Answered step by step

Verified Expert Solution

Question

1 Approved Answer

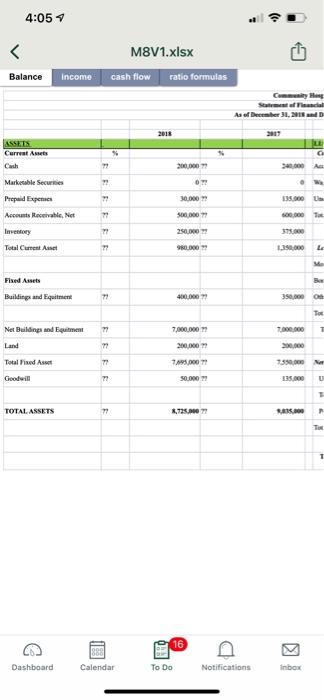

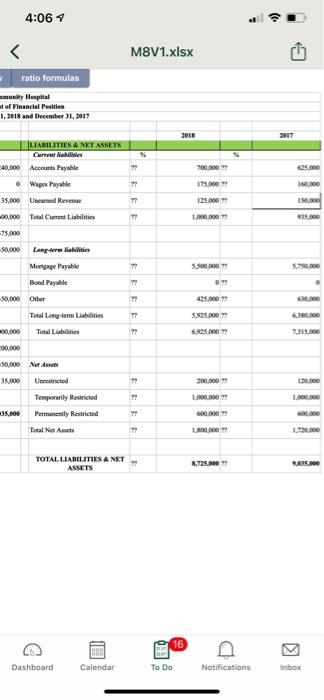

please fill in the ?? in the chart. 4:05 M8V1.xlsx Balance income cash flow ratio formulas Com Sea of As of December 31, 2018 2015

please fill in the ?? in the chart.

4:05 M8V1.xlsx Balance income cash flow ratio formulas Com Sea of As of December 31, 2018 2015 2019 TASSETS Curreal Amet Cash a 777 300.000 0 30.000 U Marketable Sec Prepaid Expenses Accounts Receivable. Not Inventory Total Current Asset EEEEEE 500.000 Te 250 375.000 90.000 1.150.000 La Fixed Assets Buildings and Equine 71 400.000 350,000 To 77 7,000,000 000000 T Net Building and Equme Land 72 200.000 200.000 79 7495.000 750.00 Totalised Goodwill 50.000 335.000 U TOTAL ASSETS 77 1.725.000 15.00 6 16 1888 Dashboard Calendar To Do Notifications Inbow 4:06 M8V1.xlsx ratio formulas munity Hospital of Financial Position 1. 2018 and December 31, 2017 361 2017 700.000 485.000 FEE 175.000 1. 125.000 1500 77 LAKE 0077 5.300,000 0 LIASILITIES A NET ASSITS Curre 40.000 Accounts Payable Wapes Pytle 35,000 Veemed Revenue 10,000 Total Curabilities -75,000 50,000 Lang-terlihilities Mortgage Puyable Bond Payable -50,000 Other Total Long-term Liabilities Total Libilities 500,000 50.000 New 35.000 Unrestricted Temporarily Restricted Permanently Restricted Total Net Ames 425.000 0.000 17 5.925.000 ?? 6,925.000 7315.000 " 2000 120.000 1.000.000 1.000.000 Y" 500.000 1.800,000 130.000 TOTAL LIABILITIES & NET ASSETS 1,725,000 RAS 6 16 1888 Dashboard Calendar To Do Notifications Inbow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started