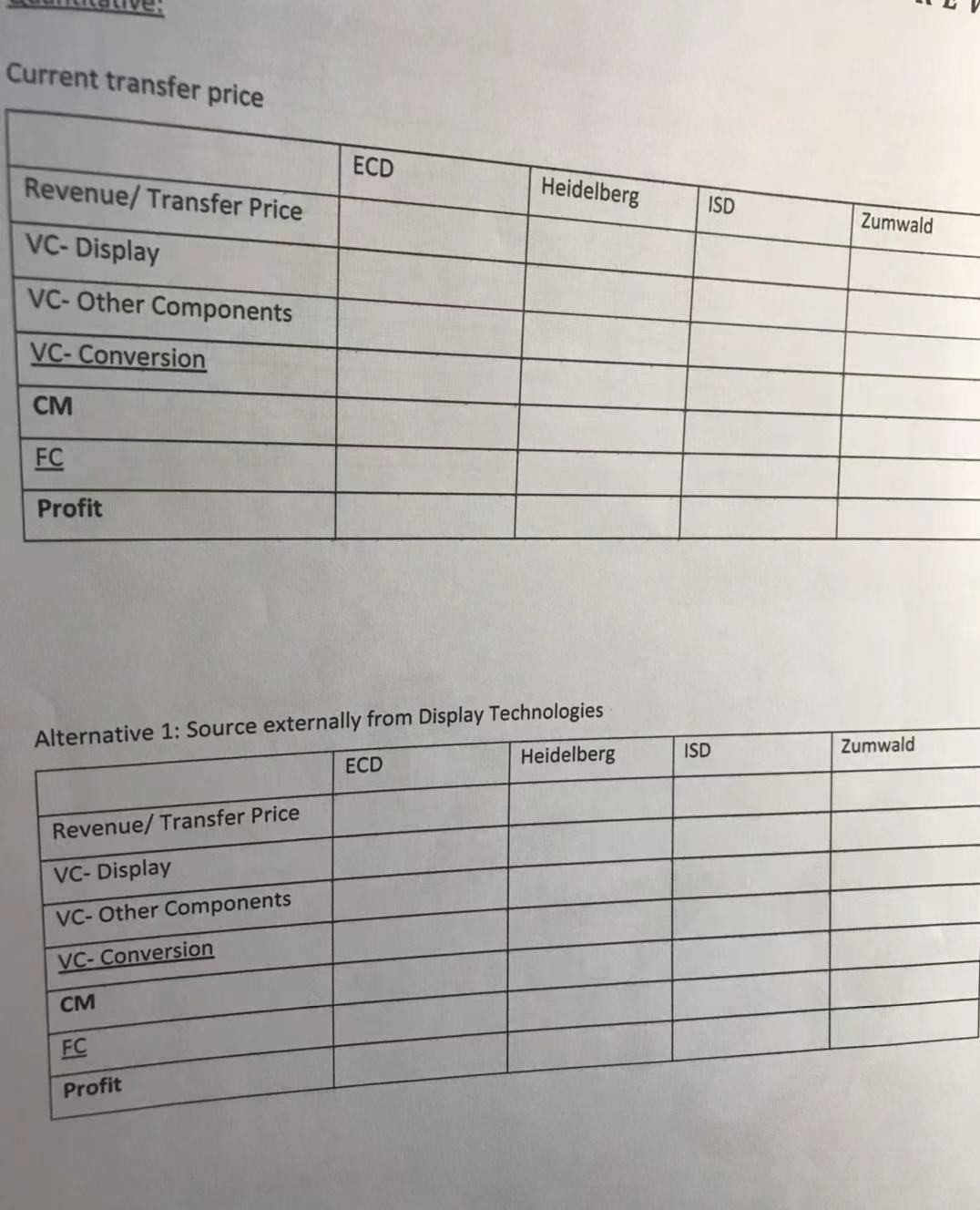

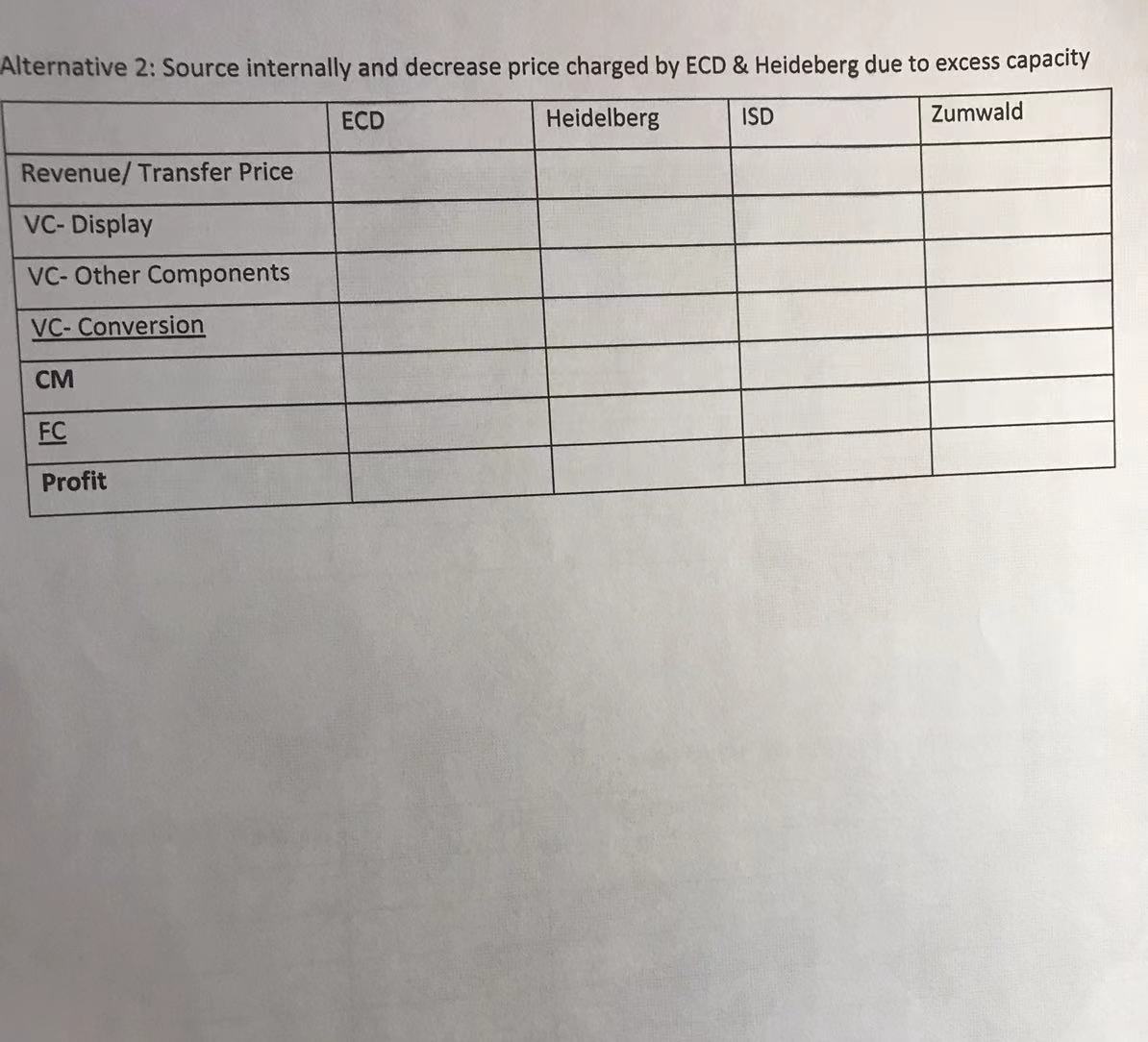

Please fill out the transfer price , alternative 1 and 2.

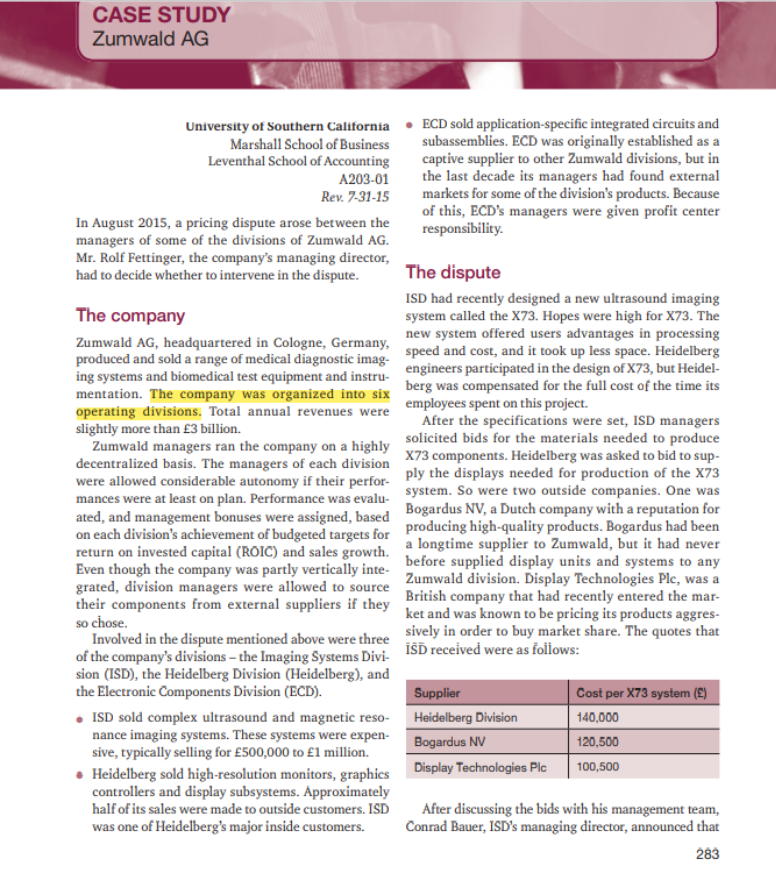

CASE STUDY Zumwald AG University of Southern California . ECD sold application-specific integrated circuits and Marshall School of Business subassemblies. ECD was originally established as a Leventhal School of Accounting captive supplier to other Zumwald divisions, but in A203-01 the last decade its managers had found external Rev. 7-31-15 markets for some of the division's products. Because of this, ECD's managers were given profit center In August 2015, a pricing dispute arose between the responsibility. managers of some of the divisions of Zumwald AG. Mr. Rolf Fettinger, the company's managing director, had to decide whether to intervene in the dispute. The dispute ISD had recently designed a new ultrasound imaging The company system called the X73. Hopes were high for X73. The Zumwald AG, headquartered in Cologne, Germany, new system offered users advantages in processing produced and sold a range of medical diagnostic imag speed and cost, and it took up less space. Heidelberg ing systems and biomedical test equipment and instru- engineers participated in the design of X73, but Heidel- mentation. The company was organized into six berg was compensated for the full cost of the time its operating divisions. Total annual revenues were employees spent on this project. slightly more than 3 billion. After the specifications were set, ISD managers Zumwald managers ran the company on a highly solicited bids for the materials needed to produce decentralized basis. The managers of each division X73 components. Heidelberg was asked to bid to sup- were allowed considerable autonomy if their perfor- ply the displays needed for production of the X73 mances were at least on plan. Performance was evalu- system. So were two outside companies. One was ated, and management bonuses were assigned, based Bogardus NV, a Dutch company with a reputation for on each division's achievement of budgeted targets for producing high-quality products. Bogardus had been return on invested capital (ROIC) and sales growth. a longtime supplier to Zumwald, but it had never Even though the company was partly vertically inte- before supplied display units and systems to any grated, division managers were allowed to source Zumwald division. Display Technologies Plc, was a their components from external suppliers if they British company that had recently entered the mar- so chose. ket and was known to be pricing its products aggres- Involved in the dispute mentioned above were three sively in order to buy market share. The quotes that of the company's divisions - the Imaging Systems Divi- ISD received were as follows: sion (ISD), the Heidelberg Division (Heidelberg), and the Electronic Components Division (ECD). Supplier Cost per X73 system (E) . ISD sold complex ultrasound and magnetic reso- Heidelberg Division 140,000 nance imaging systems. These systems were expen- Bogardus NV 120,500 sive, typically selling for $500,000 to E1 million. . Heidelberg sold high-resolution monitors, graphics Display Technologies Plc 100,500 controllers and display subsystems. Approximately half of its sales were made to outside customers. ISD After discussing the bids with his management team, was one of Heidelberg's major inside customers. Conrad Bauer, ISD's managing director, announced that 283Chapter 7 - Financial Responsibility Centers ISD would be buying its display systems from Display In the ensuing discussion, the following facts came Technologies Plc. Paul Halperin, Heidelberg's general out: manager, was livid. He immediately complained to Mr. Bauer, but when he did not get the desired response, 1. ISD's tentative target price for the X73 system was he took his complaint to Rolf Fettinger, Zumwald's (340,000.1 managing director. Mr. Fettinger agreed to look into the 2. Heidelberg's standard manufacturing cost (mate- situation. rial, labor, and overhead) for each display system A meeting was called to try to resolve the dispute. was E105,000. When asked, Mr. Halperin estimated Mr. Halperin asked Christian Schonberg, ECD's GM, to that the variable portion of this total cost was only attend this meeting to support his case. If Heidelberg E50,000. He treated Heidelberg's labor costs as fixed got this order from ISD, it would buy all of its electronic because German laws did not allow him to lay off components from ECD. employees without incurring expenses that were At this meeting, Mr. Bauer immediately showed his "prohibitively" high. anger: 3. Because of the global business slowdown, the produc- tion lines at Heidelberg that would produce the sys- Paul wants to charge his standard markup for these tems in question were operating at approximately displays. I can't afford to pay it. I'm trying to sell a 70% of capacity. In the pre ceding year, monthly pro- new product (X73) in a very competitive market. duction had ranged from 60% to 90% of total capacity. How can I show a decent ROIC if I have to pay a price for a major component that is way above mar- 4. Heidelberg's costs included E21,600 in electronic sub- ket? I can't pass on those costs to my customers. assemblies to be supplied by ECD. ECD's full manufact Paul should really want this business. I know things turing costs for the components included in each have been relatively slow for him. But all he does is system were approximately $18,000, of which approx- quote list prices and then complain when I do what imately half were out-of-pocket costs. ECD's standard is best for my division. policy was to price its products internally at full manu- We're wasting our time here. Let's stop fighting facturing cost plus 209%. The markup was intended to amongst ourselves and instead spend our time fig- give ECD an incentive to supply its product internally. uring out how to survive in these difficult business ECD was currently operating at 90% capacity. conditions. Near the end of the meeting, Mr. Bauer reminded Mr. Fettinger asked Mr. Halperin why he couldn't everybody of the company's policy of freedom of sourc- ing. He pointed out that this was not such a big deal, as match Display Technologies' price. Paul replied as the volume of business to be derived from this new follows: product was only a small fraction (less than 5%) of the Conrad is asking me to shave my price down to revenues for each of the divisions involved, at least for below cost. If we start pricing our jobs this way, the first few years. And he also did not like the potential it won't be long before we're out of business. We precedent of his being forced to source internally need to price our products so that we earn a fair because it could adversely affect his ability to get return on our investment. You demand that of thoughtful quotes from outside suppliers in the future. us; our plan is put together on that basis; and I have been pleading with my sales staff not to The decision offer deals that will kill our margins. Conrad is forgetting that my engineers helped him design As he adjourned the meeting, Mr. Fettinger promised to X73, and we provided that help with no mark-up consider all the points of view that had been expressed over our costs. Further, you can easily see that and to provide a speedy judgment. He wondered if Zumwald is better off if we supply the display there was a viable compromise or if, instead, there were systems for this new product. The situation here some management principles involved here that should is clear. If Conrad doesn't want to be a team be considered inviolate. player, then you must order him to source inter- nally! That decision is in the best interest of 1 The cost of the other components that go into X73 is $72,000. ISD's conversion cost for the X73 system is $144,000, of which $117,700 is all of us. fixed. 284Current transfer price ECD Revenue/ Transfer Price Heidelberg ISD Zumwald VC- Display VC- Other Components VC- Conversion CM FC Profit Alternative 1: Source externally from Display Technologies Heidelberg ISD Zumwald ECD Revenue/ Transfer Price VC- Display VC- Other Components VC- Conversion CM FC ProfitAlternative 2: Source internally and decrease price charged by ECD & Heideberg due to excess capacity ECD Heidelberg ISD Zumwald Revenue/ Transfer Price VC- Display VC- Other Components VC- Conversion CM FC Profit