Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please give all will thumbs up ! Required information Morning Dove Company manufactures one model of birdbath, which is very popular. Morning Dove sells all

please give all will thumbs up

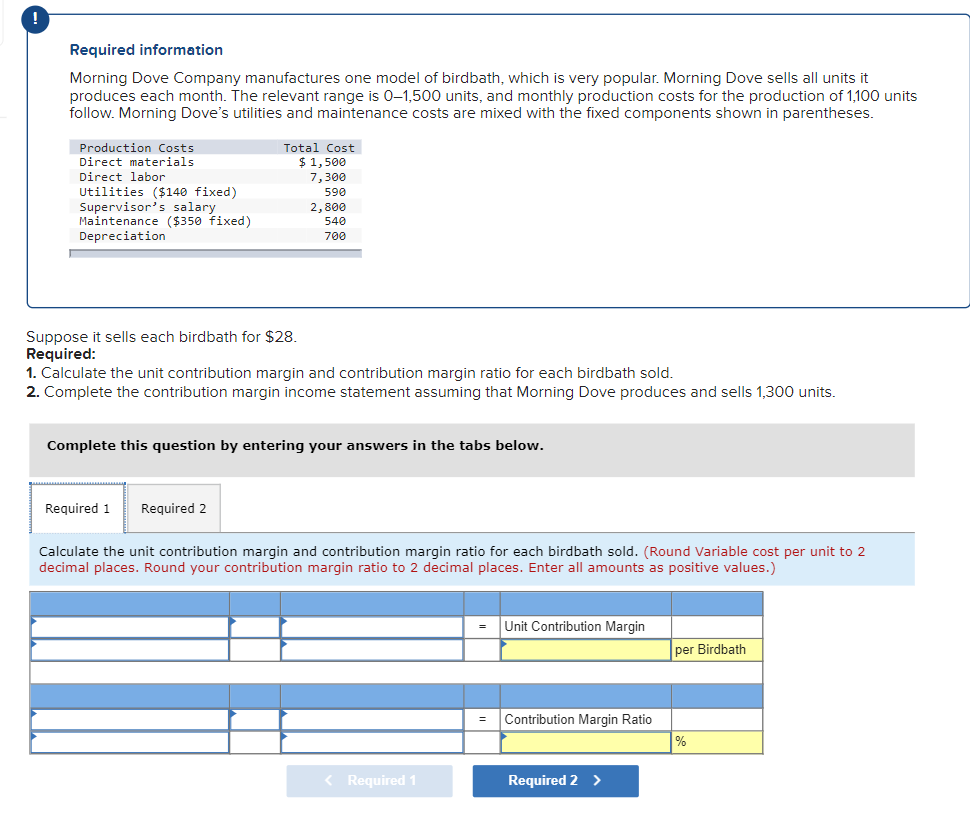

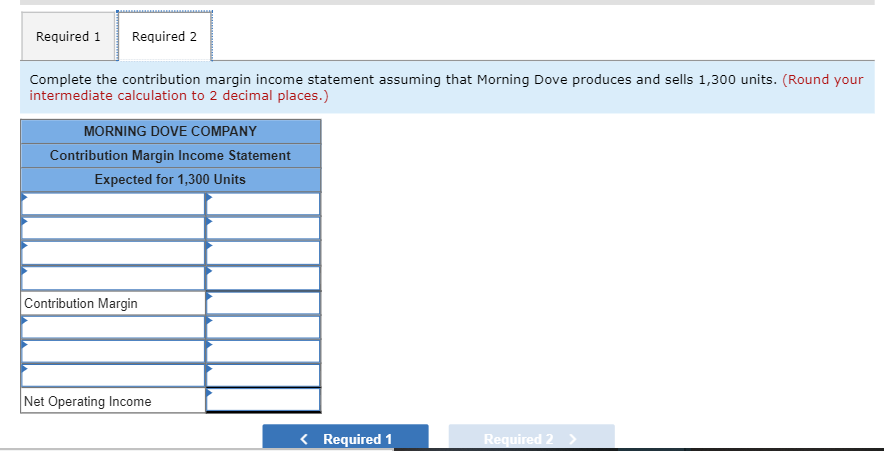

! Required information Morning Dove Company manufactures one model of birdbath, which is very popular. Morning Dove sells all units it produces each month. The relevant range is 0-1,500 units, and monthly production costs for the production of 1,100 units follow. Morning Dove's utilities and maintenance costs are mixed with the fixed components shown in parentheses. Total Cost $1,500 7,300 Production Costs Direct materials Direct labor Utilities ($140 fixed) Supervisor's salary Maintenance ($350 fixed) Depreciation 590 2,800 540 700 Suppose it sells each birdbath for $28. Required: 1. Calculate the unit contribution margin and contribution margin ratio for each birdbath sold. 2. Complete the contribution margin income statement assuming that Morning Dove produces and sells 1,300 units. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate the unit contribution margin and contribution margin ratio for each birdbath sold. (Round Variable cost per unit to 2 decimal places. Round your contribution margin ratio to 2 decimal places. Enter all amounts as positive values.) Unit Contribution Margin per Birdbath Contribution Margin Ratio % Required 1 Required 2 Complete the contribution margin income statement assuming that Morning Dove produces and sells 1,300 units. (Round your intermediate calculation to 2 decimal places.) MORNING DOVE COMPANY Contribution Margin Income Statement Expected for 1,300 Units Contribution Margin Net Operating IncomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started