please give me good answers i have plenty of zero already because of some fake answers chegg gave me.

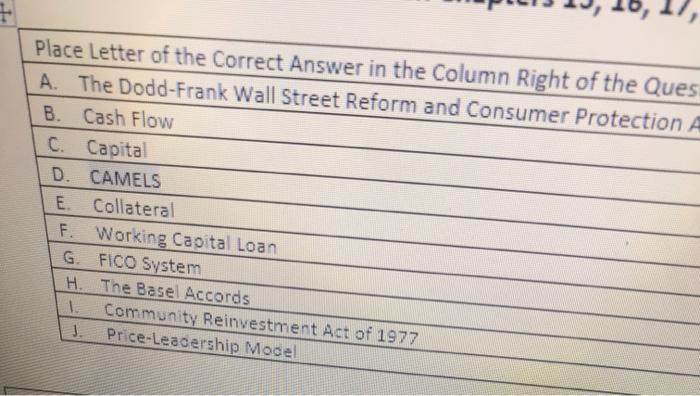

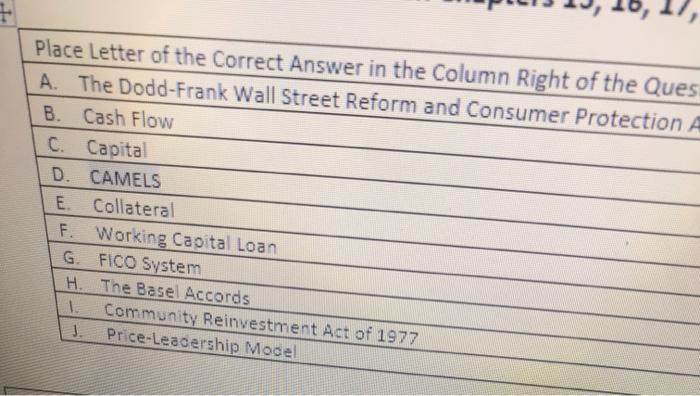

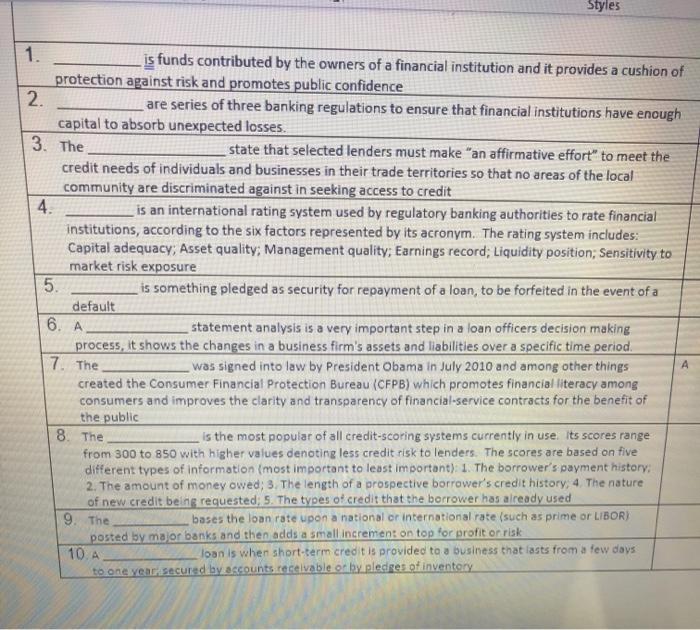

Place Letter of the Correct Answer in the Column Right of the Ques A. The Dodd-Frank Wall Street Reform and Consumer Protection A B. Cash Flow C. Capital D. CAMELS E. Collateral F. Working Capital Loan G. FICO System H. The Basel Accords 1. Community Reinvestment Act of 1977 Price-Leadership Model Styles 1. is funds contributed by the owners of a financial institution and it provides a cushion of protection against risk and promotes public confidence 2. are series of three banking regulations to ensure that financial institutions have enough capital to absorb unexpected losses. 3. The state that selected lenders must make "an affirmative effort" to meet the credit needs of individuals and businesses in their trade territories so that no areas of the local community are discriminated against in seeking access to credit 4. _ is an international rating system used by regulatory banking authorities to rate financial institutions, according to the six factors represented by its acronym. The rating system includes: Capital adequacy, Asset quality; Management quality, Earnings record; Liquidity position; Sensitivity to market risk exposure 5. is something pledged as security for repayment of a loan, to be forfeited in the event of a default 6. A statement analysis is a very important step in a loan officers decision making process, it shows the changes in a business firm's assets and liabilities over a specific time period. was signed into law by President Obama in July 2010 and among other things created the Consumer Financial Protection Bureau (CFPB) which promotes financial literacy among consumers and improves the clarity and transparency of financial service contracts for the benefit of the public 8. The is the most popular of all credit scoring systems currently in use its scores range from 300 to 850 with higher values denoting less credit risk to lenders. The scores are based on five different types of information (most important to least important): 1. The borrower's payment history, 2. The amount of money owed; 3. The length of a prospective borrower's credit history, 4. The nature of new credit being requested: 5. The types of credit that the borrower has already used 9. The bases the loan rate upon a national or international rate (such as prime or LIBOR) posted by major banks and then adds a small increment on top for profit or risk 10.A loan is when short-term credit is provided to a business that lasts from a few days to one year secured by accounts receivable or by pledges of inventory 7. The A