Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please give me asnwers to the following questions problem 1 & 2? Problem 1. (40 points). Recommended Time: 50 minutes. Score: Premium Digestive Biscuits, Inc.

please give me asnwers to the following questions problem 1 & 2?

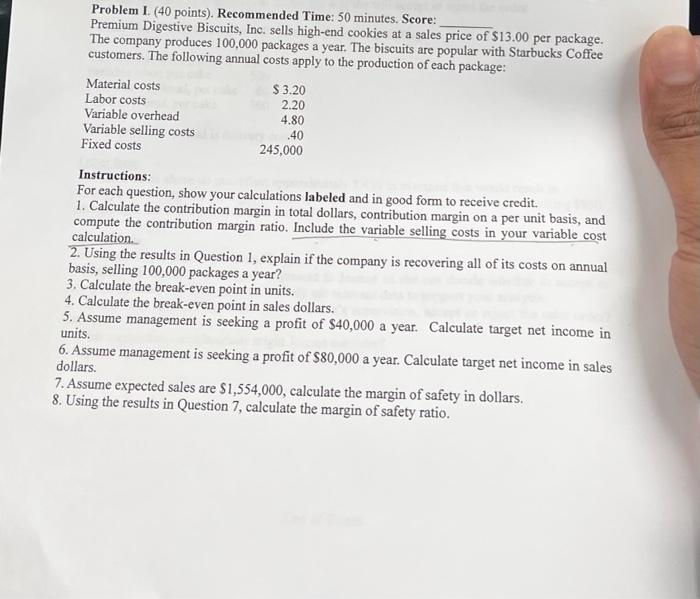

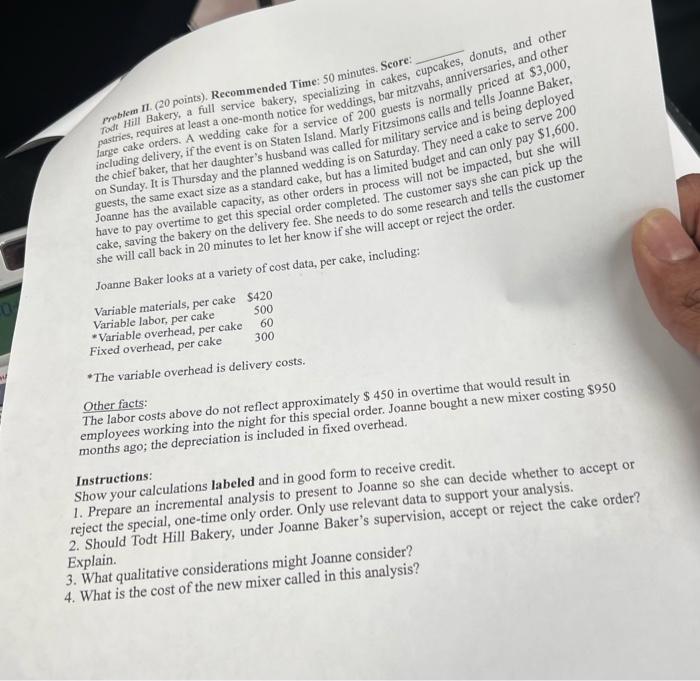

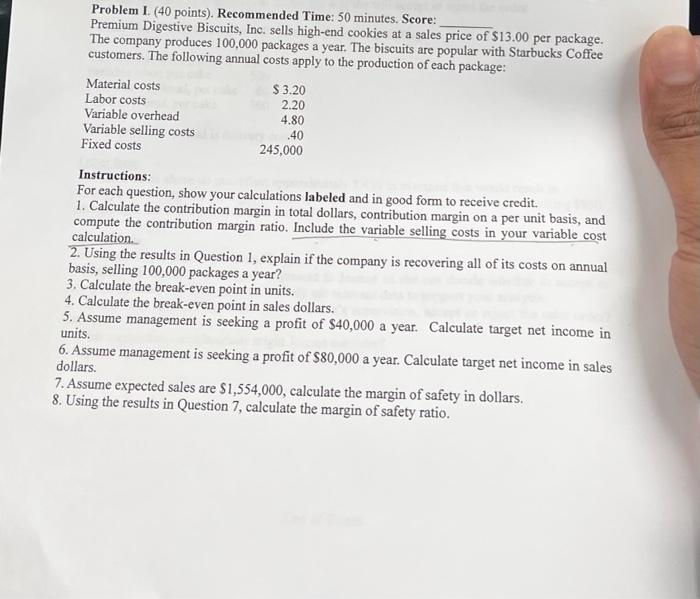

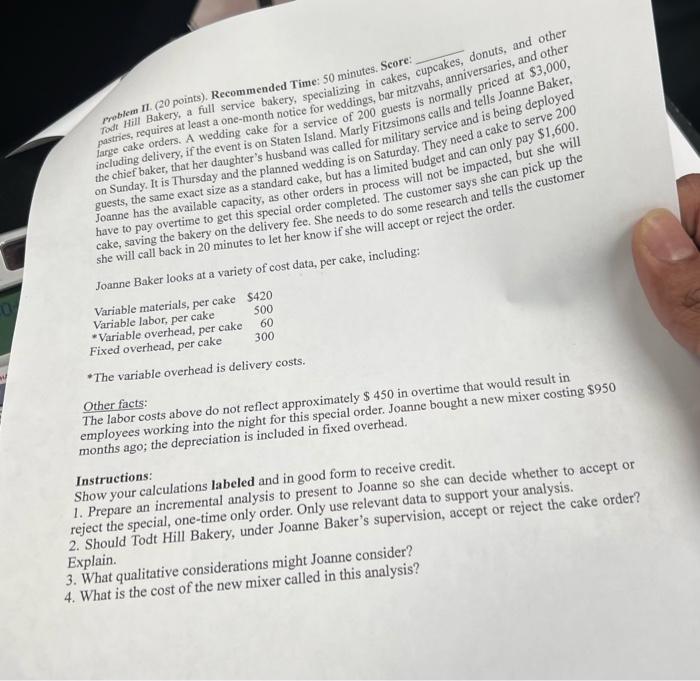

Problem 1. (40 points). Recommended Time: 50 minutes. Score: Premium Digestive Biscuits, Inc. sells high-end cookies at a sales price of $13.00 per package. The company produces 100,000 packages a year. The biscuits are popular with Starbucks Coffee customers. The following annual costs apply to the production of each package: Material costs $ 3.20 Labor costs 2.20 Variable overhead 4.80 Variable selling costs .40 Fixed costs 245,000 Instructions: For each question, show your calculations labeled and in good form to receive credit. 1. Calculate the contribution margin in total dollars, contribution margin on a per unit basis, and compute the contribution margin ratio. Include the variable selling costs in your variable cost calculation 2. Using the results in Question 1, explain if the company is recovering all of its costs on annual basis, selling 100.000 packages a year? 3. Calculate the break-even point in units. 4. Calculate the break-even point in sales dollars. 5. Assume management is seeking a profit of $40,000 a year. Calculate target net income in units. 6. Assume management is seeking a profit of $80,000 a year. Calculate target net income in sales dollars. 7. Assume expected sales are $1,554,000, calculate the margin of safety in dollars. 8. Using the results in Question 7, calculate the margin of safety ratio. Problem II (20 points). Recommended Time: 50 minutes. Score: pastries, requires at least a one-month notice for weddings, bar mitzvahs, anniversaries, and other Tode Hill Bakery, a full service bakery, specializing in cakes, cupcakes, donuts, and other including delivery, if the event is on Staten Island. Marly Fitzsimons calls and tells Joanne Baker, Large cake orders. A wedding cake for a service of 200 guests is normally priced at $3,000, on Sunday. It is Thursday and the planned wedding is on Saturday. They need a cake to serve 200 the chief baker, that her daughter's husband was called for military service and is being deployed guests, the same exact size as a standard cake, but has a limited budget and can only pay $1,600. Joanne has the available capacity, as other orders in process will not be impacted, but she will 500 60 300 the she will call back in 20 minutes to let her know if she will accept or reject the order. cake, saving the bakery on the delivery fee. She needs to do some research and tells the customer Joanne Baker looks at a variety of cost data, per cake, including: Variable materials, per cake $420 Variable labor, per cake *Variable overhead, per cake Fixed overhead, per cake *The variable overhead is delivery costs. Other facts: The labor costs above do not reflect approximately $ 450 in overtime that would result in employees working into the night for this special order. Joanne bought a new mixer costing $950 months ago; the depreciation is included in fixed overhead. Instructions: Show your calculations labeled and in good form to receive credit. 1. Prepare an incremental analysis to present to Joanne so she can decide whether to accept or reject the special, one-time only order. Only use relevant data to support your analysis. 2. Should Todt Hill Bakery, under Joanne Baker's supervision, accept or reject the cake order? Explain. 3. What qualitative considerations might Joanne consider? 4. What is the cost of the new mixer called in this analysis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started