Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please give solution within 30 minutes eo A graph Question 3 (This question has 3 items, (a), (b), and (c)) (4+ 3+ 6 = 13

please give solution within 30 minutes

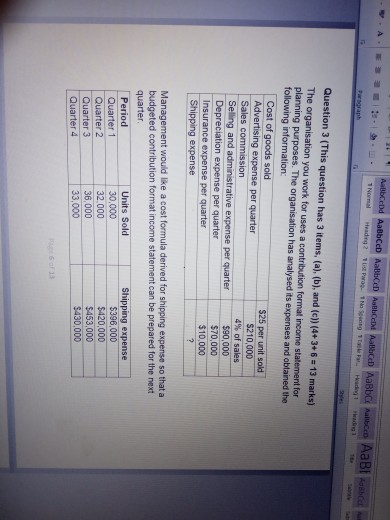

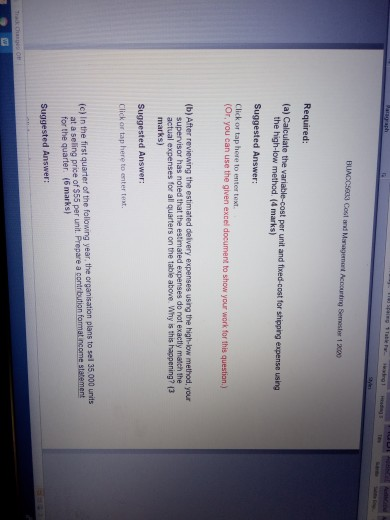

eo A graph Question 3 (This question has 3 items, (a), (b), and (c)) (4+ 3+ 6 = 13 marks) The organisation you work for uses a contribution format income statement for planning purposes. The organisation has analysed its expenses and obtained the following information: Cost of goods sold $25 per unit sold Advertising expense per quarter S210,000 Sales commission 4% of sales Selling and administrative expense per quarter $90,000 Depreciation expense per quarter $70,000 Insurance expense per quarter $10,000 ? Shipping expense Management would like a cost formula derived for shipping expense so that a budgeted contribution format income statement can be prepared for the next quarter Period Units Sold Shipping expense Quarter 1 30,000 $396,000 Quarter 2 32 000 $420,000 Quarter 3 36.000 $453,000 Quarter 4 33,000 $430,000 Paragraph ga BLACC Costanding Accounting Semester 1200 Required: (a) Calculate the variable-cost per unit and foed-cost for shipping expense using the high-low method. (4 marks) Suggested Answer: Click or tap here to enter tot (Or, you can use the given excel document to show your work for this question.) (b) After reviewing the estimated delivery expenses using the high-low method, your supervisor has noted that the estimated expenses do not exactly match the actual expenses for all quarters on the table above. Why is this happening? 13 marks) Suggested Answer: Click or tap here to enter text. (c) in the first quarter of the following year, the organisation plans to sel 35,000 units at a seling price of $55 per unit. Prepare a contribution format income statement for the quarter. (6 marks) Suggested Answer: wStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started