Question

Please finish the graphs and label them in order. Thanks! Options for the Spoilage section: I. abnormal spoilage or normal spoilage that is included in

Please finish the graphs and label them in order. Thanks!

Options for the Spoilage section:

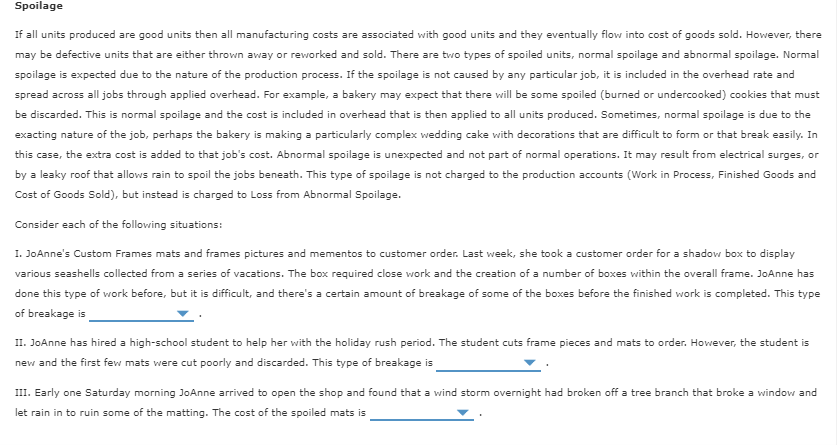

I. abnormal spoilage or normal spoilage that is included in the overhead rate and applied to all jobs or normal spoilage that is attributable to this job and charged to it

II. abnormal spoilage or normal spoilage that is included in the overhead rate and applied to all jobs or normal spoilage that is attributable to this job and charged to it

III. abnormal spoilage or normal spoilage that is included in the overhead rate and applied to all jobs or normal spoilage that is attributable to this job and charged to it

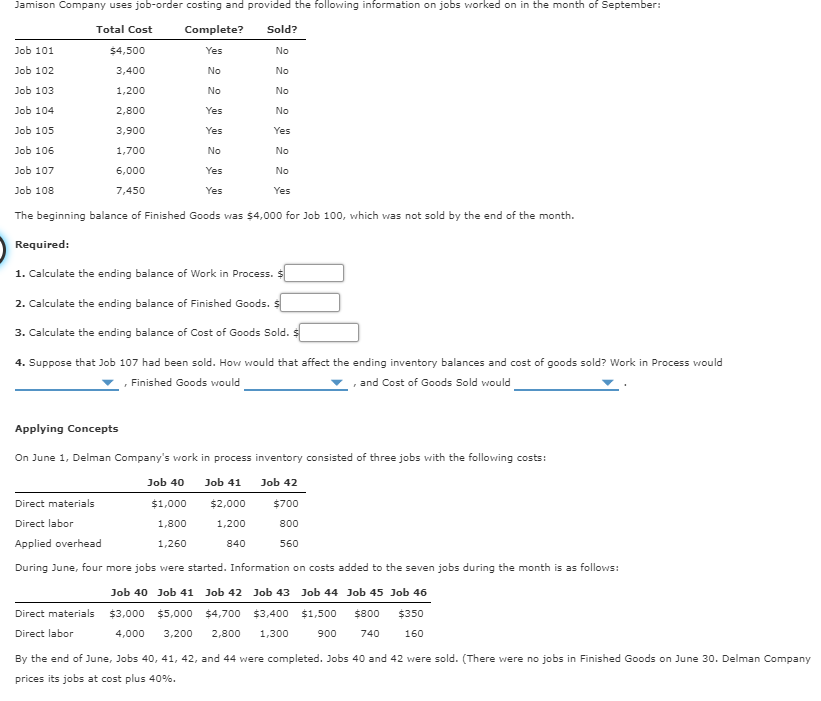

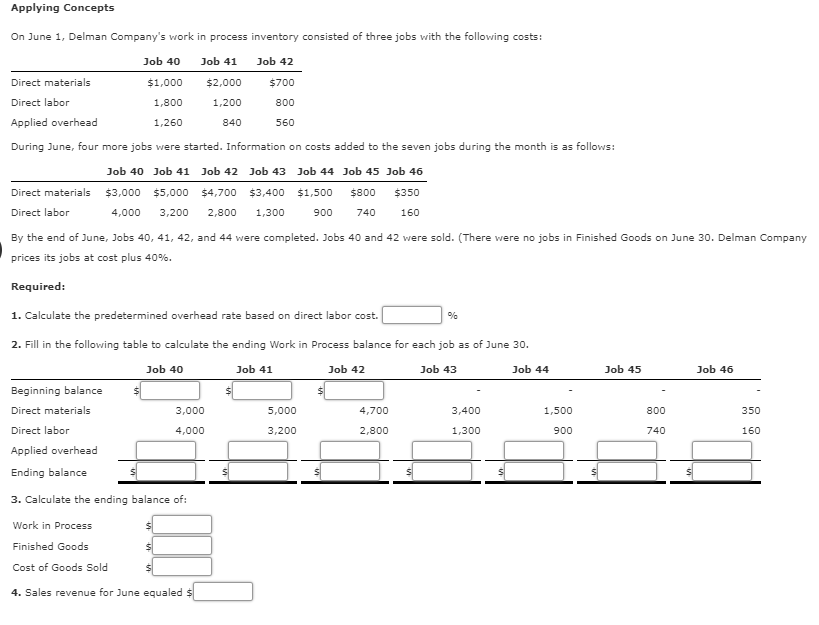

Jamison Company uses job-order costing and provided the following information on jobs worked on in the month of September: Total Cost Complete? Sold? Job 101 Job 102 Job 103 Job 104 Job 105 Job 106 Job 107 Job 108 The beginning balance of Finished Goods was $4,000 for Job 100, which was not sold by the end of the month. Required: 1. Calculate the ending balance of Work in Process. $4,500 3,400 1,200 2,800 3,900 1,700 6,000 7,450 Yes No No No No No No No No No 2. Calculate the ending balance of Finished Goods. 3. Calculate the ending balance of Cost of Goods Sold. 4. Suppose that Job 107 had been sold. How would that affect the ending inventory balances and cost of goods sold? Work in Process would Finished Goods would and Cost of Goods Sold would Applying Concepts On June 1, Delman Company's work in process inventory consisted of three jobs with the following costs: Job 40 Job 41 Job 42 $1,000 $2,000 $700 800 560 Direct materials Direct labor Applied overhead During June, four more jobs were started. Information on costs added to the seven jobs during the month is as follows 1,800 1,200 1,260 840 Job 40 Job 41 Job 42 Job 43 Job 44 Job 45 Job 46 Direct materials $3,000 $5,000 $4,700 $3,400 $1,500 $800 $350 Direct labor By the end of June, Jobs 40, 41, 42, and 44 were completed. Jobs 40 and 42 were sold. (There were no jobs in Finished Goods on June 30. Delman Company prices its jobs at cost plus 40%. 4,000 3,200 2,800 1,300 900 740 160 Applying Concepts On June 1, Delman Company's work in process inventory consisted of three jobs with the following costs Job 40 $1,000 1,800 1,260 Job 41 Job 42 $700 800 560 Direct materials Direct labor Applied overhead During June, four more jobs were started. Information on costs added to the seven jobs during the month is as follows: $2,000 1,200 840 Job 40 Job 41 Job 42 Job 43 Job 44 Job 45 Job 46 Direct materials $3,000 $5,000 $4,700 $3,400 $1,500 $800 $350 Direct labor By the end of June, Jobs 40, 41, 42, and 44 were completed. Jobs 40 and 42 were sold. (There were no jobs in Finished Goods on June 30. Delman Company prices its jobs at cost plus 40%. Required: 1. Calculate the predetermined overhead rate based on direct labor cost. 2. Fill in the following table to calculate the ending Work in Process balance for each job as of June 30. 00 740 160 4,000 3,200 2,800 1,300 Job 40 Job 41 Job 42 Job 43 Job 44 Job 45 Job 46 Beginning balance Direct materials Direct labor Applied overhead Ending balance 3. Calculate the ending balance of: Work in Process Finished Goods Cost of Goods Sold 4. Sales revenue for June equaled 3,000 5,000 4,700 3,400 1,500 350 740 4,000 3,200 2,800 1,300 160 Spoilage If all units produced are good units then all manufacturing costs are associated with good units and they eventually flow into cost of goods sold. However, there may be defective units that are either thrown away or reworked and sold. There are two types of spoiled units, normal spoilage and abnormal spoilage. Normal spoilage is expected due to the nature of the production process. If the spoilage is not caused by any particular job, it is included in the overhead rate and spread across all jobs through applied overhead. For example, a bakery may expect that there will be some spoiled (burned or undercooked) cookies that must be discarded. This is normal spoilage and the cost is included in overhead that is then applied to all units produced. Sometimes, normal spoilage is due to the exacting nature of the job, perhaps the bakery is making a particularly complex wedding cake with decorations that are difficult to form or that break easily. In this case, the extra cost is added to that job's cost. Abnormal spoilage is unexpected and not part of normal operations. It may result from electrical surges, or by a leaky roof that allows rain to spoil the jobs beneath. This type of spoilage is not charged to the production accounts (Work in Process, Finished Goods and Cost of Goods Sold), but instead is charged to Loss from Abnormal Spoilage Consider each of the following situations: I. JoAnne's Custom Frames mats and frames pictures and mementos to customer order. Last week, she took a customer order for a shadow box to display various seashells collected from a series of vacations. The box required close work and the creation of a number of boxes within the overall frame. JoAnne has done this type of work before, but it is difficult, and there's a certain amount of breakage of some of the boxes before the finished work is completed. This type of breakage isY II. JoAnne has hired a high-school student to help her with the holiday rush period. The student cuts frame pieces and mats to order. However, the student is new and the first few mats were cut poorly and discarded. This type of breakage is It. Early one Saturday morning JoAnne arrived to open the shop and found that a wind storm overnight had broken off a tree branch that broke a window and let rain in to ruin some of the matting. The cost of the spoiled mats isStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started