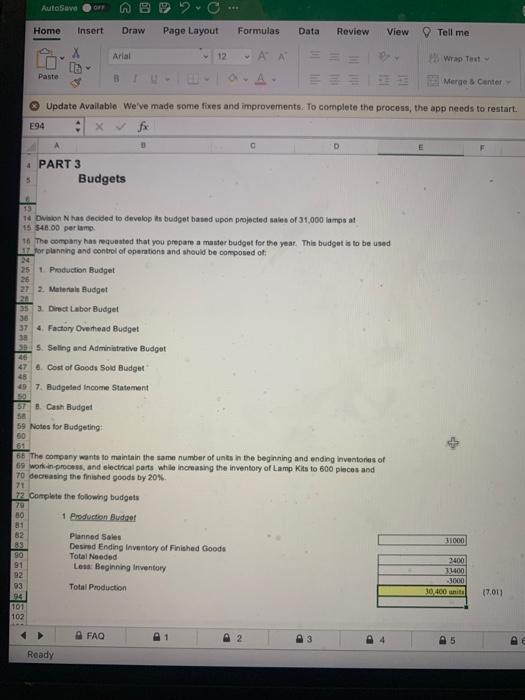

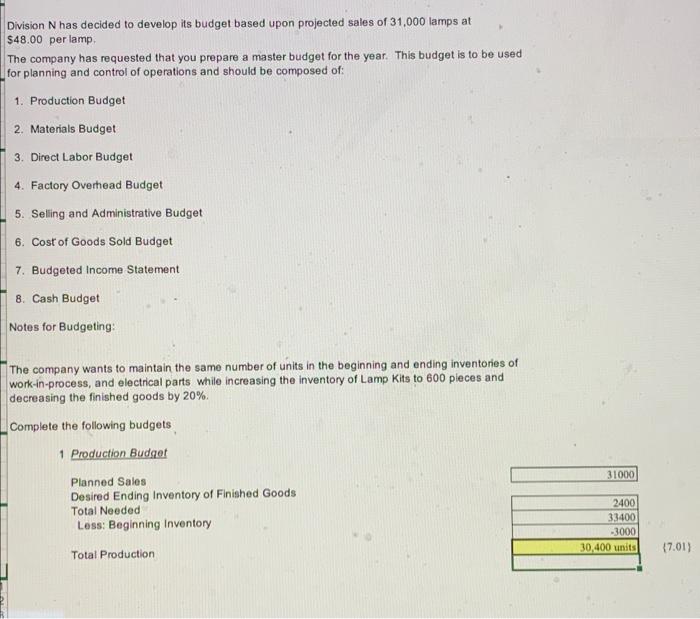

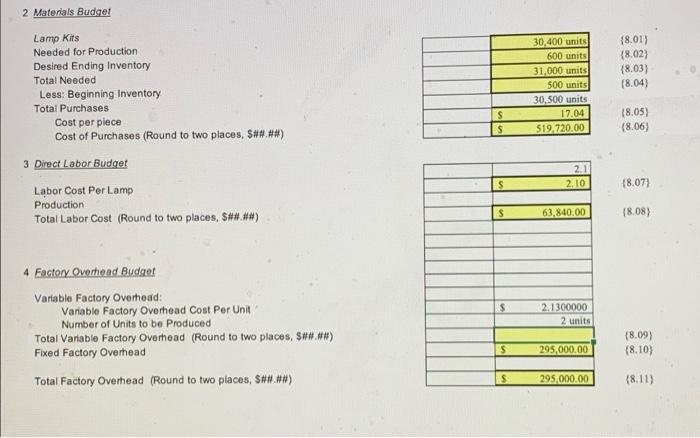

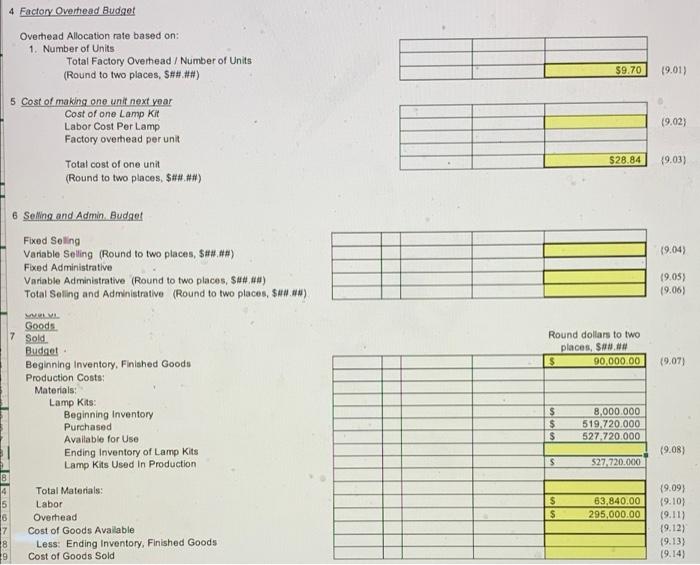

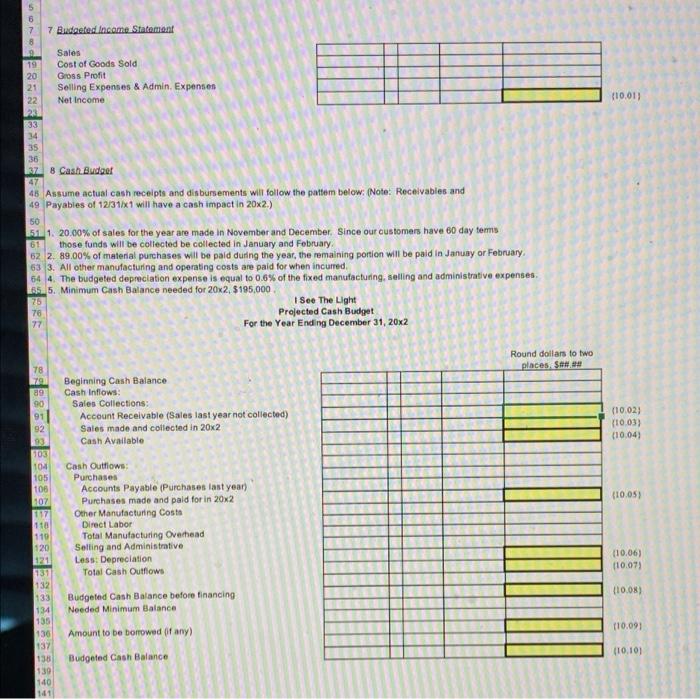

Question: please fill out the empty yellow cells. the ones already filled out are correct AE6134 Insert Draw Page Layout Formulas Data Review View Tell me

![me X Arial ] 12 Wrap Text General B 1 = =](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e31106dba47_06266e311067bac4.jpg)

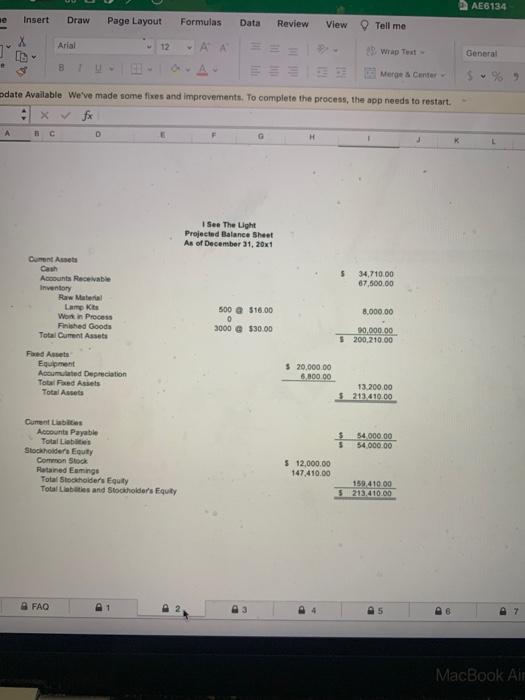

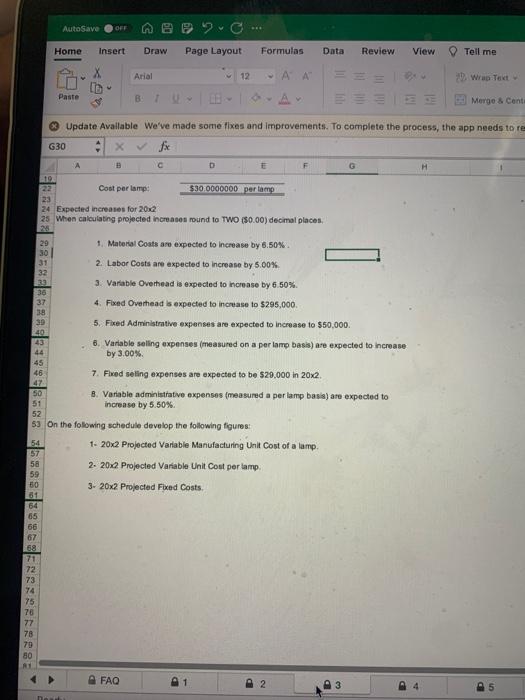

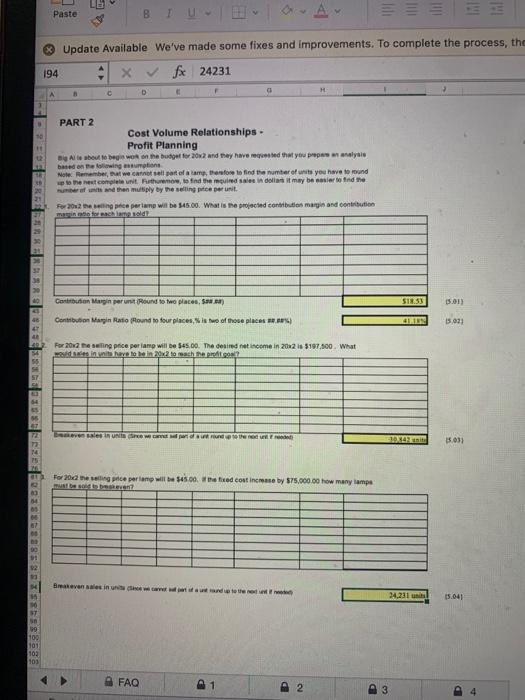

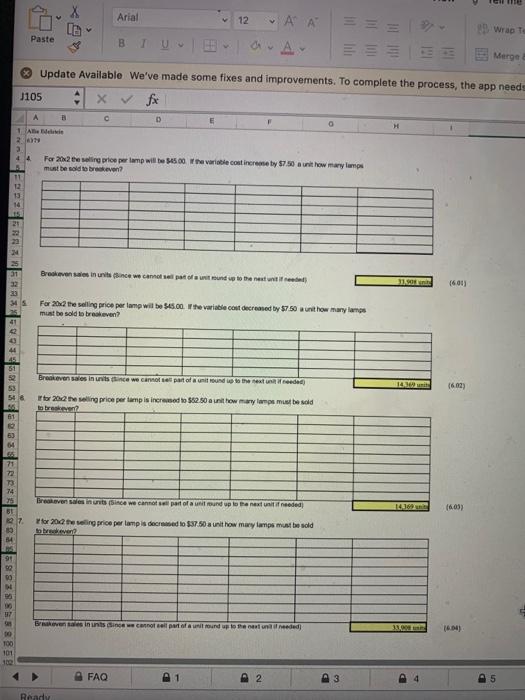

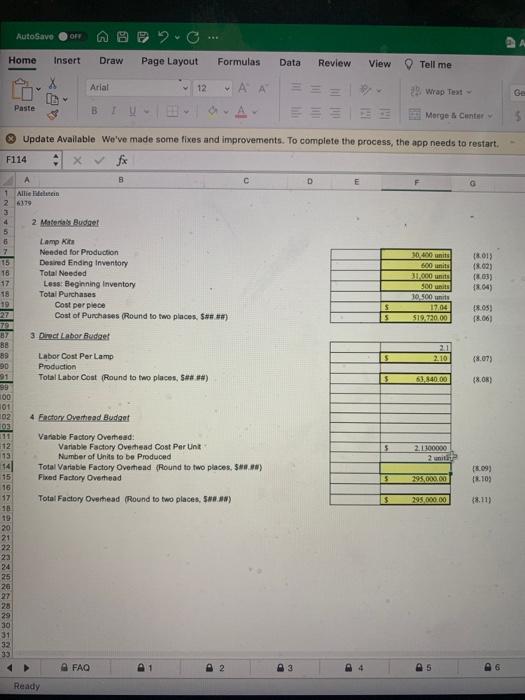

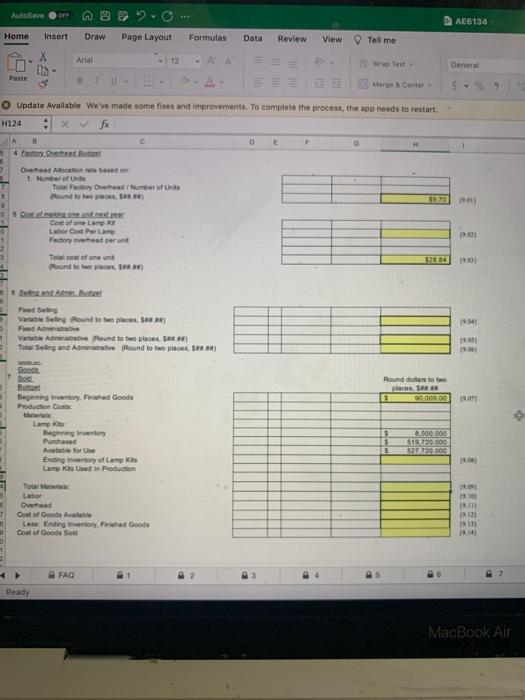

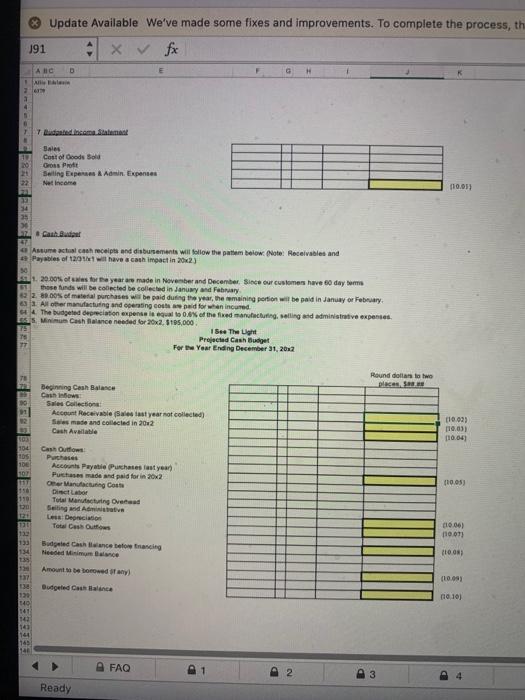

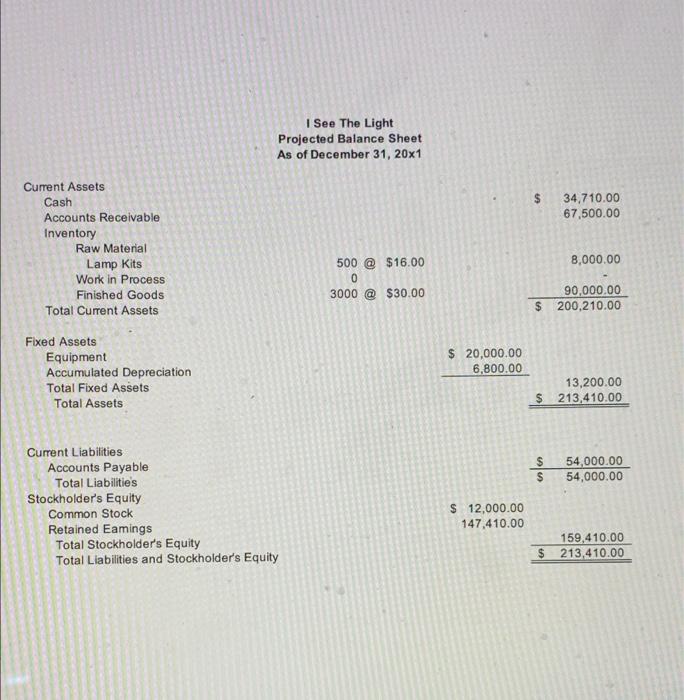

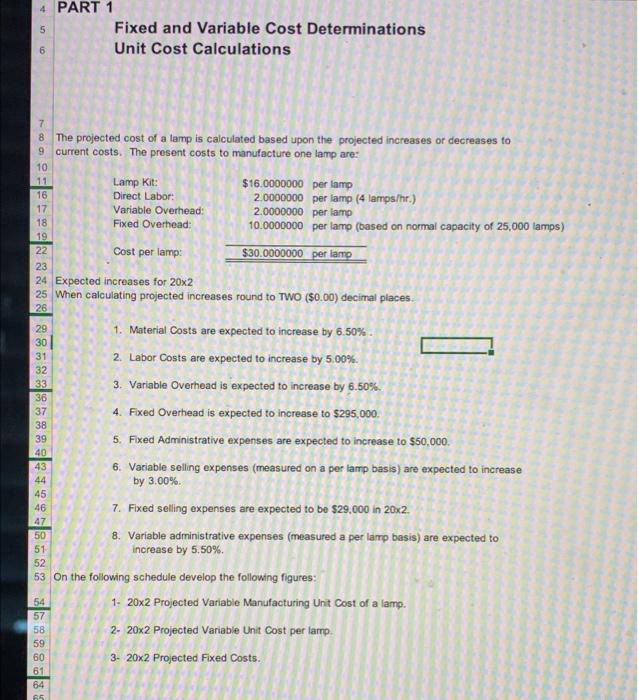

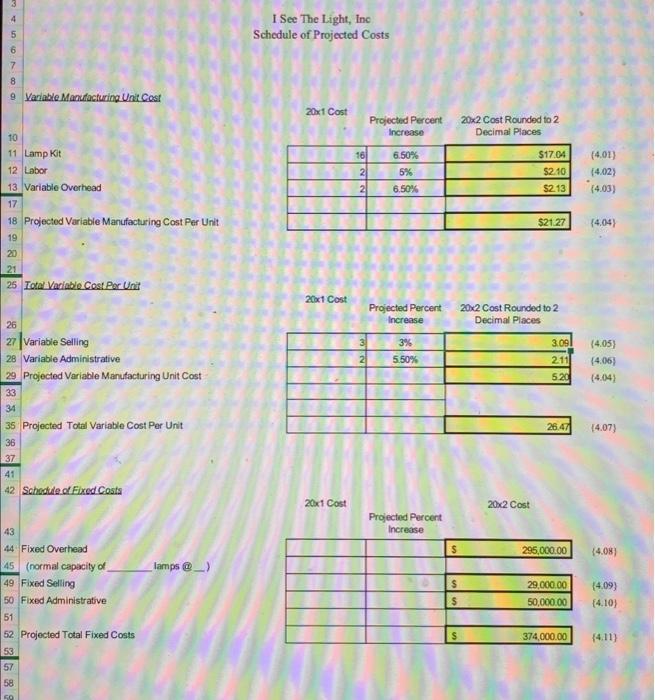

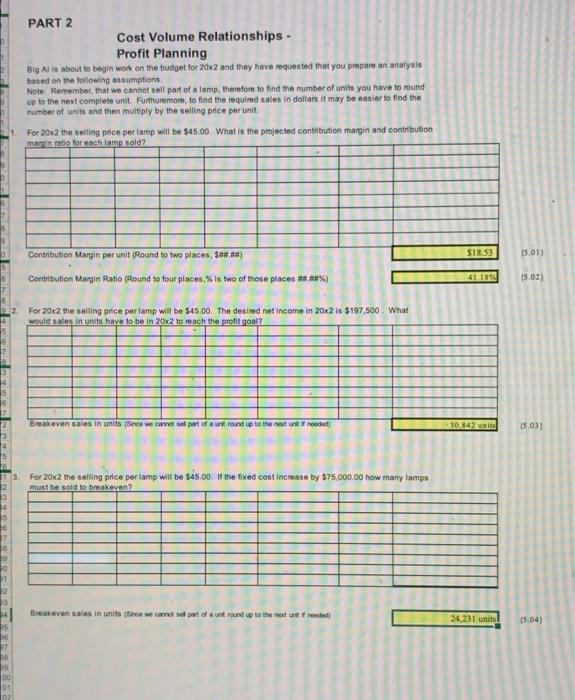

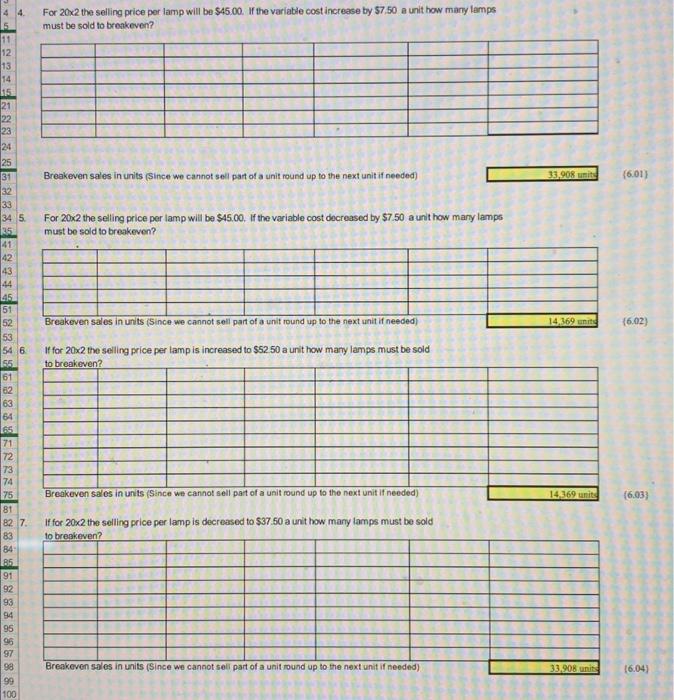

AE6134 Insert Draw Page Layout Formulas Data Review View Tell me X Arial ] 12 Wrap Text General B 1 = = = Merge Center date Available We've made some fixes and improvements. To complete the process, the app needs to restart. D G H 1 See The Light Projected Balance Sheet As of December 31, 20x1 $ 34,710.00 67,500.00 Quent Assets Cash Accounts Receivable Inventory Raw Material Lam Kits Work in Process Finished Goods Total Current Assets 8,000.00 500 @ $16.00 0 3000 $30.00 90,000.00 $ 200,210.00 Faed Asset Equipment Acumulated Depreciation Total Fixed Assets Total Assets $ 20,000.00 5.800.00 13.200.00 S213.410.00 S 54.000.00 54 000.00 Qurant Labs Account Payable Total Liabi Stockholders Equity Common Stock Retained Eumige Total Stockholder's Equity Total Liabetes and Stockholder's Equity $ 12,000.00 147,410.00 159.410 00 5 213,410.00 FAQ P 5 MacBook Air AutoSave OFF Home Insert Draw Page Layout Formulas Data Review View Tell me Arial 12 A A Wrap Text [b Paste B Mergo & Cent Update Available We've made some fixes and improvements. To complete the process, the app needs to re G30 X G H c D E F 10 Cost per lamp: $30 0000000 per tamo 23 24 Expected increases for 20.2 25 When calculating projected increases round to TWO (50.00) decimal places 32 44 45 46 29 1. Material Costs are expected to increase by 6.50% 30 2. Labor Couts are expected to increase by 5.00% 3. Variable Overhead is expected to increase by 6.50% 36 37 4. Fixed Overhead is expected to increase to $205,000 38 39 5. Fixed Administrative expenses are expected to increase to $50,000. 40 8. Variable selling expenses (measured on a per lamp basis) are expected to increase by 3.00% 7. Fixed selling expenses are expected to be $20,000 in 2012 50 8. Variable administrative expenses (measured a per lamp basis) are expected to 51 increase by 5.50%. 52 53 On the following schedule develop the following figures 1- 2012 Projected Variable Manufacturing Unit Cost of a lump. 58 2. 20x2 Projected Variable Unit Cost per lamp 59 50 3. 20x2 Projected Fixed Costs 51 64 65 66 67 68 71 72 73 74 75 78 77 78 79 54 57 P FAQ . AutoSave OF 09 Home Insert Draw Page Layout Formulas Data Review View Tell me Arla 12 to Wrap Tent BI Merge Center Update Available We've made some fixes and improvements. To complete the process, the app needs to restart. D27 x fx 3.09 A D E 20x1 Cost 20x2 Cost Rounded to 2 Decimal Places Projected Percent Increase 6.50% 5% 6.50% 16 2 2 (401) 517.04 52.10 $2.13 (403) TO 11 Lang Ke 12 Labor 13 Variable Overhead 17 18 Projected Variable Manufacturing Cost Per Unit 19 20 21 ES / Verbie Cost Perunt 521 27 14.04 20x Cost 20x2 Cost Rounded to 2 Decimal Places 26 27 Variable Seling 26 Variable Administrative 29 Projected Variable Manufacturing Unit Cost 33 Projected Percent Increase 3% 5.50% 3 2. 3.09 2.11 5.20 (4.05 (4.06 14.04) 28.47 (4.071 35 Projected Total Variable Cost Per Unit 35 37 41 42 Schedule of Fred Costs 20x1 Cost 20x2 Cost Projected Percent Increase 5 295,000.00 lamps @_) $ 5 29,000.00 50,000.00 14.09) (4:10) 43 44 Fxed Overhead 45 normal capacity of 49 Fored Soling 50 Fied Administrative 51 52 Projected Total Fixed Costs 53 57 58 59 50 FAQ s 374,000.00 (411) 5 Ready LE Paste a A IMI Update Available We've made some fixes and improvements. To complete the process, the 194 x fx 24231 A c D PART 2 Cost Volume Relationships - Profit Planning Alte sbout to begin or on the ball 2012 and they have realed that you are analysis based on rewing emotions No. Remember we cannot sell part of a cam, therefore to find the number of units you have to round to the rest complet them to find the multe sie in dit may be easier to find the of and then musly by the setting pee per unit For 2012 gece perime will be 145.00. What is the projecte contributions margins and contribution ARRERAS 40 Costin Margin perustund to two places, SIN.SI 15.01) Contribution Margin toond to four places, is two of those places.) GIN 15.091 Pox20x2 the selling price per lamp will be $45.00. The desired income in 2012 is $197.500. What ini bayon x 210 chegoal? Beveles | ERZIE 15.031 For 20 selling price perime will be $45.00. the red cost increase by $75,000.00 how many lampe Bevens in new 24,231 15.041 100 101 103 103 FAQ P 2 P 3 Arial 12 AA 29 Wrap To Paste B Merge Update Available We've made some fixes and improvements. To complete the process, the app needs 3105 X c D H 1 Ande 29 4 For 22 the selling price per lamp will be $4500 the variable continere by 57.50 a unit how marylamps must be sold to breakeven? 11 12 M Brevesa in units Bence we cannot post mund to the next time JE (600) For 2012 the selling price per lamp will be 545.00. the variable con decreased by $750 unit how many lamps must be sold to breakeven? 41 22EOS 51 Brookeve sales in units ince we cannot be part of an und to the extended) (603) Ito 202 the selling price per amp is increased to 562.50 ani how many lampe must be sold Dobre 61 71 Verses in unuts Since we cannot sell part of an und up to extitif needed] 1416 (605) 81 2 for 202 teng price permis decreased to $37.50 a unit how many lamps must be sold toeven 988858828 BV inints since we can get i found presenta el reeded 100 101 FAQ 3 Ready AutoSave C Home Insert Draw Page Layout Formulas Data Review View Tell me Arial 12 Wrap Text Paste Mere Center 3 Update Available We've made some fixes and improvements. To complete the process, the app needs to restart. E94 A D E PART 3 Budgets 19 1 Don N has decided to develop ts budget based upon projected sales of 31,000 lamps at 15 348.00 perlamp 16. The company has requested that you prepare a master budget for the year. This budget is to be used for planning and control of operations and should be composed of 24 25 Production Budget 26 27 2. Material Budget 35 3. Direct Labor Budget 30 37 4. Factory Overhead Budget 19 339 5. Seling and Administrative Budget 47 6. Cost of Goods Sold Budget 48 7. Budgeted Income Statement 57 8. Cash Budget 59 Notes for Budgeting: 60 61 66 The company wants to maintain the same number of units in the beginning and ending inventories of 69 work in process and electrical parts while increasing the inventory of Lamp Kits to 600 places and 70 decreasing the finished goods by 20% 71 72. Complete the following budgets 79 BO 1 Production Budget 31000 Planned Sales Desred Ending Inventory of Finished Goods Total Needed Lew Beginning inventory 82 83 90 91 92 93 94 101 102 3400 13400 3000 30, 400 unit Total Production 17.011 FAQ 1 2 . P 3 Ready AutoSave OF 2. Home Insert Draw Page Layout Formulas Data Review View Tell me Arial 12 A A 2 Wrap Test Se Paste BI Morge & Center 5 Update Available We've made some fixes and improvements. To complete the process, the app needs to restart. F114 Ax fx 8 c D E 1 Allen 26179 2 Material Budget Lamp Kits Needed for Production Desired Ending Inventory Total Needed Less: Beginning Inventory Total Purchases Cost perpiece Cost of Purchases (Round to two places. S) 3 Direct Labor Budget 10400 units 500 units 11.000 units 500 units 10.500 units 12.04 $10.220.00 (801) (8.02) (803) 18.04) 8051 18.061 5 2 2.10 (8.07) 4 5 6 7 15 18 17 18 19 27 TO 87 88 39 90 91 99 100 101 102 10 111 12 13 14 15 16 17 16 19 Labor Cost Per Lamp Production Total Labor Cost (Round to two places, ##) 61,840.00 (808) 4 Factory Owerhead Budget Variable Factory Overhead: Variable Factory Overhead Cost Per Unt Number of Units to be produced Total Variable Factory Overhead (Round to two places$8.) Fixed Factory Overhead 2.1300000 2 unit 18.09) 18.10) 5 295,000.00 Total Factory Overhead (Round to two places, 58.28) $ 295,000.00 & ANRROR RAB 21 22 2a 24 25 20 27 28 29 30 31 32 FAQ 2 4 5 6 Ready Autove AE6134 Home Insert Draw Page Layout Formulas Data Review View Tell me Arial 12 - AA Wrap Tyt General 1 Paste Merge seer $ Update Available We've made some lives and improvement. To complete the process, the app needs to restart H124 Xfx A D 4 Ency Queen 7 Oveed Alication based on 1. Number of Total Factory Overhead Number of the Rond top 1901 19.001 08 Qatar Contaam Labor Cost Pere Factory out perunt Tout of one Round some places, 2010 8 Send budget Fed Seng Vaste Saling Muda) F Am Adrive Round 1 two los 5#**) To Seling and Active Round to two passo) 904 18.05) 12.06 Go Sol fel Beginning remory Fished Goode Production Co Rount doar two place to 3 90 000 00 INT 5 Lang Beginning inventory Puch Avtor U Ending theory of Lang Kits Lam Kein Production 3.000.000 612 220.000 527.220.000 1 Tota bo Overhead Cost of Goode Ave La Ending wory Fished Goods Cost of Goods Store IRON 1.10 11 2.1 FAQ Ready MacBook Air Update Available We've made some fixes and improvements. To complete the process, th 191 fix Alie D E F G Bales Cost of Goods Sold Gross Profit Seling Expenses Admin Expenses Net Income 110.053 # Cash Budou Assumesc cash receipts and disbursements will follow the pattem below (Note: Receivables and 19 Payables of 2011 will have a cath impact in 20x2) 20.005 of store year are made in November and December. Since our customers have 60 days those funds will be collected be collected in Janusy and Farum 22. 1800's of material purchases will be paid during the year, the remaining portion will be paid in Januayor February All other manufacturing and operating costs as paldo when incured 44. The budgeted depreciation expense is equal to 0.0% of the fixed manufacturing selling and administrative expenses Minimum Cash Balance needed for 20x2.5195.000 15. The Light Projected Cash Budget For the Year Ending December 31, 2012 Round towe places Beginning Cash Balance Cashow Sales Collection Account Receivable (Selast year not collected Semade and collected in 2012 Cash Available 10.02) 110.03 10.041 104 105 1DE 107 10.05) Cash Outlow Puchoses Ascos Payable Purchases last year Purchases made and paid for in 2012 Manucung Con Die Labor Total Mancing Overad Selling and Admin Les Depreciations Total Cash 110 10.001 10.07) 13 Budgeted Cash Bulance before trancing Need me 11003 134 135 1 37 Amounted any (0.033 Budgeted Collane 120 140 10.101 141 141 144 145 141 FAQ a Ready Arial 12 === 19 Wrap Text Murges Paste A Update Available We've made some fixes and improvements. To complete the process, the app needs A1 Xfx D E F G H B 1 K PART 4 Process Costing - Weighted Average 6 7 8 General Information 9 10 The I See The Light Company has a related company that produces the figurines. They use process costing 17 in the molding department. The factory overhead is applied at a rate of 50% of direct labor dollars. 18 The material is added at the beginning of the process. The labor and overhead costs are assumed 19 to be added uniformly throughout. 20 21 28 29 30 31 Month of January 32 39 Selected information for January is presented below. Note that the applied overhead rate was 40 50% of direct labor costs in the molding department 41 42 43. Molding Department 50 51 Goods in-process as of January 1 were 3,100 figurines at a cost of $23,274.50. Of this amount, 54,712.00 was from 52 raw materials added, $12,375.00 for tabor and $6.187.50 for overhead. These 3,100 figurines were assumed to be 325.00% complete as to labor and overhead 54 81 During January, 22,500 units were started, 535,736.00 of materials and $63,585.00 of labor costs were incumed. 62 63 The 7.500 figurines that were in-process at the end of January were assumed to be 40.00% complete to 64 labor and overhead 185 12 Au figurines in January passed inspection 73 74 75 76 83 84 85 86 87 94 FAQ 3 5 Ready Arial X la 12 A A WE Paste a VA Me Update Available We've made some fixes and improvements. To complete the process, the app ne G13 : x x E 1 M D 26 January #MOLDNING 30 Pic Flow Us 11 Work in Process - Segitig Unis Started vs Period 15 Us Account for 15 172 Terdut Wort.in Pre-Finding 20 To counted for 112001 pre Un Mourd topics, (12.091 Eilert Units Coron Round to two places, 112.04 33 To con of Material (Round to two place, 12.01 5-STAR RSE Totalcar Conversion Round was Total Court for Round in two 12.00 112.07) Cooperativelet Round to wo place, 46 cod por equivalent of Cowen oud to be place, 12.09 58 Cod Livery mind consion Roundwoce (12.10 Cost of its related minden iwo w TIZI FAQ 2 4 Ready AutoSave OFF ome Insert Draw Page Layout Formulas Data Review View Tell me Arial 12 - A A [S 23 Wrap Text Paste B Merge & Center Update Available We've made some fixes and improvements. To complete the process, the app needs to restart. 1 xfx B C D E F G H Actual Variable Manufacturing Overhead $ 1,600.20 Actual Fixed Manufacturing Overhead $ 40,623.45 Round to two places, $. Cost of Direct Material incurred in Manufacturing Job 2407 133.01) Cost of Direct Labor Incurred in Manufacturing Job 2407 [13.02) Cost of Manufacturing Overhead Applied to Job 2407 ( (13.03) Cost of manufacturing one lamp (13.041 FAQ D D 6 I See The Light Projected Balance Sheet As of December 31, 20x1 $ 34,710.00 67,500.00 Current Assets Cash Accounts Receivable Inventory Raw Material Lamp Kits Work in Process Finished Goods Total Current Assets 8,000.00 500 @ $16.00 0 3000 $30.00 90,000.00 $ 200,210.00 Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets $ 20,000.00 6,800.00 13,200.00 $ 213,410.00 lo $ 54,000.00 54,000.00 Current Liabilities Accounts Payable Total Liabilitie's Stockholder's Equity Common Stock Retained Eamings Total Stockholder's Equity Total Liabilities and Stockholder's Equity $ 12,000.00 147,410.00 159.410.00 $ 213,410.00 4 PART 1 Fixed and Variable Cost Determinations Unit Cost Calculations 5 6 7 10 11 16 18 30 31 8 The projected cost of a lamp is calculated based upon the projected increases or decreases to 9 current costs. The present costs to manufacture one lamp are: Lamp Kit: $16.0000000 per lamp Direct Labor: 2.0000000 per lamp (4 lamps./hr.) 17 Variable Overhead: 2.0000000 per lamp Fixed Overhead 10.0000000 per lamp (based on normal capacity of 25,000 tamps) 19 22 Cost per lamp: $30.0000000 per lamp 23 24 Expected increases for 20x2 25 When calculating projected increases round to TWO ($0.00) decimal places 26 29 1. Material Costs are expected to increase by 6.50%. 2. Labor Costs are expected to increase by 5.00%. 32 33 3. Variable Overhead is expected to increase by 6.50%. 4. Fixed Overhead is expected to increase to $295,000 39 5. Fixed Administrative expenses are expected to increase to $50,000 40 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 3.00% 7. Fixed selling expenses are expected to be $29,000 in 20x2. 8. Variable administrative expenses (measured a per lamp basis) are expected to 51 increase by 5,50%. 53 On the following schedule develop the following figures: 1- 20x2 Projected Variable Manufacturing Unit Cost of a lamp. 57 2- 20x2 Projected Variable Unit Cost per lamp 60 3- 20x2 Projected Fixed Costs. 36 37 38 43 44 45 46 47 50 52 54 58 59 61 64 05 4 I See The Light, Inc Schedule of Projected Costs 5 6 7 D000 9 Variable Manufacturing Unit Coat 20x1 Cost Projected Percent Increase 20x2 Cost Rounded to 2 Decimal Places 16 6.50% 6% $17.04 $2.10 $2.13 (4.01) (4.02) 14.03) 2 6.50% 10 11 Lamp Kit 12 Labor 13 Variable Overhead 17 18 Projected Variable Manufacturing Cost Per Unit 19 20 21 25 Total Variable Cost Per Unit $21.27 4.04) 2041 Cost Projected Percent Increase 20x2 Cost Rounded to 2 Decimal Places 26 27 Variable Selling 28 Variable Administrative 29 Projected Variable Manufacturing Unit Cost 3% 5.50% 3.09 211 520 (4.05) (406) (4.04) 33 34 35 Projected Total Variable Cost Per Unit 26.47 {4.07) 36 37 41 42 Schade of Fixed Costs 20x1 Cost 20x2 Cost Projected Percent Increase 43 $ 295,000.00 {4.08 44 Fixed Overhead 45 (normal capacity of 49 Fixed Selling 50 Fixed Administrative lamps @_) $ 29,000.00 50,000.00 (4.09) [4.10) $ 51 52 Projected Total Fixed Costs 374,000.00 {4.11) 53 57 58 FO PART 2 Cost Volume Relationships. Profit Planning Big Al is about to begin work on the budget for 20x2 and they have requested that you prepare an analysis based on the following assumptions Note: Remember that we cannot sell part of a lamp, therefore to find the number of units you have to round up to the next complete unit. Furthuremore to find the required sales in dollar it may be easier to find the number of units and then multiply by the selling price per unit For 2012 the selling price per lamp will be $45.00. What is the projected contribution margin and contribution margin ratio for each lamp sold? Contribution Margin per unit (Round to two places, S) $18.53 15.01) Contribution Margin Ratio (Round to four places, % is two of those places #%) 15.02) 2. For 20x2 the selling price per lamp will be $45.00. The desired ret income in 20x2 is $197.500. What would sales in units have to be in 20x2 to reach the profit goal? Breakeven sales in units (Since we cannot part of aunt round up to the mount needed 10,842 units 15.03) For 20x2 the selling price per inmp will be 545.00. If the fixed cost increase by $75,000.00 how many lamps must be sold to breakeven? Brakeven sales in unito (ince we camere part of our round up to the resterende 24.231 unit 15.04) 35 For 20x2 the selling price per lamp will be $45.00. If the variable cost increase by $7.50 a unit how many lamps must be sold to breakeven? 4 4 15 11 12 13 14 05 21 22 23 24 25 Breakeven sales in units (Since we cannot sell part of a unit round up to the next unit if needed) 33,908 unit (6.01) For 20x2 the selling price per lamp will be 545.00. If the variable cost decreased by $750 a unit how many lamps must be sold to breakeven? Breakeven sales in units (Since we cannot sell part of a unit round up to the next unit if needed) 14,369 unit {6.02) If for 20x2 the selling price per lamp is increased to $5250 a unit how many lamps must be sold to breakeven? 31 32 33 34 5 25 41 42 43 44 05 51 52 53 546 155 61 62 63 64 65 71 72 73 74 75 81 82 7. 83 84 B5 91 Breakeven sales in units (Since we cannot sell part of a unit round up to the next unit if needed) 14.169 units (6.033 If for 20x2 the selling price per lamp is decreased to $37.50 a unit how many lamps must be sold to breakeven? 8 88 98888 94 95 96 97 98 99 Breakeven sales in units (Since we cannot sell part of a unit round up to the next unit if needed) 33.908 unit 16.04) Division N has decided to develop its budget based upon projected sales of 31,000 lamps at $48.00 per lamp The company has requested that you prepare a master budget for the year. This budget is to be used for planning and control of operations and should be composed of: 1. Production Budget 2. Materials Budget 3. Direct Labor Budget 4. Factory Overhead Budget 5. Selling and Administrative Budget 6. Cost of Goods Sold Budget 7. Budgeted Income Statement 8. Cash Budget Notes for Budgeting: The company wants to maintain the same number of units in the beginning and ending inventories of work-in-process, and electrical parts while increasing the inventory of Lamp Kits to 600 pieces and decreasing the finished goods by 20% Complete the following budgets 1 Production Budget 31000 Planned Sales Desired Ending Inventory of Finished Goods Total Needed Less: Beginning Inventory 2400 33400 -3000 30,400 units (7.01) Total Production 2 Materials Budget Lamp Kits Needed for Production Desired Ending Inventory Total Needed Less: Beginning Inventory Total Purchases Cost per piece Cost of Purchases (Round to two places, S####) 3 Direct Labor Budget Labor Cost Per Lamp Production Total Labor Cost (Round to two places, $####) 30,400 units 600 units 31,000 units 500 units 30.500 units 17.04 $19.720.00 {8.01) (8.02) 18.03) (8.04) $ $ (8.05) (8.06 2.1 2.10 s {8.07) $ 63,840.00 18.08) $ 4 Factory Overhead Budget Variable Factory Overhead: Variable Factory Overhead Cost Per Unit Number of Units to be produced Total Variable Factory Overhead (Round to two places, $####) Fixed Factory Overhead 2.1300000 2 units (8.09) (8.10) $ 295,000.00 Total Factory Overhead (Round to two places, S.) S 295,000.00 (8.11) $9.70 19.01) 4 Factory Overhead Budget Overhead Allocation rate based on: 1. Number of Units Total Factory Overhead / Number of Units (Round to two places, S#.##) 5 Cost of making one unit next year Cost of one Lamp kit Labor Cost Per Lamp Factory overhead per unit Total cost of one unit (Round to two places. $####) (9.02) $28.84 {9.03) 19.04) 6 Selling and Admin. Budget Fixed Seling Variable Selling (Round to two places, S##.##) Fixed Administrative Variable Administrative (Round to two places, S.) Total Seling and Administrative (Round to two places, sw.) SRL Goods. (9.05) 19.06) 7 Sold Round dollars to two places, S. $ 90,000.00 (9.07) Budget Beginning Inventory. Finished Goods Production Costs: Materials: Lamp Kits: Beginning Inventory Purchased Available for Use Ending Inventory of Lamp Kits Lamp Kits Used In Production $ $ $ 8,000,000 519,720.000 527.720.000 (9.08) 5 $27.720.000 B $ $ 63,840.00 295,000.00 16 7 18 19 Total Materials: Labor Overhead Cost of Goods Available Less: Ending Inventory, Finished Goods Cost of Goods Sold {9.09) (9.10) (9.11) 19.12) (9.13) 19.14) ovo 7 Budgeted Income Statement 110.011 Sales 19 Cost of Goods Sold 20 Gross Profit 21 Selling Expenses & Admin Expenses 22 Net Income 23 33 34 35 36 7 8 Cash Budget 47 45 Assume actual cash receipts and disbursements will follow the patterm below: (Note: Receivables and 49 Payables of 12/31/x 1 will have a cash impact in 20x2.) 50 51. 1. 20.00% of sales for the year are made in November and December. Since our customers have 60 day toms 61 those funds will be collected be collected in January and February 62 2. 89.00% of material purchases will be paid during the year, the remaining portion will be paid in Januay or February 63 3. All other manufacturing and operating costs are paid for when incurred 64 4. The budgeted depreciation expense is equal to 0.6% of the fixed manufacturing, selling and administrative expenses. 35. 5. Minimum Cash Balance needed for 20x2. $195.000 26 1 See The Light 76 Projected Cash Budget 77 For the Year Ending December 31, 20x2 Round dollars to two places S. 78 Beginning Cash Balance Cash Inflows: Sales Collections: Account Receivable (Sales last year not collected) Sales made and collected in 20x2 Cash Available (10.02) 10.03) (10.04) (10.05) 89 90 91 92 33 103 104 105 108 107 117 118 119 120 121 131 132 133 134 135 136 137 138 139 140 141 Cash Outflows: Purchases Accounts Payable (Purchases last year) Purchases made and paid for in 20x2 Other Manufacturing Costa Direct Labor Total Manufacturing Overhead Selling and Administrative Less: Depreciation Total Cash Outflows 110.06) 110.07) 110.08) Budgeted Cash Balance before financing Needed Minimum Balance (10.091 Amount to be bomowed of any) (10.101 Budgeted Cash Balance 8 MOLDING 10 Physical Flow of Units 13 Work-in-Process - Beginning 14 Units Started this Period 15 Units to Account for 17 Total transferred out 19 Work-in-Process - Ending 20 Total Accounted for 21 22 {12.01) {12.02) 25 Equivalent Units Material (Round to two places, #, .NAF) 26 {12.03) 18p=g = 6688m2 w 28 Equivalent Units Conversion (Round to two places, ##.#.) (12.04 31 8688% Total cost of Material (Round to two places, ##*****.) (12.05 Total cost of Conversion (Round to two places, ##.48.24) 38 Total cost to account for (Round to two places, #..##) {12.06) (12.07) 43 Cost per equivalent unit of Material (Round to two places, (12.08) 45 46 Cost per equivalent unit of Conversion (Round to two places, st.) {12.09) 47 51 {12.10) 55 Cost of the ending inventory, material and convesion (Round to two places. Sit. 88888889882898 (12.11) 84 Cost of the units transferred, material and convesion (Round to two places, S. 9 TO 11 12. To keep records of the actual cost of a special order job, a Job Order Cost System has been developed 15 Overhead is applied at the rate of 50% of the direct labor cost. 16 17 18 19 Job Order Costing Section 22 23 On January 1, 20x2. Division S began Job 2407 for the Client, THE BIG CHILDREN STORE. The 24 job called for 4,000 customized lamps. The following set of transactions occurred from 25 January 5 until the job was completed: 26 5 Jan Purchased 4,075 Lamp Kits @ $16.65 per kit. 30 9-Jan 4,150 sets of Lamp Kits were requisitioned. 47-Jan Payroll of 610 Direct Labor Hours @ $9.85 per hour. 30-Jan Payroll of 660 Direct Labor Hours @ $10.10 per hour. 30 Jan 3,990 lamps were completed and shipped. All materials requisitioned were used or scrapped, and are a cost of normal processing. 37 38 Month End Overhead Infomation 39 Actual Variable Manufacturing Overhead $ 1,600.20 40 Actual Fixed Manufacturing Overhead $ 40,623.45 43 2898 46 Round to two places, S. Cost of Direct Material incurred in Manufacturing Job 2407 (13.01) Cost of Direct Labor incurred in Manufacturing Job 2407 (13.02) 51 52 53 54 57 58 59 60 611 64 65 56 67 FR 71 72 73 74 75 75 77 ya Cost of Manufacturing Overhead Applied to Job 2407 (13.03) Cost of manufacturing one lamp 13.04)

Step by Step Solution

There are 3 Steps involved in it

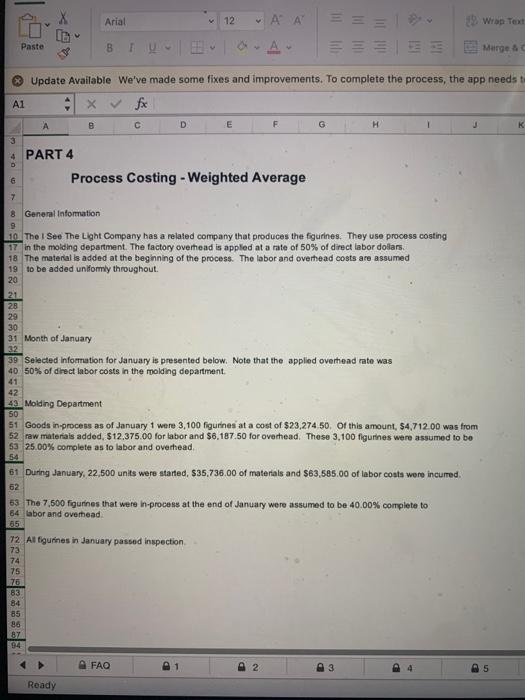

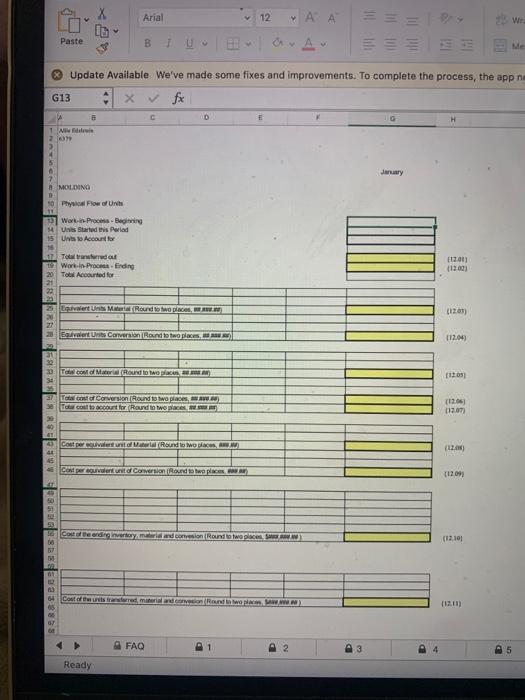

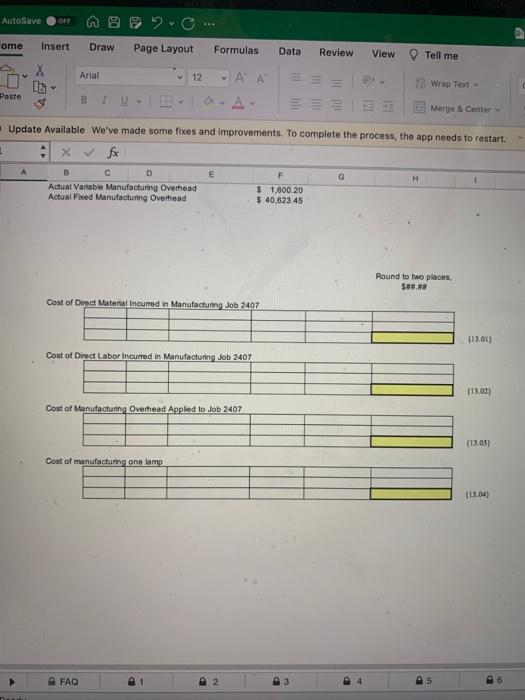

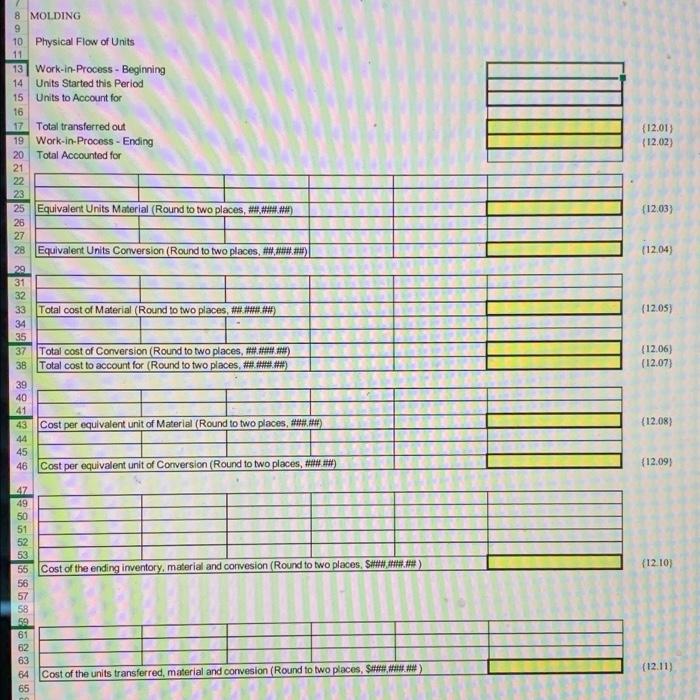

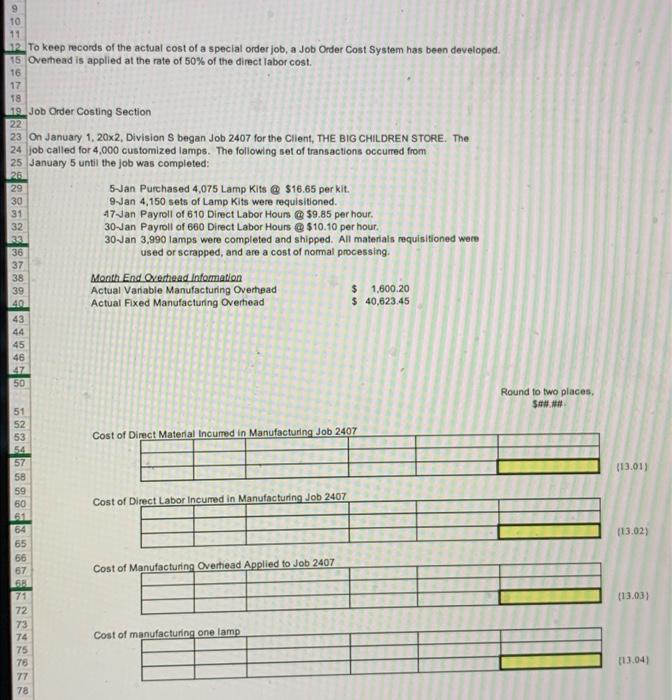

Get step-by-step solutions from verified subject matter experts