Answered step by step

Verified Expert Solution

Question

1 Approved Answer

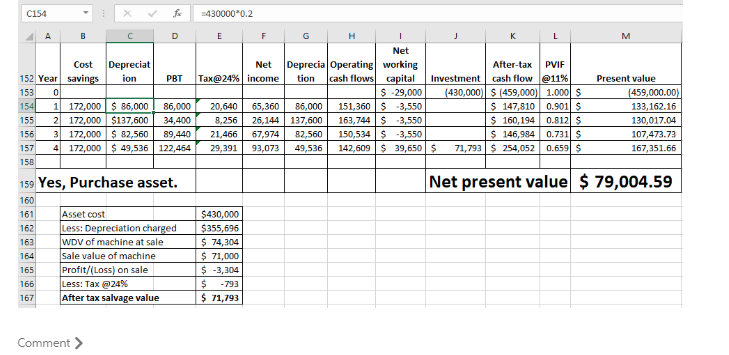

Please give (explain) the excel formula that calculates the PVIF @ 11% in the table shown above. I am not getting the same results when

Please give (explain) the excel formula that calculates the PVIF @ 11% in the table shown above. I am not getting the same results when I enter the formula so I am sure I am using a wrong cell reference somewhere.

C154 430000*0.2 A D M Cost Depreciat 152 Year savings ion PBT 153 0 154 1 172,000 $ 85,000 86,000 155 2 172,000 $137,600 34,400 156 3 172,000 $ 82,560 89,440 157 4 172,000 $ 49,536 122,464 158 E F H L Net Net Deprecia Operating working After-tax PVIF Tax@24% income tion cash flows capital Investment cash flow @11% $ -29,000 (430,000) S (459,000) 1.000 $ 20,640 65,360 86,000 151,360 S 3,550 $ 147,810 0.901 S 8,256 26,144 137,600 163,744$ 3,550 $ 160,194 0.812 $ 21,466 67,974 82,560 150,534$ 3,550 $ 146,994 0.731 $ 29,391 93,073 49,536 142,609 $ 39,650 $ 71,793 $ 254,052 0.659 $ Present value (459,000.00) 133,162.16 130,017.04 107,473.73 167,351.66 159 Yes, Purchase asset. Net present value $ 79,004.59 160 161 162 163 164 165 166 167 Asset cost Less: Depreciation charged WDV of machine at sale Sale value of machine Profit/(Loss) on sale Less: Tax @24% After tax salvage value $430,000 $355,696 $ 74,304 $ 71,000 $ -3,304 $ -793 $ 71,793 Comment >Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started