &development Selling & administrative Interest expens . 724 . Income before income taxes,05 Net Income Source: Perriga Company. 1992 Annual Report. 12 RE: Perrigo Company - Complete all ratios, analyze trends, industry average and report your interpretation for each ratio. Due Date: 04-08-19 NO late papers will be accepted Industry Interpre- 1991 1992 tation Current Quick Leverage Debt-Assets Debt-Equity 100 Asset Turnover Fixed Asset Ratio Inventory Turnover A/R Turnover Avg. Co11ection - : ROS ROI ROE Before Taker . Balance Sheels at June 30, t991, and 199z (In thousands) Current a . Accounts receivables ne 84 31,261 Cash . . i.., , ..;' 106,504 Inven Prepaid expenss and ther current assets,6092 . Total current asses Property and equlpmet (atcost)8.74 45,975 Machiner anden Less accumulat 19,324 d depreciatfon Coat i excess of net assels of ecured buslnlesses 3.027 ilabilities & Shareholders' Equity :: Curr t liabilities: ini 41 896. :: Accounts payable : f Payrolls and related taces .. Accrued expenses r C Current instets onlong-tom to mdebt 871, a ::. Total current liabi ties 14,744 12,600 (1 ss current installments) t..wh.ema a45.999.. 132,285 Retained earmings Total shareholders equity -source: PergO Company, 1992 AnalFeat.f. ::: Ode, v 42. Perrigo wa ahigh owth company Beween fiscal 1989 (he firat full year after the final marag ment-led buyout) and hsal 192 the company's sales and het income grew ai compounded aonual . Tates of approximately 24% and 07%, respectiyely. However helyoleveragedbuyouts resulted in ya _a high long-te debt-to equitytai of 3.3:1 nJune 1990 (before the initial public issue of its stock). Primacily as a tesult ot the initialstock ofering this alodecreased io 025:1 by June 1992. nd Swan and South Carolina subsidi aries. Perrigo's sales and het income had hlstorically peakad ii the second and third quarters of the, fiscal year while the frst quarter had been its least profitable, Sales of cough and cold remiedies iraditionally peakd during the second and third fiscal qarters as customers stocked inventories for the winter months. Sales of suntan products peaked in the third and fourth quarters as customiers stocked up for the summef months, To fund its high growth, the company noted in its 1992 Anmual Report that it does not currenily pay eash dividends Exhibit 10 gives the company's financial data. Perrigo did not break down the sales and profits ofits Cumberla -.' Inco ie Statements June 30, 1990 1991, and i992 (In thousands) RE 1992 Gross profit- . . Operating expenses: ;,.,,,, . .. e34%-' : .,..1 1,269.. HTT9,159 , 76,651 5.305 h Research &development Selling & administrative Interest expens . 724 . Income before income taxes,05 Net Income Source: Perriga Company. 1992 Annual Report. 12