Question

Please follow these directions exactly: 1Create a P&L and cash flow from scratch, following the directions below. Do not use templates.When you create these, add

Please follow these directions exactly:

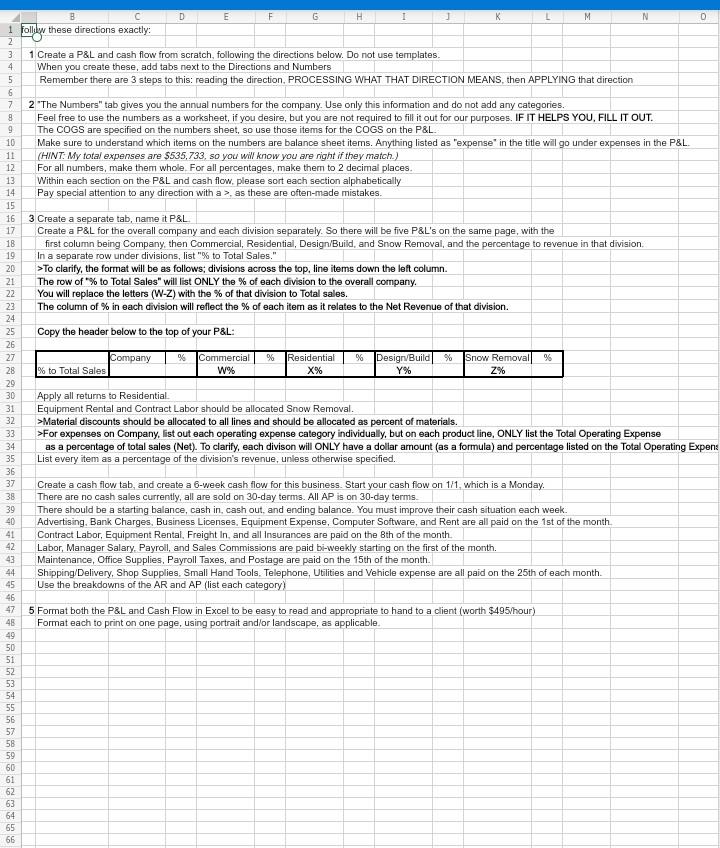

1Create a P&L and cash flow from scratch, following the directions below. Do not use templates.When you create these, add tabs next to the Directions and Numbers Remember there are 3 steps to this: reading the direction, PROCESSING WHAT THAT DIRECTION MEANS,

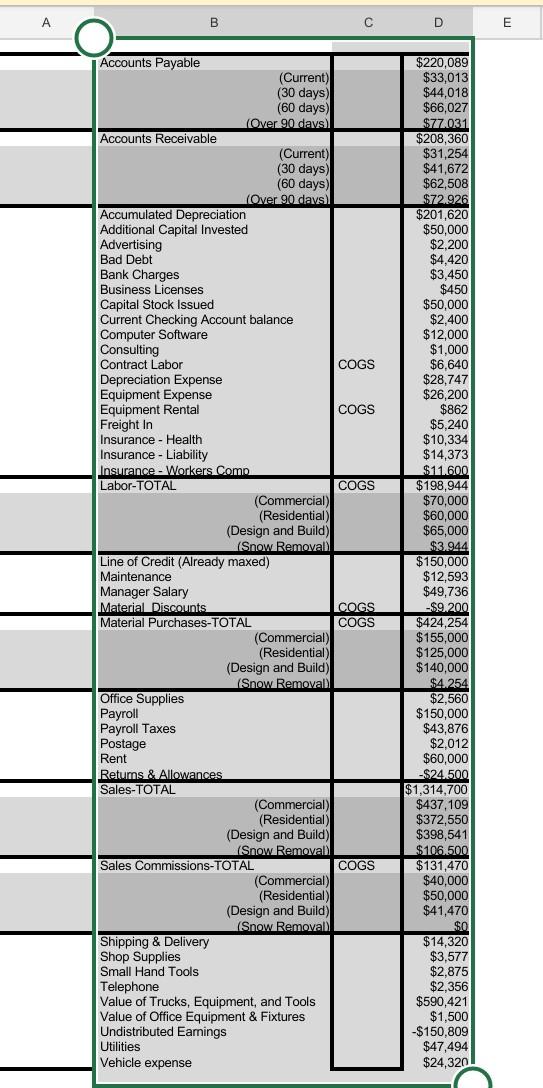

then APPLYING that direction2"The Numbers" tab gives you the annual numbers for the company. Use only this information and do not add any categories.Feel free to use the numbers as a worksheet, if you desire, but you are not required to fill it out for our purposes. IF IT HELPS YOU, FILL IT OUT.The COGS are specified on the numbers sheet, so use those items for the COGS on the P&L.

Make sure to understand which items on the numbers are balance sheet items. Anything listed as "expense" in the title will go under expenses in the P&L.(HINT: My total expenses are $535,733, so you will know you are right if they match.)For all numbers, make them whole.

For all percentages, make them to 2 decimal places.Within each section on the P&L and cash flow, please sort each section alphabeticallyPay special attention to any direction with a >, as these are often-made mistakes.3Create a separate tab, name it P&L.Create a P&L for the overall company and each division separately. So there will be five P&L's on the same page, with the first column being Company, then Commercial, Residential, Design/Build, and Snow Removal, and the percentage to revenue in that division.In a separate row under divisions, list "% to Total Sales." >To clarify, the format will be as follows; divisions across the top, line items down the left column. The row of "% to Total Sales" will list ONLY the % of each division to the overall company.You will replace the letters (W-Z) with the % of that division to Total sales.The column of % in each division will reflect the % of each item as it relates to the Net Revenue of that division.Copy the header below to the top of your P&L:Company%Commercial%Residential %Design/Build%Snow Removal%% to Total SalesW%X%Y%Z%Apply all returns to Residential.Equipment Rental and Contract Labor should be allocated Snow Removal.>Material discounts should be allocated to all lines and should be allocated as percent of materials.>For expenses on Company, list out each operating expense category individually, but on each product line,

ONLY list the Total Operating Expense as a percentage of total sales (Net). To clarify, each divison will ONLY have a dollar amount (as a formula) and percentage listed on the Total Operating Expense line. List every item as a percentage of the division's revenue, unless otherwise specified.Create a cash flow tab, and create a 6-week cash flow for this business. Start your cash flow on 1/1, which is a Monday

.There are no cash sales currently, all are sold on 30-day terms. All AP is on 30-day terms. There should be a starting balance, cash in, cash out, and ending balance. You must improve their cash situation each week.Advertising, Bank Charges, Business Licenses, Equipment Expense, Computer Software, and Rent are all paid on the 1st of the month.Contract Labor, Equipment Rental, Freight In, and all Insurances are paid on the 8th of the month.Labor, Manager Salary, Payroll, and Sales Commissions are paid bi-weekly starting on the first of the month.Maintenance, Office Supplies, Payroll Taxes, and Postage are paid on the 15th of the month.Shipping/Delivery, Shop Supplies, Small Hand Tools, Telephone, Utilities and Vehicle expense are all paid on the 25th of each month.Use the breakdowns of the AR and AP (list each category)5Format both the P&L and Cash Flow in Excel to be easy to read and appropriate to hand to a client (worth $495/hour)Format each to print on one page, using portrait and/or landscape, as applicable.

A B Accounts Payable Accounts Receivable Accumulated Depreciation Additional Capital Invested Advertising Bad Debt Bank Charges Business Licenses Capital Stock Issued Current Checking Account balance Computer Software Consulting Contract Labor Depreciation Expense Equipment Expense Equipment Rental Freight In Insurance Health. Insurance - Liability Insurance - Workers Comp Labor-TOTAL Line of Credit (Already maxed) Maintenance Manager Salary Material Discounts Material Purchases-TOTAL (Commercial) (Residential) (Design and Build) (Snow Removal) Office Supplies Payroll Payroll Taxes Postage Rent Retums & Allowances Sales-TOTAL (Commercial) (Residential) (Design and Build) (Snow Removal) Sales Commissions-TOTAL (Commercial) (Residential) (Design and Build) (Snow Removal) Shipping & Delivery Shop Supplies Small Hand Tools Telephone Value of Trucks, Equipment, and Tools Value of Office Equipment & Fixtures Undistributed Earnings Utilities Vehicle expense (Current) (30 days) (60 days) (Over 90 days) (Current) (30 days) (60 days) (Over 90 days) (Commercial) (Residential) (Design and Build) (Snow Removal) C COGS COGS COGS COGS COGS COGS D E $220,089 $33,013 $44,018 $66,027 $77.031 $208,360 $31,254 $41,672 $62,508 $72.926 $201,620 $50,000 $2,200 $4,420 $3,450 $450 $50,000 $2,400 $12,000 $1.000 $6,640 $28,747 $26,200 $862 $5,240 $10,334 $14,373 $11.600 $198,944 $70,000 $60,000 $65,000 $3.944 $150,000 $12,593 $49,736 -$9.200 $424,254 $155,000 $125,000 $140,000 $4.254 $2.560 $150,000 $43,876 $2,012 $60,000 -$24.500 $1,314,700 $437,109 $372,550 $398,541 $106.500 $131.470 $40,000 $50,000 $41,470 $0 $14,320 $3,577 $2,875 $2,356 $590,421 $1,500 -$150,809 $47,494 $24,320 D E F G H 1 J K L M N 1 follow these directions exactly: 2 3 1 Create a P&L and cash flow from scratch, following the directions below. Do not use templates. When you create these, add tabs next to the Directions and Numbers Remember there are 3 steps to this: reading the direction, PROCESSING WHAT THAT DIRECTION MEANS, then APPLYING that direction 2 "The Numbers" tab gives you the annual numbers for the company. Use only this information and do not add any categories. 8 Feel free to use the numbers as a worksheet, if you desire, but you are not required to fill it out for our purposes. IF IT HELPS YOU, FILL IT OUT. The COGS are specified on the numbers sheet, so use those items for the COGS on the P&L. 9 10 Make sure to understand which items on the numbers are balance sheet items. Anything listed as "expense" in the title will go under expenses in the P&L. (HINT: My total expenses are $535,733, so you will know you are right if they match.) 11 12 For all numbers, make them whole. For all percentages, make them to 2 decimal places. 13 Within each section on the P&L and cash flow, please sort each section alphabetically 14 Pay special attention to any direction with a >, as these are often-made mistakes. 16 3 Create a separate tab, name it P&L. 17 Create a P&L for the overall company and each division separately. So there will be five P&L's on the same page, with the first column being Company, then Commercial, Residential, Design/Build, and Snow Removal, and the percentage to revenue in that division. In a separate row under divisions, list "% to Total Sales." 20 >To clarify, the format will be as follows; divisions across the top, line items down the left column. The row of "% to Total Sales" will list ONLY the % of each division to the overall company. 22 You will replace the letters (W-Z) with the % of that division to Total sales. 23 The column of % in each division will reflect the % of each item as it relates to the Net Revenue of that division. Copy the header below to the top of your P&L: Company % Commercial % Residential % Design/Build % W% X% Y% Snow Removal % Z% % to Total Sales Apply all returns to Residential. Equipment Rental and Contract Labor should be allocated Snow Removal. 32 >Material discounts should be allocated to all lines and should be allocated as percent of materials. 33 >For expenses on Company, list out each operating expense category individually, but on each product line, ONLY list the Total Operating Expense 34 as a percentage of total sales (Net). To clarify, each divison will ONLY have a dollar amount (as a formula) and percentage listed on the Total Operating Expens List every item as a percentage of the division's revenue, unless otherwise specified. 36 37 Create a cash flow tab, and create a 6-week cash flow for this business. Start your cash flow on 1/1, which is a Monday. There are no cash sales currently, all are sold on 30-day terms. All AP is on 30-day terms. 38 39 There should be a starting balance, cash in, cash out, and ending balance. You must improve their cash situation each week. Advertising, Bank Charges, Business Licenses. Equipment Expense, Computer Software, and Rent are all paid on the 1st of the month. Contract Labor, Equipment Rental, Freight In, and all Insurances are paid on the 8th of the month. Labor, Manager Salary, Payroll, and Sales Commissions are paid bi-weekly starting on the first of the month. Maintenance, Office Supplies, Payroll Taxes, and Postage are paid on the 15th of the month. Shipping/Delivery, Shop Supplies, Small Hand Tools. Telephone, Utilities and Vehicle expense are all paid on the 25th of each month. Use the breakdowns of the AR and AP (list each category) 5 Format both the P&L and Cash Flow in Excel to be easy to read and appropriate to hand to a client (worth $495/hour) Format each to print on one page, using portrait and/or landscape, as applicable. 48 49 4567 15 6 N 18 19 1284567 8 & 30 1 2 3 4 35 7 8 4423456035603234 65 66 28 29 31 41 47 51 57 58 59 61 0 A B Accounts Payable Accounts Receivable Accumulated Depreciation Additional Capital Invested Advertising Bad Debt Bank Charges Business Licenses Capital Stock Issued Current Checking Account balance Computer Software Consulting Contract Labor Depreciation Expense Equipment Expense Equipment Rental Freight In Insurance Health. Insurance - Liability Insurance - Workers Comp Labor-TOTAL Line of Credit (Already maxed) Maintenance Manager Salary Material Discounts Material Purchases-TOTAL (Commercial) (Residential) (Design and Build) (Snow Removal) Office Supplies Payroll Payroll Taxes Postage Rent Retums & Allowances Sales-TOTAL (Commercial) (Residential) (Design and Build) (Snow Removal) Sales Commissions-TOTAL (Commercial) (Residential) (Design and Build) (Snow Removal) Shipping & Delivery Shop Supplies Small Hand Tools Telephone Value of Trucks, Equipment, and Tools Value of Office Equipment & Fixtures Undistributed Earnings Utilities Vehicle expense (Current) (30 days) (60 days) (Over 90 days) (Current) (30 days) (60 days) (Over 90 days) (Commercial) (Residential) (Design and Build) (Snow Removal) C COGS COGS COGS COGS COGS COGS D E $220,089 $33,013 $44,018 $66,027 $77.031 $208,360 $31,254 $41,672 $62,508 $72.926 $201,620 $50,000 $2,200 $4,420 $3,450 $450 $50,000 $2,400 $12,000 $1.000 $6,640 $28,747 $26,200 $862 $5,240 $10,334 $14,373 $11.600 $198,944 $70,000 $60,000 $65,000 $3.944 $150,000 $12,593 $49,736 -$9.200 $424,254 $155,000 $125,000 $140,000 $4.254 $2.560 $150,000 $43,876 $2,012 $60,000 -$24.500 $1,314,700 $437,109 $372,550 $398,541 $106.500 $131.470 $40,000 $50,000 $41,470 $0 $14,320 $3,577 $2,875 $2,356 $590,421 $1,500 -$150,809 $47,494 $24,320 D E F G H 1 J K L M N 1 follow these directions exactly: 2 3 1 Create a P&L and cash flow from scratch, following the directions below. Do not use templates. When you create these, add tabs next to the Directions and Numbers Remember there are 3 steps to this: reading the direction, PROCESSING WHAT THAT DIRECTION MEANS, then APPLYING that direction 2 "The Numbers" tab gives you the annual numbers for the company. Use only this information and do not add any categories. 8 Feel free to use the numbers as a worksheet, if you desire, but you are not required to fill it out for our purposes. IF IT HELPS YOU, FILL IT OUT. The COGS are specified on the numbers sheet, so use those items for the COGS on the P&L. 9 10 Make sure to understand which items on the numbers are balance sheet items. Anything listed as "expense" in the title will go under expenses in the P&L. (HINT: My total expenses are $535,733, so you will know you are right if they match.) 11 12 For all numbers, make them whole. For all percentages, make them to 2 decimal places. 13 Within each section on the P&L and cash flow, please sort each section alphabetically 14 Pay special attention to any direction with a >, as these are often-made mistakes. 16 3 Create a separate tab, name it P&L. 17 Create a P&L for the overall company and each division separately. So there will be five P&L's on the same page, with the first column being Company, then Commercial, Residential, Design/Build, and Snow Removal, and the percentage to revenue in that division. In a separate row under divisions, list "% to Total Sales." 20 >To clarify, the format will be as follows; divisions across the top, line items down the left column. The row of "% to Total Sales" will list ONLY the % of each division to the overall company. 22 You will replace the letters (W-Z) with the % of that division to Total sales. 23 The column of % in each division will reflect the % of each item as it relates to the Net Revenue of that division. Copy the header below to the top of your P&L: Company % Commercial % Residential % Design/Build % W% X% Y% Snow Removal % Z% % to Total Sales Apply all returns to Residential. Equipment Rental and Contract Labor should be allocated Snow Removal. 32 >Material discounts should be allocated to all lines and should be allocated as percent of materials. 33 >For expenses on Company, list out each operating expense category individually, but on each product line, ONLY list the Total Operating Expense 34 as a percentage of total sales (Net). To clarify, each divison will ONLY have a dollar amount (as a formula) and percentage listed on the Total Operating Expens List every item as a percentage of the division's revenue, unless otherwise specified. 36 37 Create a cash flow tab, and create a 6-week cash flow for this business. Start your cash flow on 1/1, which is a Monday. There are no cash sales currently, all are sold on 30-day terms. All AP is on 30-day terms. 38 39 There should be a starting balance, cash in, cash out, and ending balance. You must improve their cash situation each week. Advertising, Bank Charges, Business Licenses. Equipment Expense, Computer Software, and Rent are all paid on the 1st of the month. Contract Labor, Equipment Rental, Freight In, and all Insurances are paid on the 8th of the month. Labor, Manager Salary, Payroll, and Sales Commissions are paid bi-weekly starting on the first of the month. Maintenance, Office Supplies, Payroll Taxes, and Postage are paid on the 15th of the month. Shipping/Delivery, Shop Supplies, Small Hand Tools. Telephone, Utilities and Vehicle expense are all paid on the 25th of each month. Use the breakdowns of the AR and AP (list each category) 5 Format both the P&L and Cash Flow in Excel to be easy to read and appropriate to hand to a client (worth $495/hour) Format each to print on one page, using portrait and/or landscape, as applicable. 48 49 4567 15 6 N 18 19 1284567 8 & 30 1 2 3 4 35 7 8 4423456035603234 65 66 28 29 31 41 47 51 57 58 59 61 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started