Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please give the functions and not just the answers. Thank you Five years ago you obtained a 25-year $200,000 mortgage loan that has an interest

Please give the functions and not just the answers. Thank you

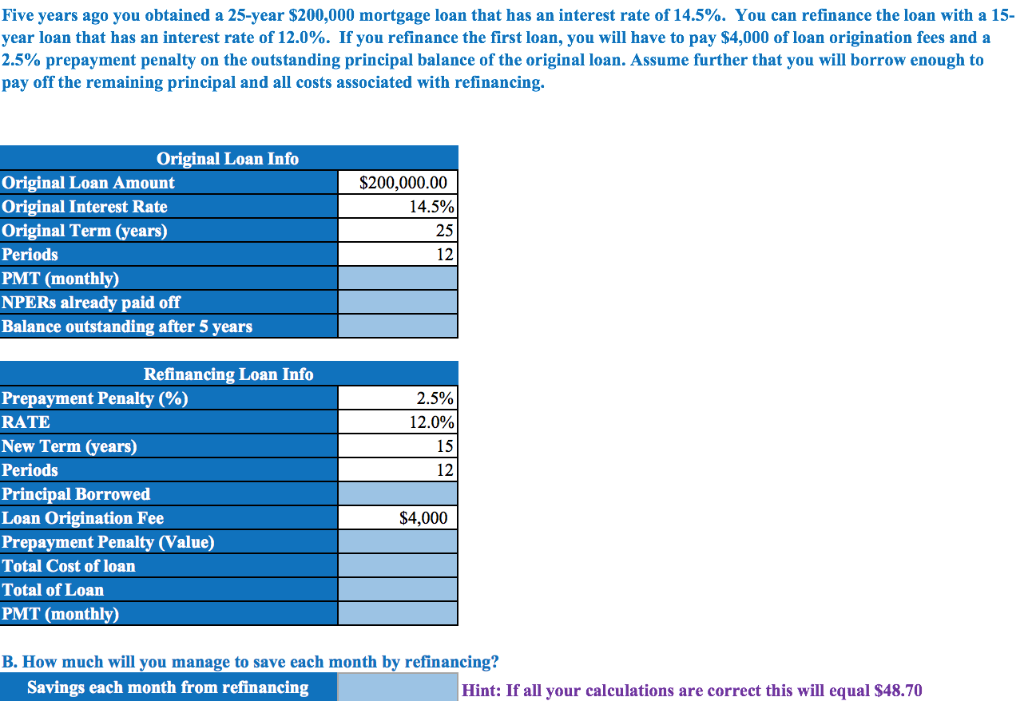

Five years ago you obtained a 25-year $200,000 mortgage loan that has an interest rate of 14.5%. You can refinance the loan with a 15- year loan that has an interest rate of 12.0%. If you refinance the first loan, you will have to pay $4,000 of loan origination fees and a 2.5% prepayment penalty on the outstanding principal balance of the original loan. Assume further that you will borrow enough to pay off the remaining principal and all costs associated with refinancing. Original Loan Info Original Loan Amount $200,000.00 Original Interest Rate 14.5% Original Term (years) 25 Periods 12 PMT (monthly) NPERS already paid off Balance outstanding after 5 years Refinancing Loan Info Prepayment Penalty (% 2.5% RATE 12.0% New Term (years) 15 Periods 12 Principal Borrowed $4,000 Loan Origination Fee Prepayment Penalty (Value) Total Cost of loan Total of Loan PMT (monthly) B. How much will you manage to save each month by refinancing? Savings each month from refinancing Hint: If all your calculations are correct this will equal $48.70Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started