Answered step by step

Verified Expert Solution

Question

1 Approved Answer

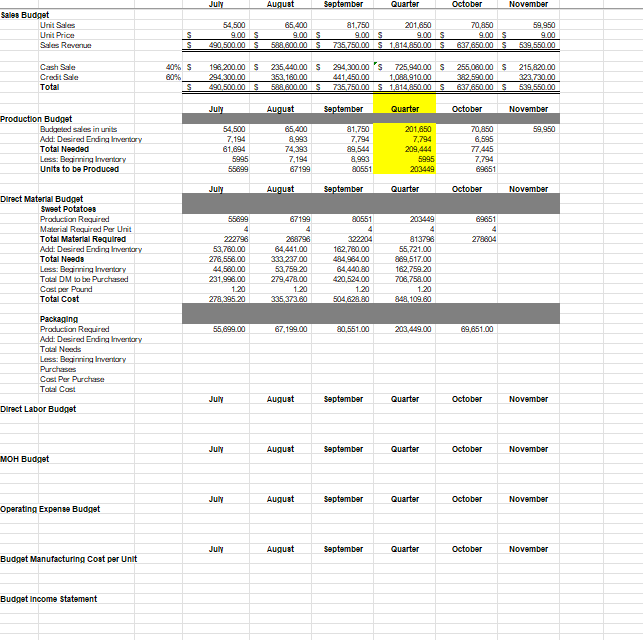

Please format your response like an excel spreadsheet and display the formulas required for each row on the far right side. For reference, I attached

Please format your response like an excel spreadsheet and display the formulas required for each row on the far right side. For reference, I attached screenshots of my progress thus far.

The Sweet Crunch Company produces and sells organic Sweet Potato Chips. The onepound family size bag of chips has two direct materials Organic Sweet Potatoes and packaging. The production process includes slicing the potatoes, lightly frying them, and lightly seasoning them with salt. Indirect materials include small amount of oil used to fry the chips and salt. Sweet Crunch is preparing budgets for the third quarter ending September For each requirement below prepare budgets by month for July, August, and September, and a total budget for the quarter.

The previous years sales for the corresponding period were:

July bags

August bags

September bags

October bags

November bags

The company expects the above volume of sales to increase by for the period July November The budgeted selling price for is $ per bag of chips. The company expects of its sales to be cash COD sales. The remaining of sales will be made on credit. Prepare a Sales Budget for Sweet Crunch Company.

The company desires to have finished goods inventory on hand at the end of each month equal to percent of the following month's budgeted unit sales. On June Sweet Crunch expects to have bags of chips on hand. Use the @ROUNDUP function to round up to the nearest whole number of units in desired ending inventory. Prepare a Production budget.

The final product bags of chips requires two direct materials: sweet potatoes and packaging. pounds of raw potatoes are required for each onepound bag of potato chips. Management desires to have materials on hand ie pounds of potatoes at the end of each month equal to percent of the following month's production needs. The beginning materials inventory, July is expected to be pounds. Potatoes cost $ per pound.

Packaging material is purchased by the roll and bags of chips are produced from each roll. The packaging is made from biodegradable, organic plant fiber that extends the shelf life of the potato chips while preserving its freshness. Management desires to have packaging on hand at the end of each month equal to percent of the following month's production needs. The beginning inventory of packaging ie rolls of packaging material in July is expected to be rolls. Packaging is expected to cost $ per roll.

Note, budgeted production in October is required in order to complete the direct materials budget for September. Also, use the @ROUNDUP function to round up to the nearest whole number of pounds of potatoes and number of rolls of packaging both for desired ending inventory and material to purchase. Further, because two direct materials are required for production potatoes and rolls of packaging you will need a separate schedule for each direct material. Prepare a Direct Materials budget.

Each bag of chips requires hours of direct labor. Each hour of direct labor costs the company $ Prepare a Direct Labor budget.

Sweet Crunch Company budgets indirect materials eg salt, oil at $ per bag. Sweet Crunch treats indirect labor and utilities as mixed costs. The variable components are $ per bag for indirect labor and $ per bag for utilities. The following fixed costs per month are budgeted for indirect labor, $ utilities, $ and other, $ Prepare a Manufacturing Overhead budget.

Variable selling and administrative expenses are $ per bag of chips sold. Fixed selling and administrative expenses are $ per month. These costs are not itemized, ie the budget has only two line items variable operating expenses and fixed operating expenses. Prepare an Operating Expenses budget.

Prepare a Budgeted Manufacturing Cost per unit budget. Refer to exhibit for guidance. To calculate FMOHunit calculate total FMOH for the year and divide this by budgeted production for the year. The total production volume for the year is budgeted at bags.

Prepare a Budgeted Income Statement for the quarter for Sweet Crunch Company. Assume interest expense of $ and income tax expense of of income before taxes. Sweet Crunch Companys goal for the quarter is to make its net income greater than of its sales revenue. To determine whether the company achieves the goal, use @IF function. In the IF function, you need to label Achieved if it achieves the goal if the condition is met or Not Achieved if it does not achieve if the condition is not met Use the CELL right next to Net Income cell to make the IF function that returns one of the labels based on whether the condition net income sales revenue is met or not.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started