Please fix where i got wrong

Please fix where i got wrong

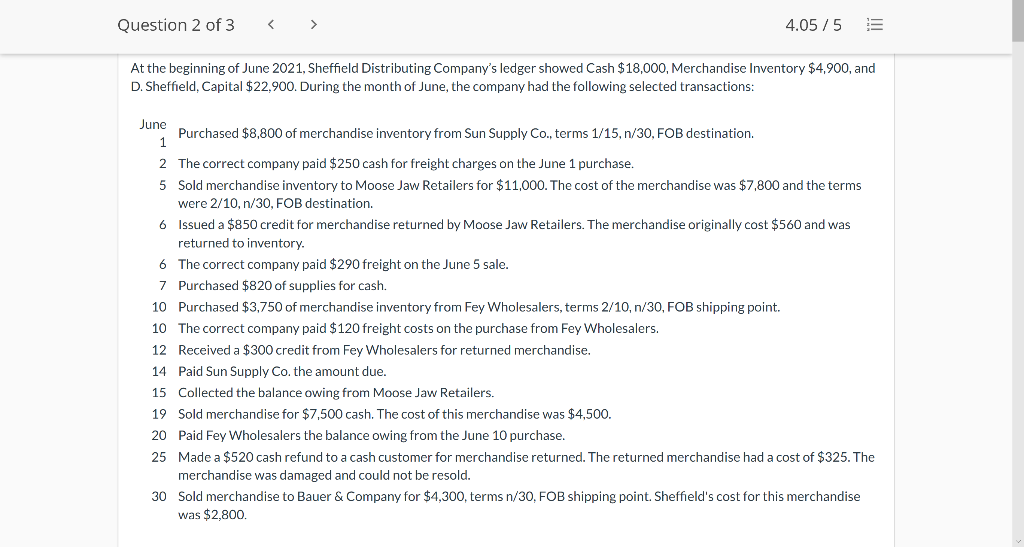

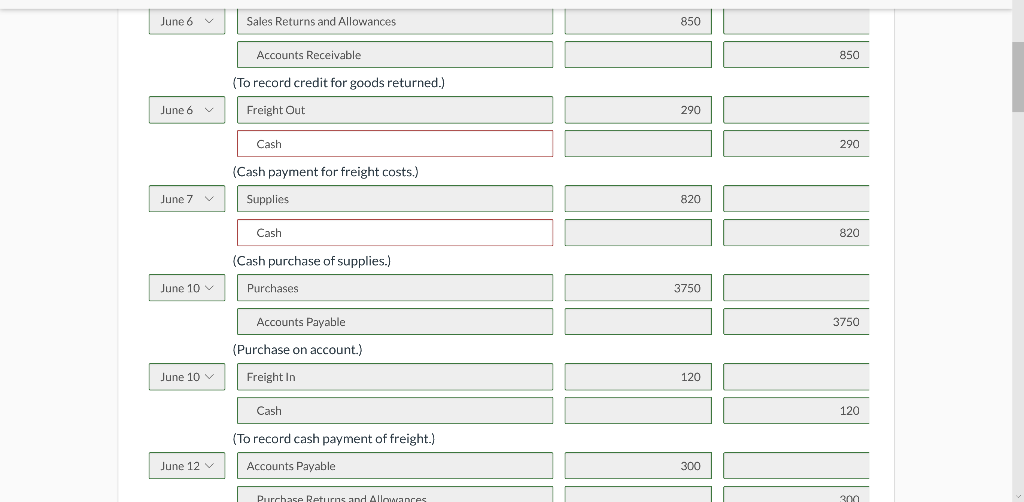

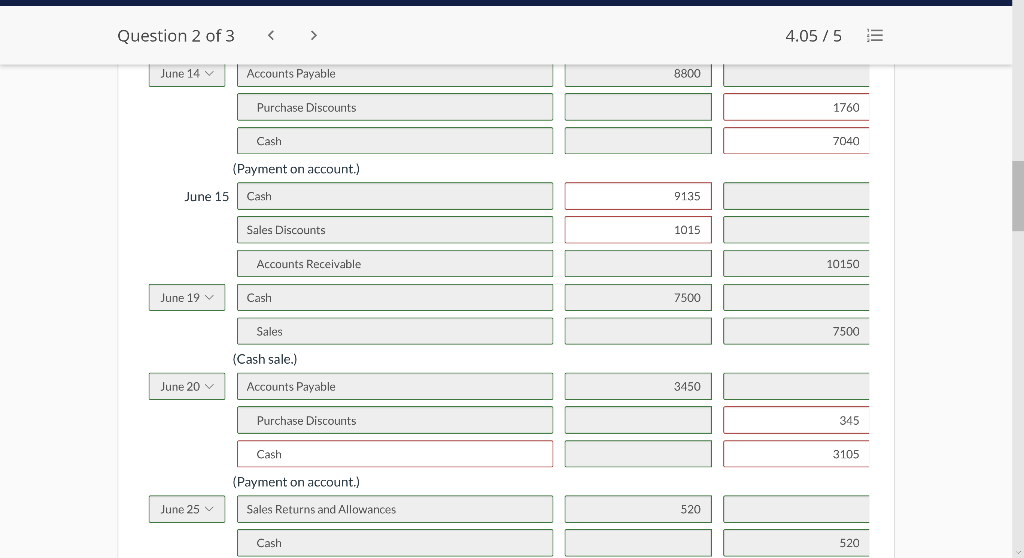

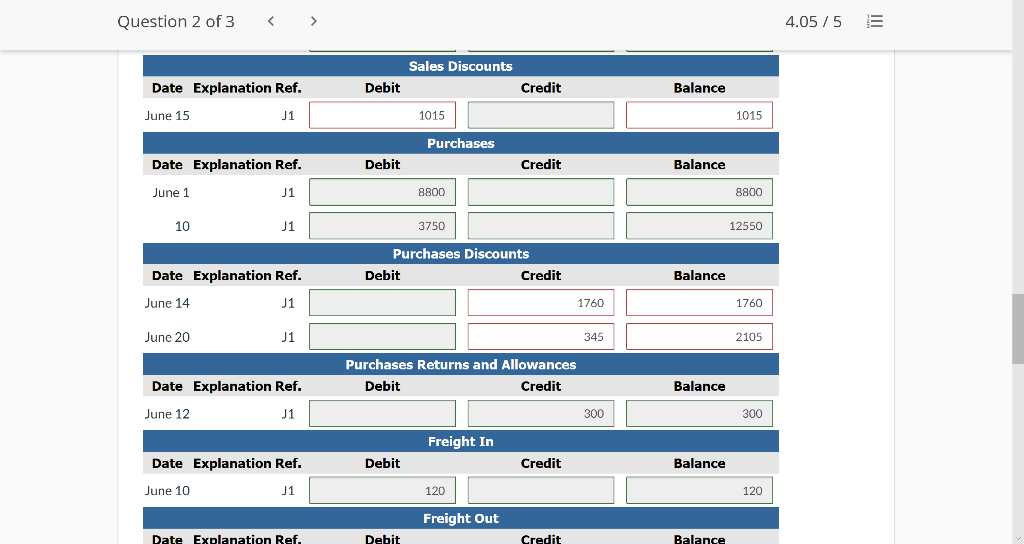

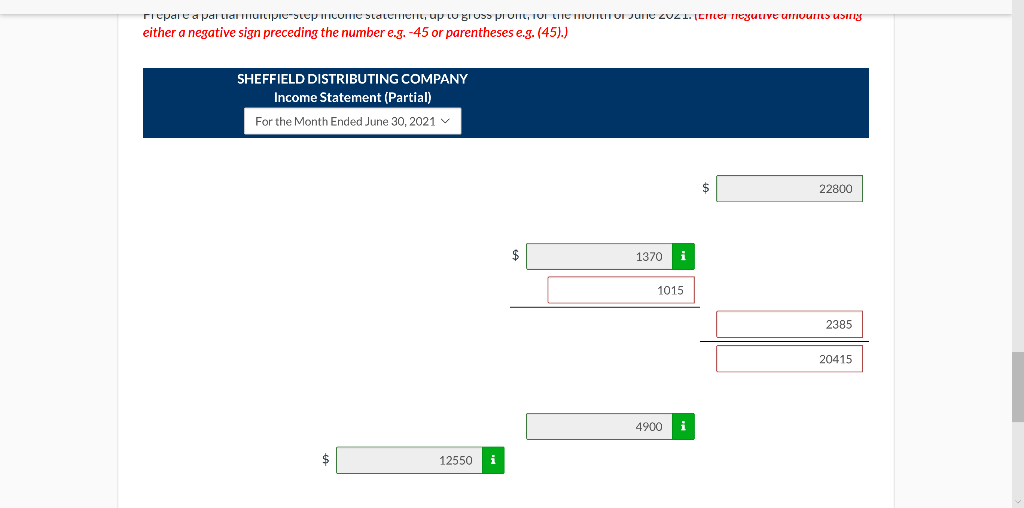

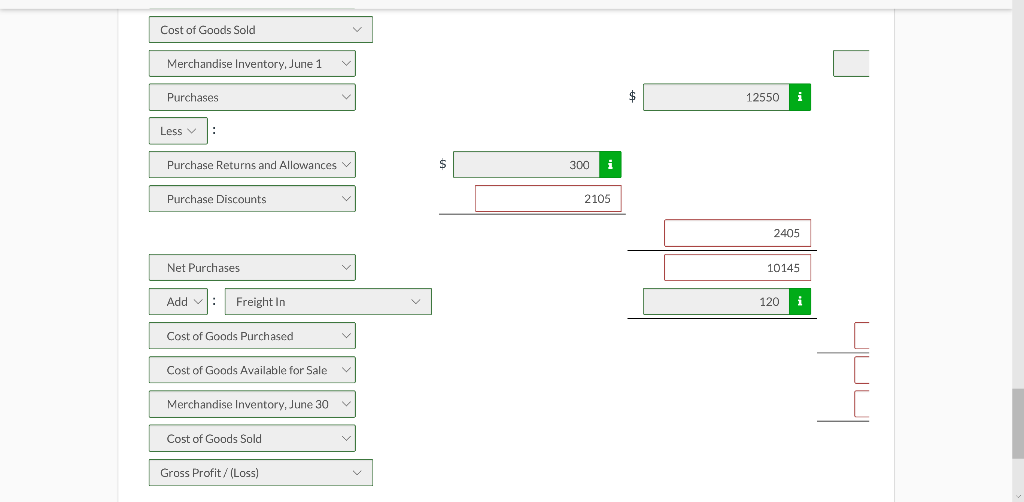

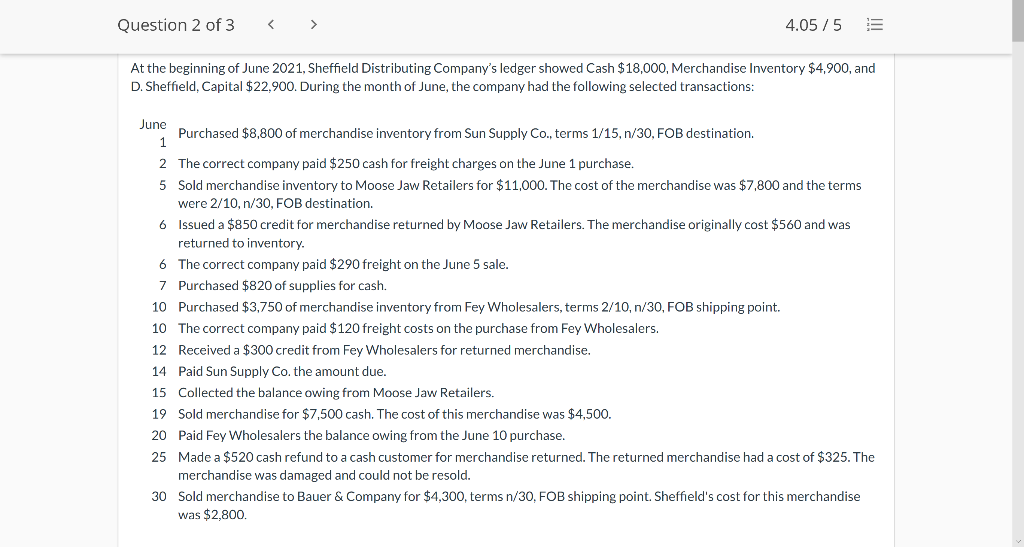

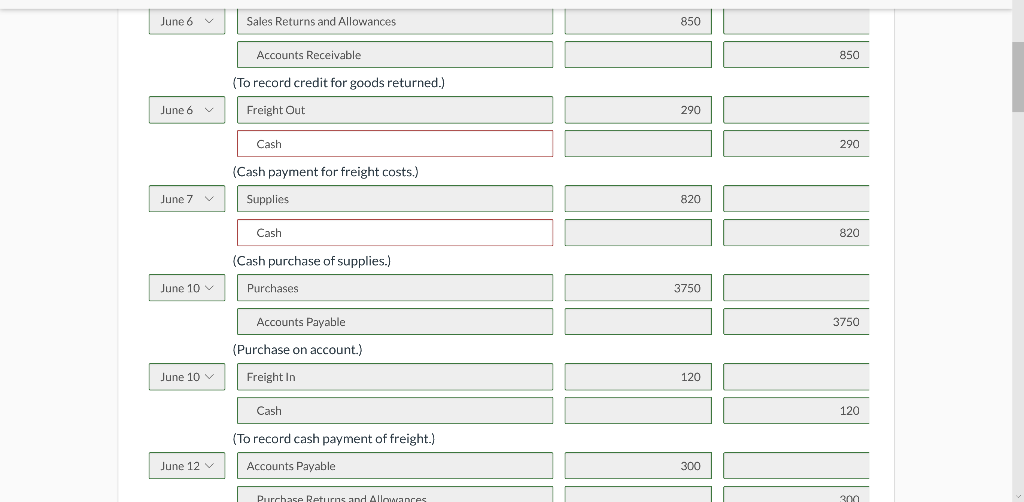

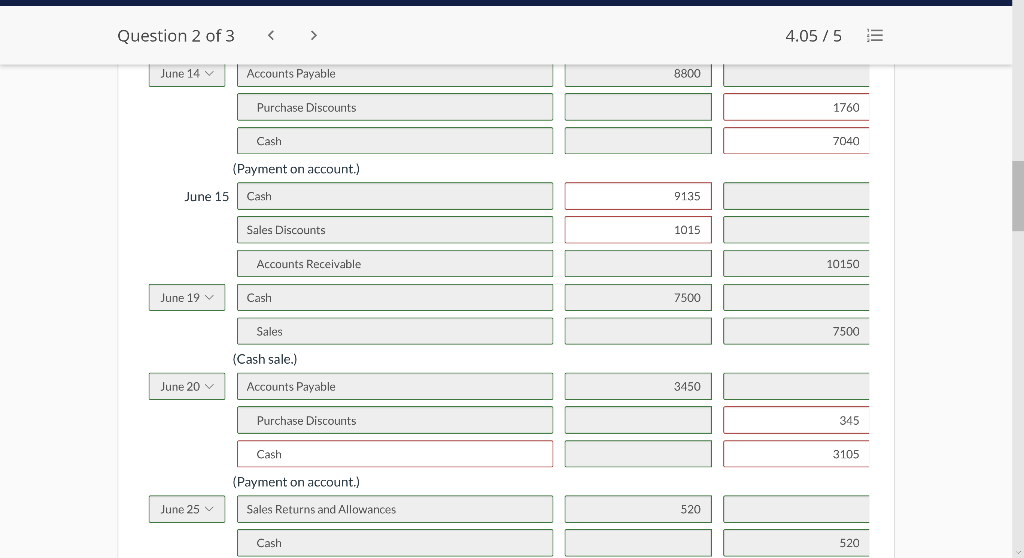

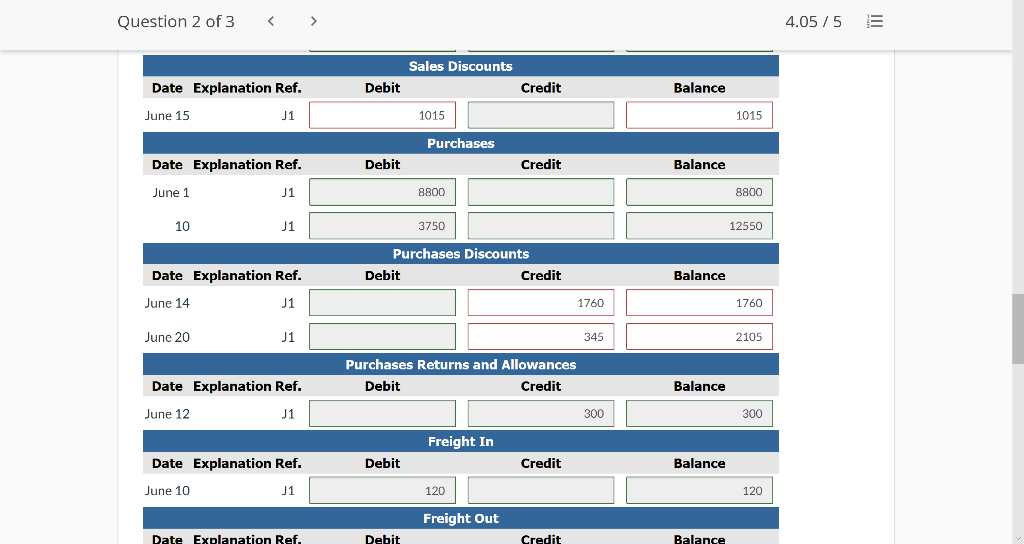

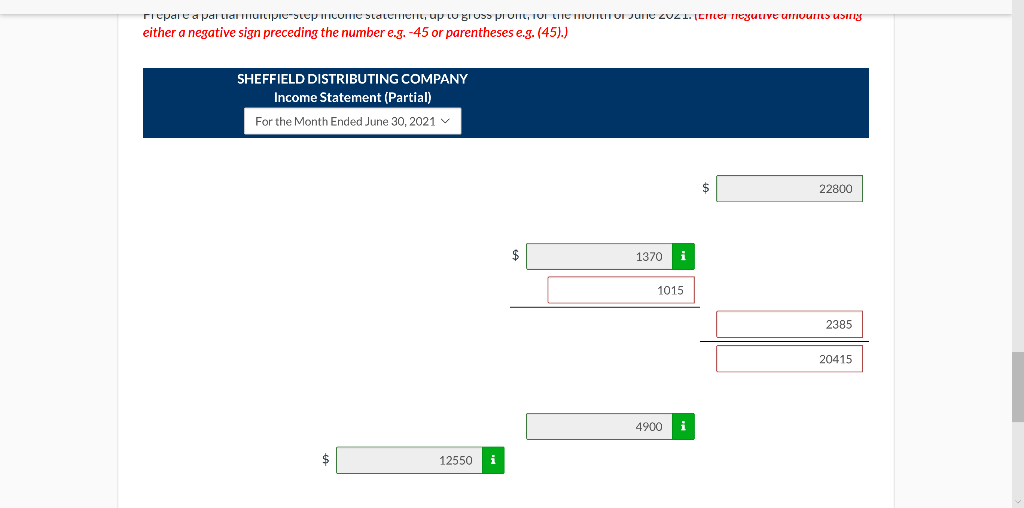

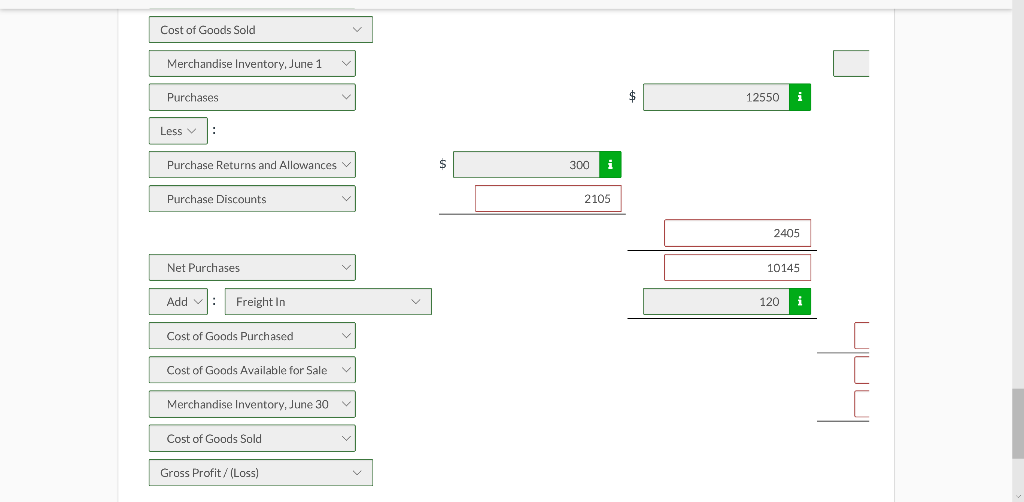

Question 2 of 3 4.05 / 5 At the beginning of June 2021, Sheffield Distributing Company's ledger showed Cash $18,000, Merchandise Inventory $4,900, and D. Sheffield, Capital $22.900. During the month of June, the company had the following selected transactions: June Purchased $8,800 of merchandise inventory from Sun Supply Co., terms 1/15, n/30, FOB destination. 1 2 The correct company paid $250 cash for freight charges on the June 1 purchase. 5 Sold merchandise inventory to Moose Jaw Retailers for $11,000. The cost of the merchandise was $7,800 and the terms were 2/10, n/30, FOB destination. 6 Issued a $850 credit for merchandise returned by Moose Jaw Retailers. The merchandise originally cost $560 and was returned to inventory. 6 The correct company paid $290 freight on the June 5 sale. 7 Purchased $820 of supplies for cash. 10 Purchased $3,750 of merchandise inventory from Fey Wholesalers, terms 2/10,n/30, FOB shipping point. 10 The correct company paid $120 freight costs on the purchase from Fey Wholesalers. 12 Received a $300 credit from Fey Wholesalers for returned merchandise. 14 Paid Sun Supply Co. the amount due. 15 Collected the balance owing from Moose Jaw Retailers. 19 Sold merchandise for $7,500 cash. The cost of this merchandise was $4,500. 20 Paid Fey Wholesalers the balance owing from the June 10 purchase. 25 Made a $520 cash refund to a cash customer for merchandise returned. The returned merchandise had a cost of $325. The merchandise was damaged and could not be resold. 30 Sold merchandise to Bauer & Company for $4,300, terms n/30, FOB shipping point. Sheffield's cost for this merchandise was $2.800. June 6 Sales Returns and Allowances 850 Accounts Receivable 850 (To record credit for goods returned.) June 6 v Freight Out 290 Cash 290 (Cash payment for freight costs.) June 7 7 Supplies 820 Cash 820 (Cash purchase of supplies.) June 10 Purchases 3750 Accounts Payable 3750 (Purchase on account.) June 10 v Freight in 120 Cash 120 (To record cash payment of freight.) June 12 Accounts Payable 300 Purchase Returns and Allowances Question 2 of 3 > 4.05 / 5 June 14 v Accounts Payable 8800 Purchase Discounts 1760 Cash 7040 (Payment on account.) June 15 Cash 9135 Sales Discounts 1015 Accounts Receivable 10150 June 19 v Cash 7500 Sales 7500 (Cash sale.) June 20 Accounts Payable 3450 Purchase Discounts 345 Cash 3105 (Payment on account.) June 25 Sales Returns and Allowances 520 Cash 520 Question 2 of 3 4.05 / 5 Sales Discounts Debit Credit Balance Date Explanation Ref. June 15 J1 1015 1015 Purchases Date Explanation Ref. Debit Credit Balance June 1 J1 8800 8800 10 J1 3750 12550 Purchases Discounts Debit Credit Balance Date Explanation Ref. June 14 J1 1760 1760 June 20 J1 345 2105 Purchases Returns and Allowances Debit Credit Date Explanation Ref. Balance June 12 J1 300 300 Freight In Date Explanation Ref. Debit Credit Balance June 10 J1 120 120 Freight Out Date Explanation Ref. Debit Credit Balance riepare a parlia TULIPC-Step Come Statement, up LU BIUS PIUIL, TUI UTIE MOTTLITVI June Zuz 1. (Cret rregulIVE UNvurususny either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) SHEFFIELD DISTRIBUTING COMPANY Income Statement (Partial) For the Month Ended June 30, 2021 $ 22800 1370 1015 2385 20415 4900 $ 12550 Cost of Goods Sold Merchandise Inventory, June 1 Purchases $ 12550 Less : Purchase Returns and Allowances $ 300 Purchase Discounts 2105 2405 Net Purchases 10145 Add : Freight In 120 i Cost of Goods Purchased Cost of Goods Available for Sale Merchandise Inventory, June 30 Cost of Goods Sold Gross Profit/(Loss)

Please fix where i got wrong

Please fix where i got wrong