Answered step by step

Verified Expert Solution

Question

1 Approved Answer

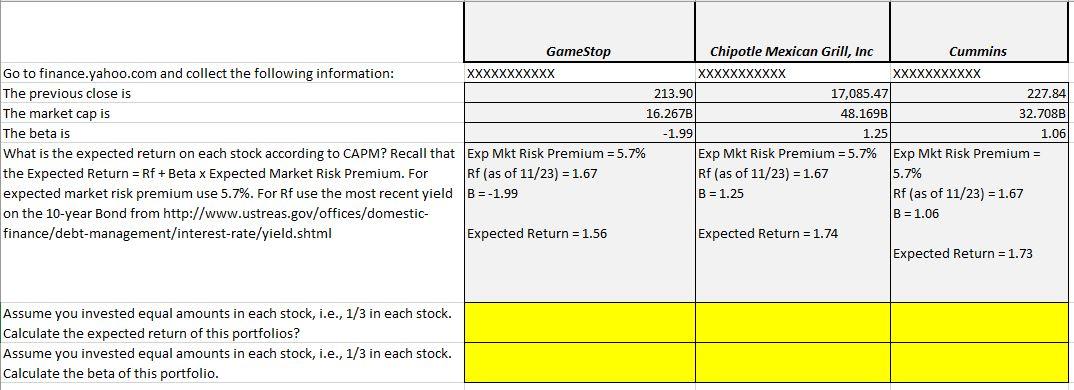

Please fill out the highlighted areas for these three companies. GameStop Chipotle Mexican Grill, Inc Cummins Go to finance.yahoo.com and collect the following information: XXXXXXXXXXX

Please fill out the highlighted areas for these three companies.

GameStop Chipotle Mexican Grill, Inc Cummins Go to finance.yahoo.com and collect the following information: XXXXXXXXXXX XXXXXXXXXXX XXXXXXXXXXX The previous close is 213.90 17,085.47 227.84 The market cap is 16.267B 48.169B 32.708B The beta is -1.99 1.25 1.06 What is the expected return on each stock according to CAPM? Recall that Exp Mkt Risk Premium = 5.7% Exp Mkt Risk Premium = 5.7% Exp Mkt Risk Premium = the Expected Return = Rf + Beta x Expected Market Risk Premium. For Rf (as of 11/23) = 1.67 Rf (as of 11/23) = 1.67 5.7% expected market risk premium use 5.7%. For Rf use the most recent yield B =-1.99 B = 1.25 Rf (as of 11/23) = 1.67 on the 10-year Bond from http://www.ustreas.gov/offices/domestic- B = 1.06 finance/debt-management/interest-rate/yield.shtml Expected Return = 1.56 Expected Return = 1.74 Expected Return = 1.73 Assume you invested equal amounts in each stock, i.e., 1/3 in each stock. Calculate the expected return of this portfolios? Assume you invested equal amounts in each stock, i.e., 1/3 in each stock. Calculate the beta of this portfolio. GameStop Chipotle Mexican Grill, Inc Cummins Go to finance.yahoo.com and collect the following information: XXXXXXXXXXX XXXXXXXXXXX XXXXXXXXXXX The previous close is 213.90 17,085.47 227.84 The market cap is 16.267B 48.169B 32.708B The beta is -1.99 1.25 1.06 What is the expected return on each stock according to CAPM? Recall that Exp Mkt Risk Premium = 5.7% Exp Mkt Risk Premium = 5.7% Exp Mkt Risk Premium = the Expected Return = Rf + Beta x Expected Market Risk Premium. For Rf (as of 11/23) = 1.67 Rf (as of 11/23) = 1.67 5.7% expected market risk premium use 5.7%. For Rf use the most recent yield B =-1.99 B = 1.25 Rf (as of 11/23) = 1.67 on the 10-year Bond from http://www.ustreas.gov/offices/domestic- B = 1.06 finance/debt-management/interest-rate/yield.shtml Expected Return = 1.56 Expected Return = 1.74 Expected Return = 1.73 Assume you invested equal amounts in each stock, i.e., 1/3 in each stock. Calculate the expected return of this portfolios? Assume you invested equal amounts in each stock, i.e., 1/3 in each stock. Calculate the beta of this portfolioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started