Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please give me the answer for each question 1-12 Q1. An adjusting entry could be made for each of the following except: Select one: a.

Please give me the answer for each question 1-12

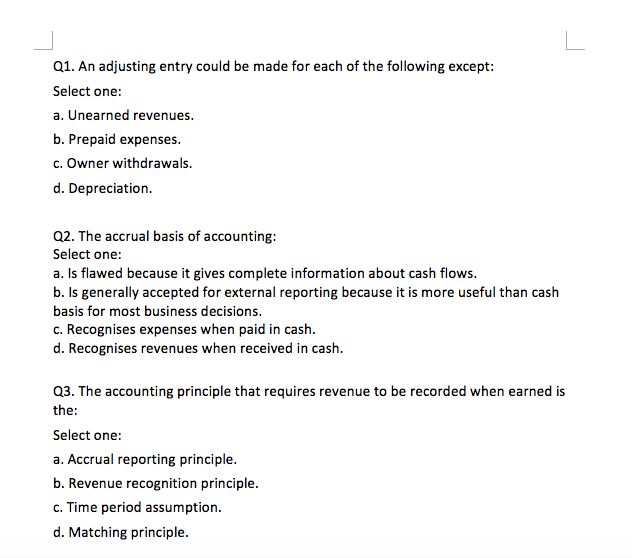

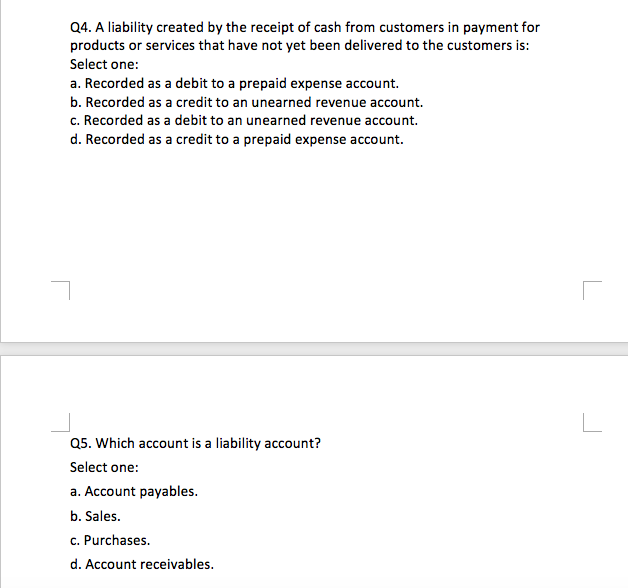

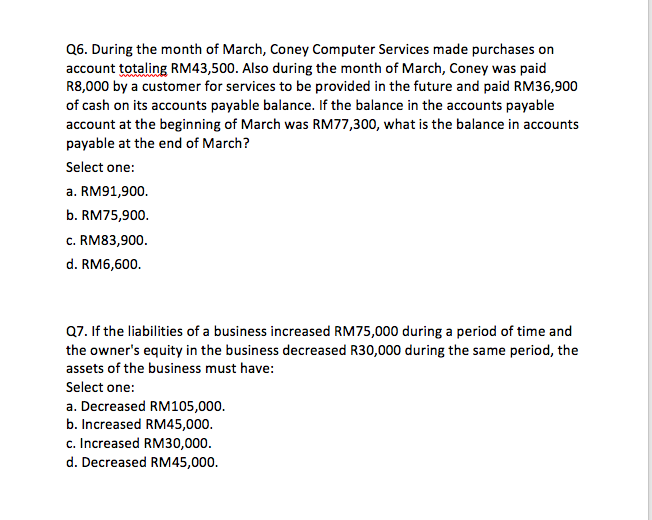

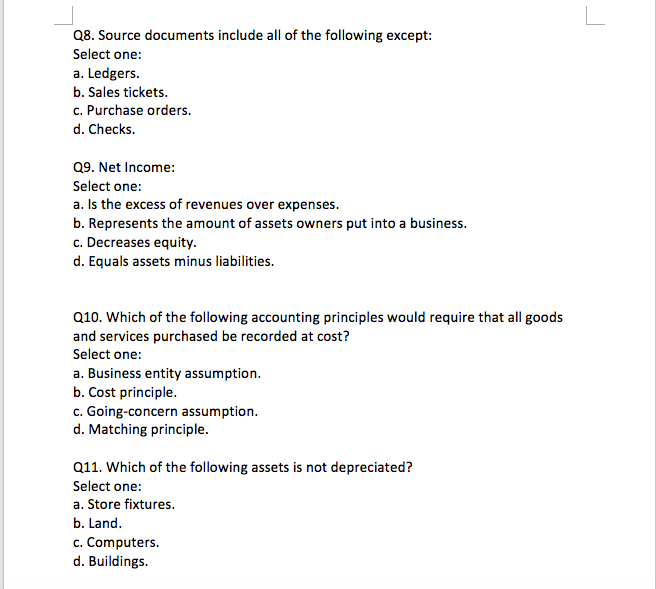

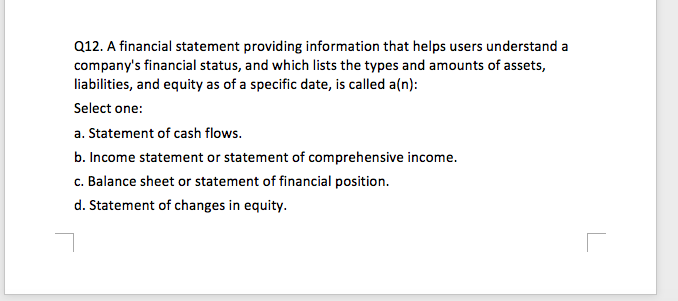

Q1. An adjusting entry could be made for each of the following except: Select one: a. Unearned revenues. b. Prepaid expenses. c. Owner withdrawals. d. Depreciation. Q2. The accrual basis of accounting: Select one: a. Is flawed because it gives complete information about cash flows. b. Is generally accepted for external reporting because it is more useful than cash basis for most business decisions. c. Recognises expenses when paid in cash. d. Recognises revenues when received in cash. Q3. The accounting principle that requires revenue to be recorded when earned is the: Select one: a. Accrual reporting principle. b. Revenue recognition principle. C. Time period assumption. d. Matching principle. Q4. A liability created by the receipt of cash from customers in payment for products or services that have not yet been delivered to the customers is: Select one: a. Recorded as a debit to a prepaid expense account. b. Recorded as a credit to an unearned revenue account. c. Recorded as a debit to an unearned revenue account. d. Recorded as a credit to a prepaid expense account. Q5. Which account is a liability account? Select one: a. Account payables. b. Sales. c. Purchases. d. Account receivables. Q6. During the month of March, Coney Computer Services made purchases on account totaling RM43,500. Also during the month of March, Coney was paid R8,000 by a customer for services to be provided in the future and paid RM36,900 of cash on its accounts payable balance. If the balance in the accounts payable account at the beginning of March was RM77,300, what is the balance in accounts payable at the end of March? Select one: a. RM91,900. b. RM75,900. C. RM83,900. d. RM6,600. Q7. If the liabilities of a business increased RM75,000 during a period of time and the owner's equity in the business decreased R30,000 during the same period, the assets of the business must have: Select one: a. Decreased RM105,000. b. Increased RM45,000. c. Increased RM30,000. d. Decreased RM45,000. Q8. Source documents include all of the following except: Select one: a. Ledgers. b. Sales tickets. c. Purchase orders. d. Checks. Q9. Net Income: Select one: a. Is the excess of revenues over expenses. b. Represents the amount of assets owners put into a business. c. Decreases equity. d. Equals assets minus liabilities. Q10. Which of the following accounting principles would require that all goods and services purchased be recorded at cost? Select one: a. Business entity assumption. b. Cost principle. c. Going-concern assumption. d. Matching principle. Q11. Which of the following assets is not depreciated? Select one: a. Store fixtures. b. Land. c. Computers. d. Buildings. Q12. A financial statement providing information that helps users understand a company's financial status, and which lists the types and amounts of assets, liabilities, and equity as of a specific date, is called a(n): Select one: a. Statement of cash flows. b. Income statement or statement of comprehensive income. c. Balance sheet or statement of financial position. d. Statement of changes in equityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started