Answered step by step

Verified Expert Solution

Question

1 Approved Answer

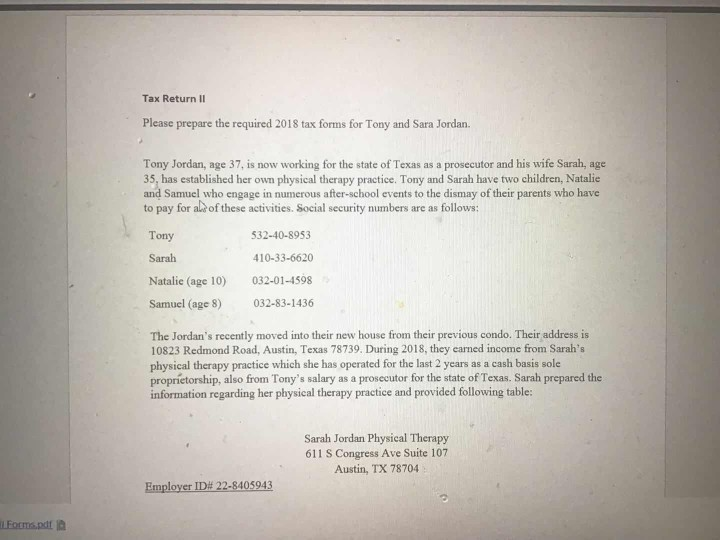

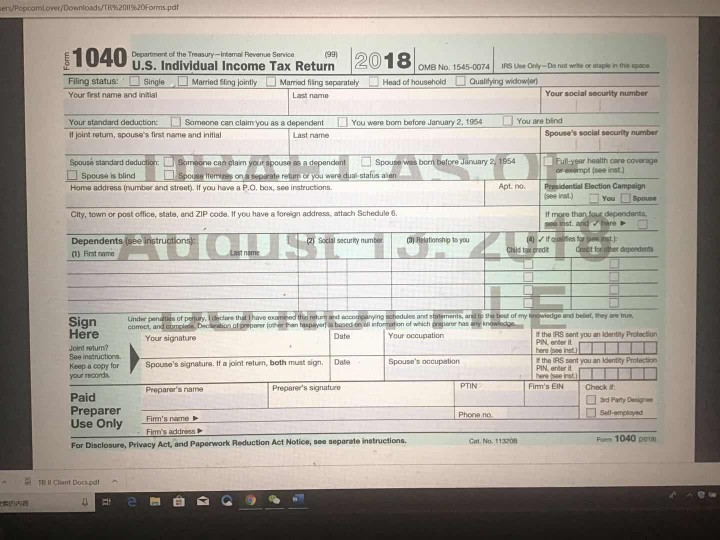

please fill out the second form Tax Return II Please prepare the required 2018 tax forms for Tony and Sara Jordan. Tony Jordan, age 37,

please fill out the second form

Tax Return II Please prepare the required 2018 tax forms for Tony and Sara Jordan. Tony Jordan, age 37, is now working for the state of Texas as a prosecutor and his wife Sarah, age 35, has established her own physical therapy practice. Tony and Sarah have two children, Natalie Samuel who engage in numerous after-school events to the dismay of their parents who have to pay for ale of these activities. Social security numbers are as follows: Tony 532-40-8953 Sarah 410-33-6620 Natalie (age 10) 032-01-4598 Samuel (age 8) 032-83-1436 The Jordan's recently moved into their new house from their previous condo. Their address is 10823 Redmond Road, Austin, Texas 78739. During 2018, they earned income from Sarah's physical therapy practice which she has operated for the last 2 years as a cash basis sole proprietorship, also from Tony's salary as a prosecutor for the state of Texas. Sarah prepared the information regarding her physical therapy practice and provided following table: Sarah Jordan Physical Therapy 611 S Congress Ave Suite 107 Austin, TX 78704 Employer ID# 22-8405943 ers/popcorntover / Downloads/T R%2011 %20forms.pdf Department of the Treasury-Intemal Revenue Service U.S. Individual Income Tax Return OMB No. 1545-0074UseOnly-De not write or ssaple in thes spacs Flling status: Single Married Sling jointly Mariad filing separately Head of householdQualitying widowlen Your social security number Your frst name and initial Last name Your standard deduction: Semeone can claim you as a dependentYou ware bom before January 2. 1954L You are bind Spouse's social security number If joint retum, spouse's first name and initial Last name health care Spouse standard deduction can clarm ewimpt (see irst) spouse is blind o you were dual-stafus Apt. no. Prosidential Election Campaign see inst.) Home address (number and street). If you have a P.O, box, see instructions YouSpouse City, town or post office, state, and ZIP code. If you have a foreign address, attach Schedule 6 Social security numberRelationship to you Dependents (1) Rirst rame and to the best of my owledge and beliet, they are true, Sign cormet Here f the IRS sent you an identity Protection PIN, enter ft Your occupation Date Your signature Joint return? See instructions. f the IRS sent you an ldentity Protection PIN, enter i Spouse's occupation Keep a copy for your records Spouse's signature. If a joint return, both must sign. Date PTIN Finm's EIN Preparer's signature Preparars name Paid Preparer Use Only 3ed Party Designe Phone no Fim's narme Foms 1040 1 Gat. No. 113208 For Disclosure, Privacy Act, and Paporwork Reduction Act Notice, see separate instructions. FR El Client Docspon Tax Return II Please prepare the required 2018 tax forms for Tony and Sara Jordan. Tony Jordan, age 37, is now working for the state of Texas as a prosecutor and his wife Sarah, age 35, has established her own physical therapy practice. Tony and Sarah have two children, Natalie Samuel who engage in numerous after-school events to the dismay of their parents who have to pay for ale of these activities. Social security numbers are as follows: Tony 532-40-8953 Sarah 410-33-6620 Natalie (age 10) 032-01-4598 Samuel (age 8) 032-83-1436 The Jordan's recently moved into their new house from their previous condo. Their address is 10823 Redmond Road, Austin, Texas 78739. During 2018, they earned income from Sarah's physical therapy practice which she has operated for the last 2 years as a cash basis sole proprietorship, also from Tony's salary as a prosecutor for the state of Texas. Sarah prepared the information regarding her physical therapy practice and provided following table: Sarah Jordan Physical Therapy 611 S Congress Ave Suite 107 Austin, TX 78704 Employer ID# 22-8405943 ers/popcorntover / Downloads/T R%2011 %20forms.pdf Department of the Treasury-Intemal Revenue Service U.S. Individual Income Tax Return OMB No. 1545-0074UseOnly-De not write or ssaple in thes spacs Flling status: Single Married Sling jointly Mariad filing separately Head of householdQualitying widowlen Your social security number Your frst name and initial Last name Your standard deduction: Semeone can claim you as a dependentYou ware bom before January 2. 1954L You are bind Spouse's social security number If joint retum, spouse's first name and initial Last name health care Spouse standard deduction can clarm ewimpt (see irst) spouse is blind o you were dual-stafus Apt. no. Prosidential Election Campaign see inst.) Home address (number and street). If you have a P.O, box, see instructions YouSpouse City, town or post office, state, and ZIP code. If you have a foreign address, attach Schedule 6 Social security numberRelationship to you Dependents (1) Rirst rame and to the best of my owledge and beliet, they are true, Sign cormet Here f the IRS sent you an identity Protection PIN, enter ft Your occupation Date Your signature Joint return? See instructions. f the IRS sent you an ldentity Protection PIN, enter i Spouse's occupation Keep a copy for your records Spouse's signature. If a joint return, both must sign. Date PTIN Finm's EIN Preparer's signature Preparars name Paid Preparer Use Only 3ed Party Designe Phone no Fim's narme Foms 1040 1 Gat. No. 113208 For Disclosure, Privacy Act, and Paporwork Reduction Act Notice, see separate instructions. FR El Client DocsponStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started