Answered step by step

Verified Expert Solution

Question

1 Approved Answer

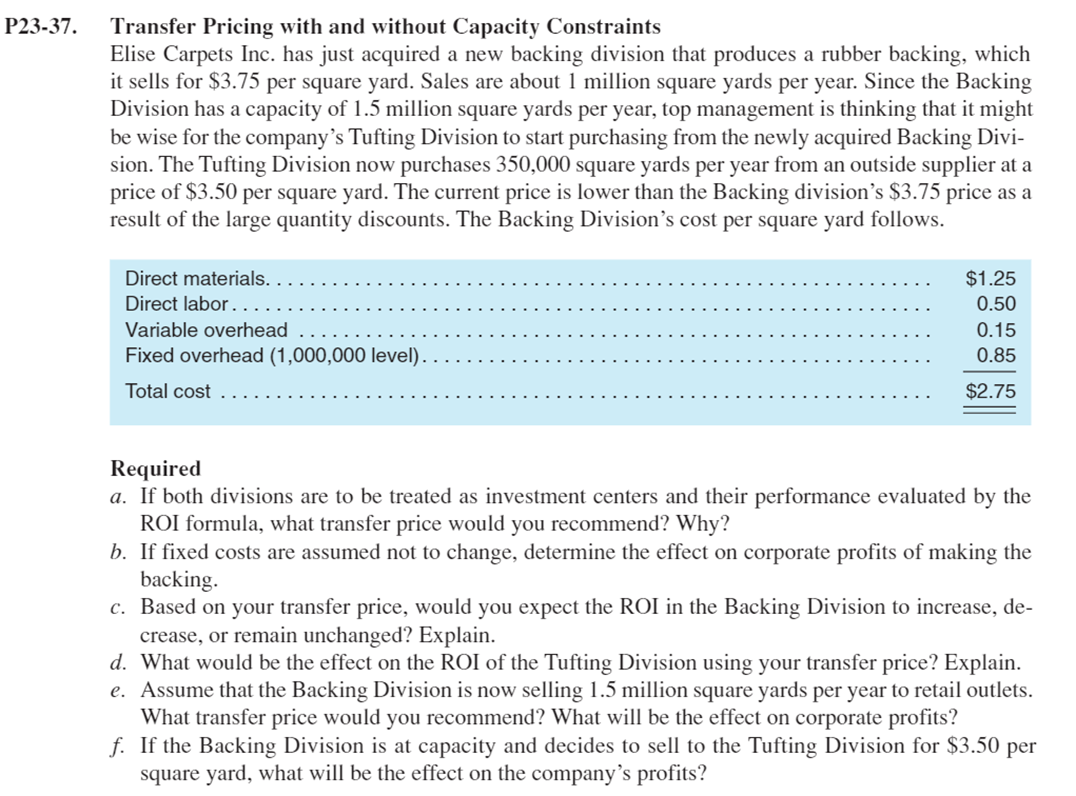

Transfer Pricing with and without Capacity Constraints Elise Carpets Inc. has just acquired a new backing division that produces a rubber backing, which it sells

Transfer Pricing with and without Capacity Constraints Elise Carpets Inc. has just acquired a new backing division that produces a rubber backing, which it sells for $3.75 per square yard. Sales are about 1 million square yards per year. Since the Backing Division has a capacity of 1.5 million square yards per year, top management is thinking that it might be wise for the company's Tufting Division to start purchasing from the newly acquired Backing Division. The Tufting Division now purchases 350,000 square yards per year from an outside supplier at a price of $3.50 per square yard. The current price is lower than the Backing division's $3.75 price as a result of the large quantity discounts. The Backing Division's cost per square yard follows. Required a. If both divisions are to be treated as investment centers and their performance evaluated by the ROI formula, what transfer price would you recommend? Why? b. If fixed costs are assumed not to change, determine the effect on corporate profits of making the backing. c. Based on your transfer price, would you expect the ROI in the Backing Division to increase, decrease, or remain unchanged? Explain. d. What would be the effect on the ROI of the Tufting Division using your transfer price? Explain. e. Assume that the Backing Division is now selling 1.5 million square yards per year to retail outlets. What transfer price would you recommend? What will be the effect on corporate profits? f. If the Backing Division is at capacity and decides to sell to the Tufting Division for $3.50 per square yard, what will be the effect on the company's profits

Transfer Pricing with and without Capacity Constraints Elise Carpets Inc. has just acquired a new backing division that produces a rubber backing, which it sells for $3.75 per square yard. Sales are about 1 million square yards per year. Since the Backing Division has a capacity of 1.5 million square yards per year, top management is thinking that it might be wise for the company's Tufting Division to start purchasing from the newly acquired Backing Division. The Tufting Division now purchases 350,000 square yards per year from an outside supplier at a price of $3.50 per square yard. The current price is lower than the Backing division's $3.75 price as a result of the large quantity discounts. The Backing Division's cost per square yard follows. Required a. If both divisions are to be treated as investment centers and their performance evaluated by the ROI formula, what transfer price would you recommend? Why? b. If fixed costs are assumed not to change, determine the effect on corporate profits of making the backing. c. Based on your transfer price, would you expect the ROI in the Backing Division to increase, decrease, or remain unchanged? Explain. d. What would be the effect on the ROI of the Tufting Division using your transfer price? Explain. e. Assume that the Backing Division is now selling 1.5 million square yards per year to retail outlets. What transfer price would you recommend? What will be the effect on corporate profits? f. If the Backing Division is at capacity and decides to sell to the Tufting Division for $3.50 per square yard, what will be the effect on the company's profits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started