Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please fill out the yellow spaces as shown on the excel sheet Webmasters.com has developed a powerful new server that would be used for corporations'

Please fill out the yellow spaces as shown on the excel sheet

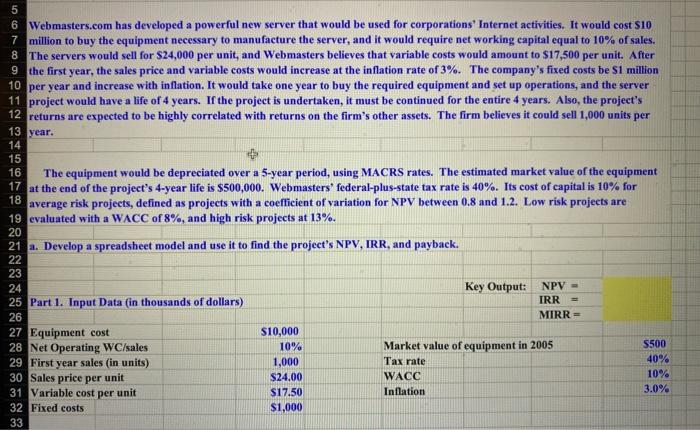

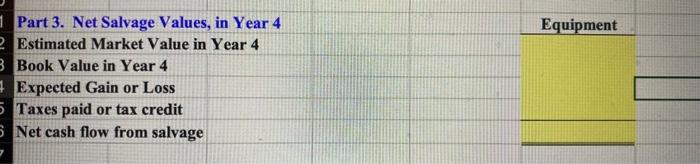

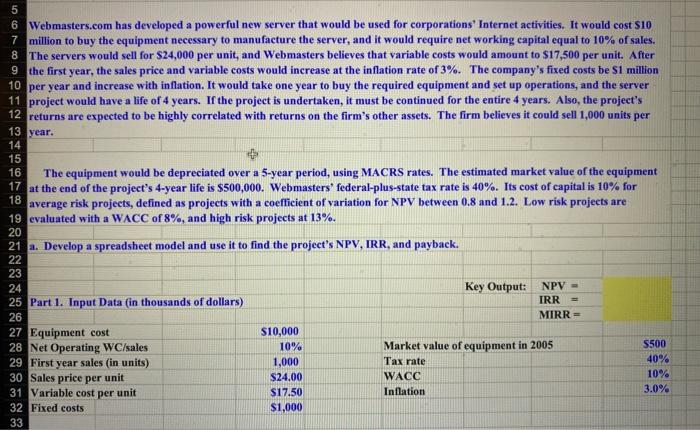

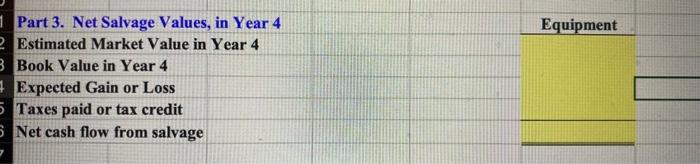

Webmasters.com has developed a powerful new server that would be used for corporations' Internet activities. It would cost S10 million to buy the equipment necessary to manufacture the server, and it would require net working capital equal to 10% of sales. The servers would sell for $24,000 per unit, and Webmasters believes that variable costs would amount to $17,500 per unit. After the first year, the sales price and variable costs would increase at the inflation rate of 3%. The company's fixed costs be $1 million per year and increase with inflation. It would take one year to buy the required equipment and set up operations, and the server project would have a life of 4 years. If the project is undertaken, it must be continued for the entire 4 years. Also, the project's returns arc expected to be highly correlated with returns on the firm's other assets. The firm believes it could sell 1,000 units per year. The equipment would be depreciated over a 5-year period, using MACRS rates. The estimated market value of the equipment at the end of the project's 4-year life is $500,000. Webmasters' federal-plus-state tax rate is 40%. Its cost of capital is 10% for average risk projects, defined as projects with a coefficient of variation for NPV between 0.8 and 1.2. Low risk projects are evaluated with a WACC of 8%, and high risk projects at 13%. a. Develop a spreadsheet model and use it to find the project's NPV, IRR, and payback. Part 3. Net Salvage Values, in Year 4 Equipment Estimated Market Value in Year 4 Book Value in Year 4 Expected Gain or Loss Taxes paid or tax credit Net cash flow from salvage Webmasters.com has developed a powerful new server that would be used for corporations' Internet activities. It would cost S10 million to buy the equipment necessary to manufacture the server, and it would require net working capital equal to 10% of sales. The servers would sell for $24,000 per unit, and Webmasters believes that variable costs would amount to $17,500 per unit. After the first year, the sales price and variable costs would increase at the inflation rate of 3%. The company's fixed costs be $1 million per year and increase with inflation. It would take one year to buy the required equipment and set up operations, and the server project would have a life of 4 years. If the project is undertaken, it must be continued for the entire 4 years. Also, the project's returns arc expected to be highly correlated with returns on the firm's other assets. The firm believes it could sell 1,000 units per year. The equipment would be depreciated over a 5-year period, using MACRS rates. The estimated market value of the equipment at the end of the project's 4-year life is $500,000. Webmasters' federal-plus-state tax rate is 40%. Its cost of capital is 10% for average risk projects, defined as projects with a coefficient of variation for NPV between 0.8 and 1.2. Low risk projects are evaluated with a WACC of 8%, and high risk projects at 13%. a. Develop a spreadsheet model and use it to find the project's NPV, IRR, and payback. Part 3. Net Salvage Values, in Year 4 Equipment Estimated Market Value in Year 4 Book Value in Year 4 Expected Gain or Loss Taxes paid or tax credit Net cash flow from salvage

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started