Answered step by step

Verified Expert Solution

Question

1 Approved Answer

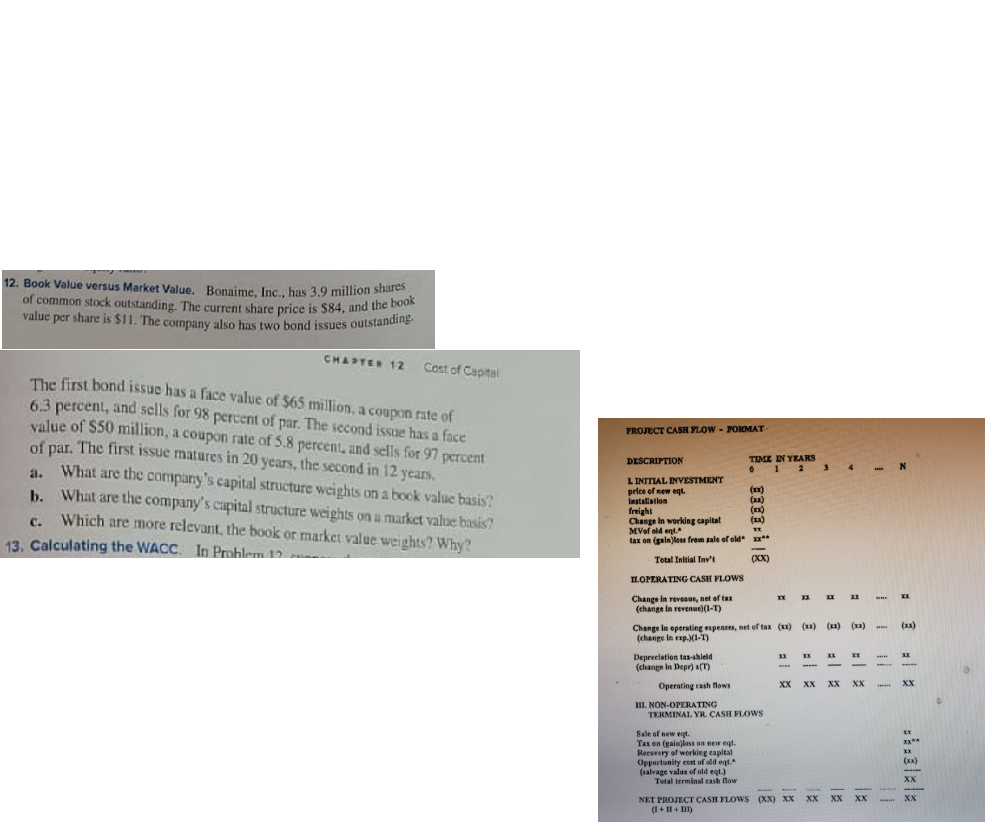

PLEASE FOLLOW THE FORMAT 12. Book Value versus Market Value. Bonaime, Inc., has 3.9 million shares of common stock outstanding. The current share price is

PLEASE FOLLOW THE FORMAT

12. Book Value versus Market Value. Bonaime, Inc., has 3.9 million shares of common stock outstanding. The current share price is $84, and the book value per share is $11. The company also has two bond issues outstanding. CHAPTER 12 Cost of Capital PROJECT CASH FLOW - FORMAT The first bond issue has a face value of 565 million, a coupon rate of 6.3 percent, and sells for 98 percent of par. The second issue has a face value of S50 million, a coupon rate of 5.8 percent, and sells for 97 percent of par. The first issue matures in 20 years, the second in 12 years. What are the company's capital structure weights on a book value basis? b. What are the company's capital structure weights on a market value basis? Which are more relevant, the book or market value weights? Why? 13. Calculating the WACC. In Problem 12 a. ) () DESCRIPTION TIME IN YEARS 1 2 3 4 4 - N L INITIAL INVESTMENT price of new egt (2x) installation frtight (2x) Change in working capital (2x) MVof old egt. tax on (painless from sale of old **** Total Initial Invit (XX) ) TL OPERATING CASH FLOWS Change in revenue, net of tax (change in revenue) (1-1) (x2) LE Change la operating expenses, net of tax (N) (11)()().. (change in exp. 1-T) Depreciation tas-shield ** IL (change in Depr) (T) Operating cash flows xx xx xx XX HII NON-OPERATING TERMINAL YR CASH FLOWS XX Sale of new egt. Taxon (Raia loss on newegt Recovery of working capital Opportunity cost of oldet. (salvage value of old egt.) Total terminal cash now (x) XX XX XX NET PROJECT CASH FLOWS (XX) XX XXXX (1 +11+ DIT)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started