Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please find intrinsic value using perpetuity model As we know, there are four main valuation methods. For this case study we are going to use

Please find intrinsic value using perpetuity model

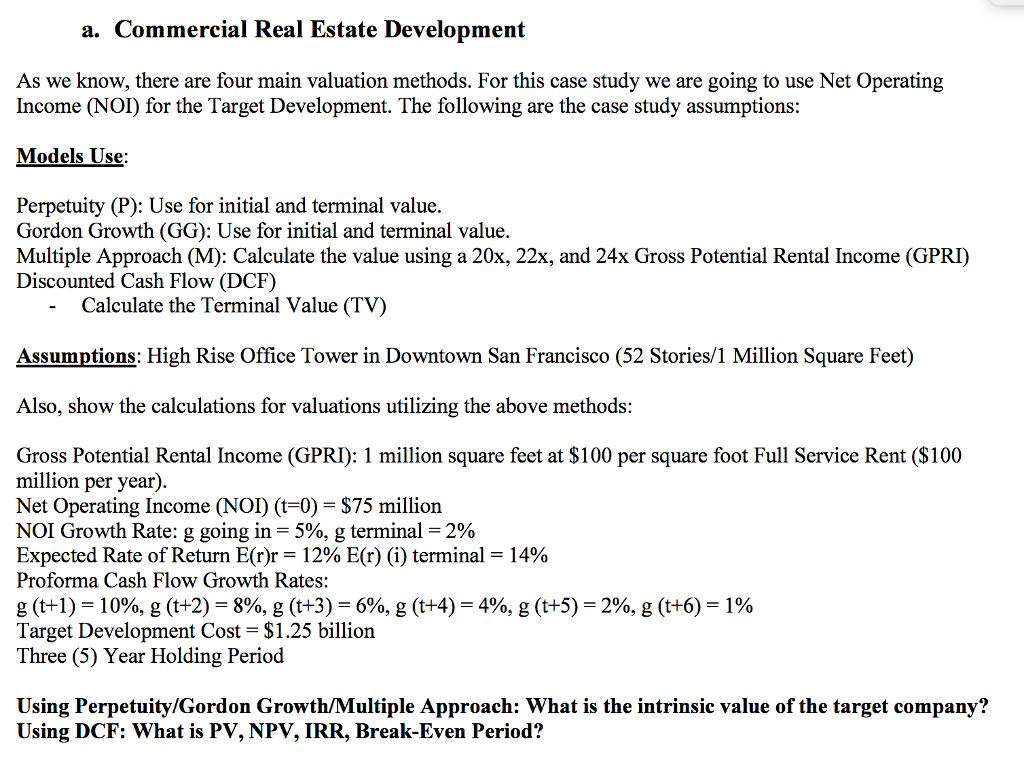

As we know, there are four main valuation methods. For this case study we are going to use Net Operating Income (NOI) for the Target Development. The following are the case study assumptions: Models Use: Perpetuity (P): Use for initial and terminal value. Gordon Growth (GG): Use for initial and terminal value. Multiple Approach (M): Calculate the value using a 20x, 22x, and 24x Gross Potential Rental Income (GPRI) Discounted Cash Flow (DCF) - Calculate the Terminal Value (TV) Assumptions: High Rise Office Tower in Downtown San Francisco (52 Stories 1 Million Square Feet) Also, show the calculations for valuations utilizing the above methods: Gross Potential Rental Income (GPRI): 1 million square feet at $100 per square foot Full Service Rent ($ 100 million per year). Net Operating Income (NOI) (t = 0) = $75 million. NOI Growth Rate: g going in = 5%, g terminal = 2% Expected Rate of Return E (r) r = 12% E (r) (i) terminal = 14% Proforma Cash Flow Growth Rates: g (t + 1) = 10%, g (t + 2) = 8%, g (t + 3) = 6%, g (t + 4) = 4%, g (t + 5) = 2%, g (t + 6) = 1% Target Development Cost = $1.25 billion Three (5) Year Holding Period Using Perpetuity/Gordon Growth/Multiple Approach: What is the intrinsic value of the target company? Using DCF: What is PV, NPV, IRR, Break-Even PeriodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started