please finish whole cash budget-partially completed in picture

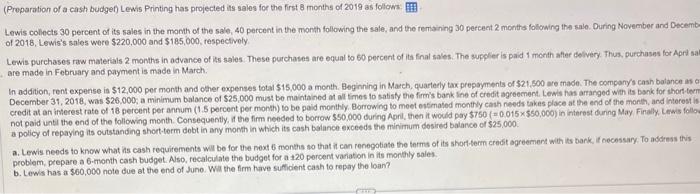

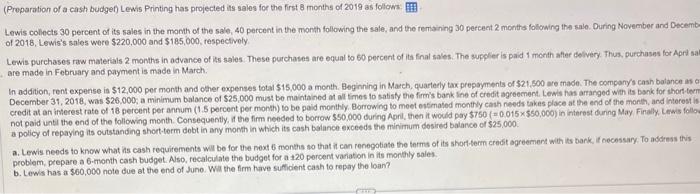

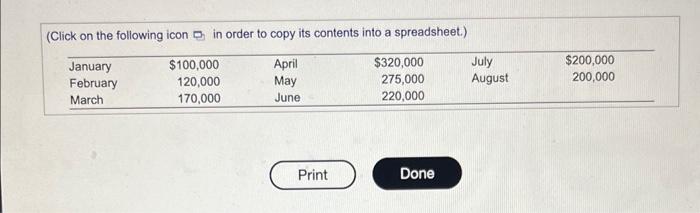

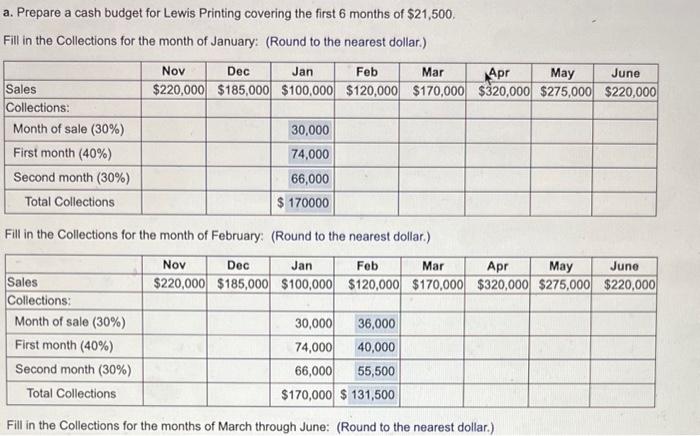

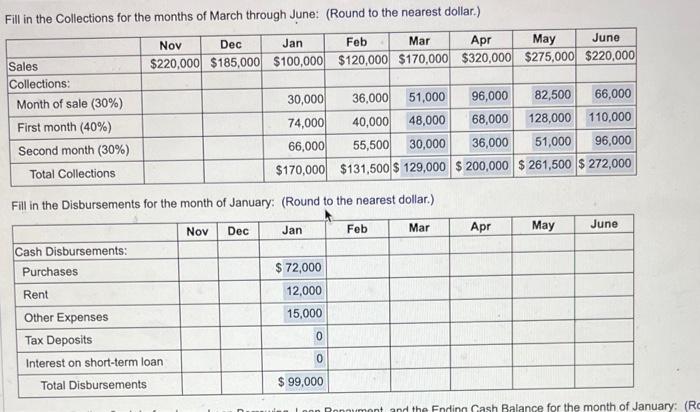

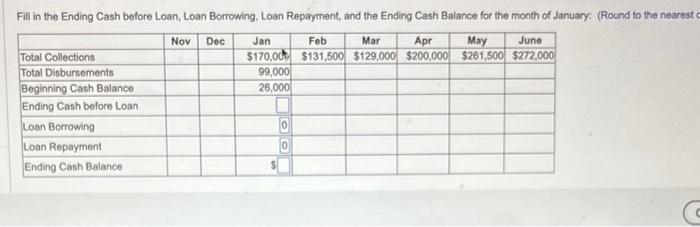

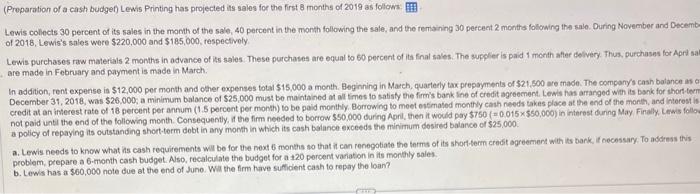

(Proparation of a cash budgef) Lewis Printing has projected its sales for the first 8 months of 2019 as follows: Lewis colects 30 percent of its sales in the month of the sale, 40 percent in the month following the sale, and the remaining 30 percent 2 months following the sale. During November and Decemt of 2018, Lewis's sales were $220,000 and $185,000, respectivoly Lewis purchases raw materials 2 months in advance of iss sales. These purchases are oqual to 50 percent of its final sales. The suppler is paid 1 month after delivery. Thus, purchases for Apri sa are made in February and payment is made in March. December 31, 2018, was $26,000; a minimum balonce of $25,000 must be maintained at all times 10 satisly the firmis bark line of credit agreement. Lewis has arranged with its bank for thorf ter credit at an interest rate of 18 percent per annum (1.5 percent per month) to be poid monthy. Borrowing to meet estimated monthly cash needs takes place at the end of the month, and interest in not paid unti the end of the following month. Consequently, it the firm needed to borrow 550.000 during Apri, then it woudd pay $750 ( =0.015550,000) in interest during May Finally. Lewis follo a policy of repaying its outstanding short-term dobt in any month in which its cash balance exceeds the minimum dosired balance of $25.000. problem, prepare a 6 -month cash budget. Also, recalculate the budget for a 20 percent variation in its monthly sales. b. Lewis has a $60,000 note due at the end of June. Wia the firm have sutident cash to repay the loan? (Click on the following icon in order to copy its contents into a spreadsheet.) a. Prepare a cash budget for Lewis Printing covering the first 6 months of $21,500. Fill in the Collections for the month of January: (Round to the nearest dollar.) Fill in the Collections for the month of February: (Round to the nearest dollar.) Fill in the Collections for the months of March through June: (Round to the nearest dollar.) Fill in the Collections for the months of March through June: (Round to the nearest dollar.) Fill in the Disbursements for the month of January: (Round to the nearest dollar.) Fill in the Ending Cash before Loan, Loan Borrowing. Loan Repayment, and the Ending Cash Balance for the month of January. (Round to the nearest \begin{tabular}{|l|c|c|r|c|c|c|c|c|} \hline & Nov & Dec & \multicolumn{1}{c|}{ Jan } & Feb & Mar & Apr & May & June \\ \hline Total Collections & & & $170,06 & $131,500 & $129,000 & $200,000 & $261,500 & $272,000 \\ \hline Total Disbursements & & & 99,000 & & & & & \\ \hline Beginning Cash Balance & & & 26,000 & & & & & \\ \hline Ending Cash before Loan & & & & & & & & \\ \hline Loan Borrowing & & & 0 & & & & & \\ \hline Loan Repayment & & & 0 & & & & & \\ \hline Ending Cash Balance & & & $ & & & & & \\ \hline \end{tabular}